EUR/USD gains on us shutdown fears and data watch

The EUR/USD pair extended gains for a second consecutive session, trading around 1.1727. The move reflects market concerns over a potential US government shutdown and caution ahead of key economic releases due this week.

A partial shutdown of US federal agencies could begin as early as Wednesday if Congress fails to pass a funding bill before the fiscal year ends on Tuesday. President Donald Trump is scheduled to meet with congressional leaders in an effort to reach a compromise.

Investor attention is also focused on upcoming US data, including the September non-farm payrolls report, JOLTS job openings, the ADP private employment survey, and the ISM manufacturing index. Strong indicators last week have tempered expectations for aggressive Fed easing, with markets now pricing in roughly 40 basis points of rate cuts by year-end.

Broad-based US dollar weakness has provided additional support for the euro.

Technical analysis: EUR/USD

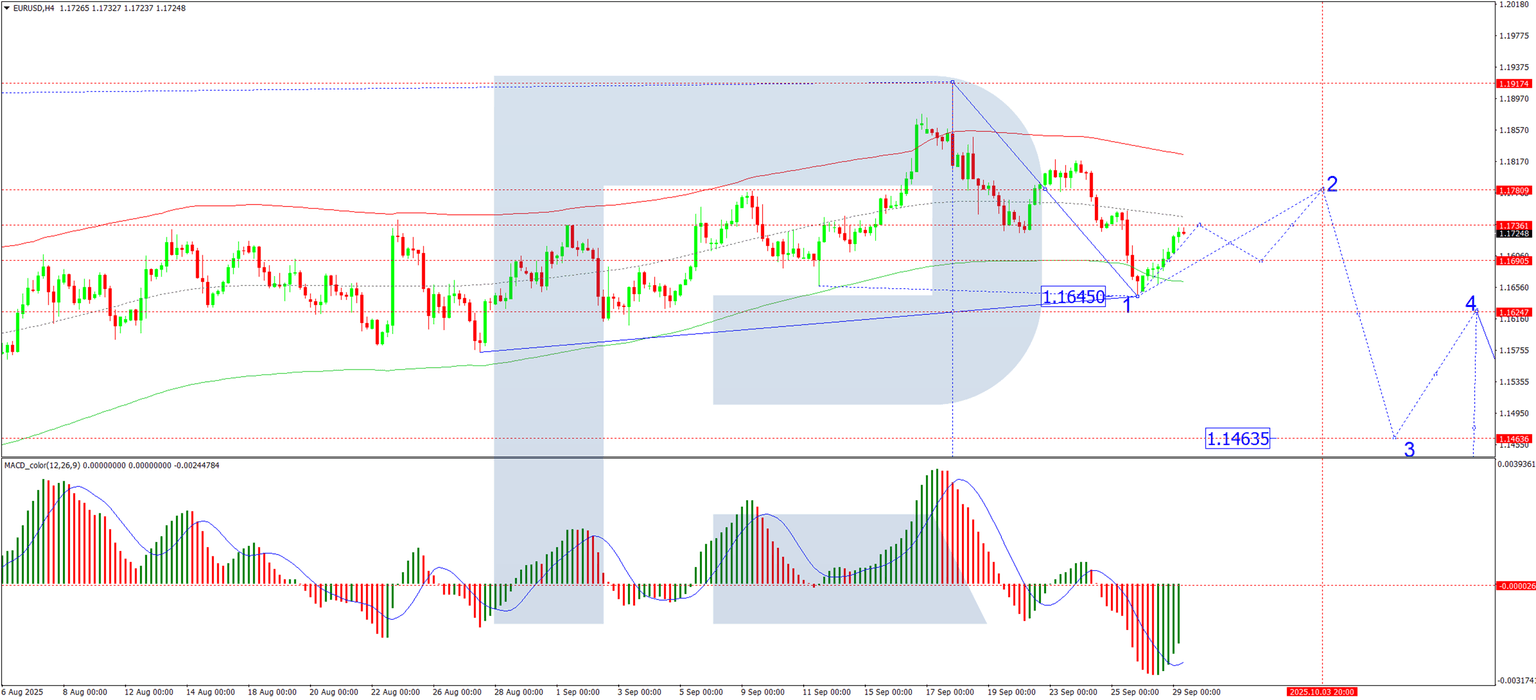

H4 Chart:

On the H4 chart, EUR/USD established a consolidation range above 1.1645 before breaking upward into a corrective phase. We expect the pair to advance toward 1.1730, followed by a pullback to 1.1695. A subsequent rise toward 1.1780 is anticipated, at which point the corrective potential is likely to be exhausted. A new decline toward 1.1625 may then develop. The MACD indicator supports this view, with its signal line below zero but exiting the histogram zone—suggesting potential upward momentum toward the zero line.

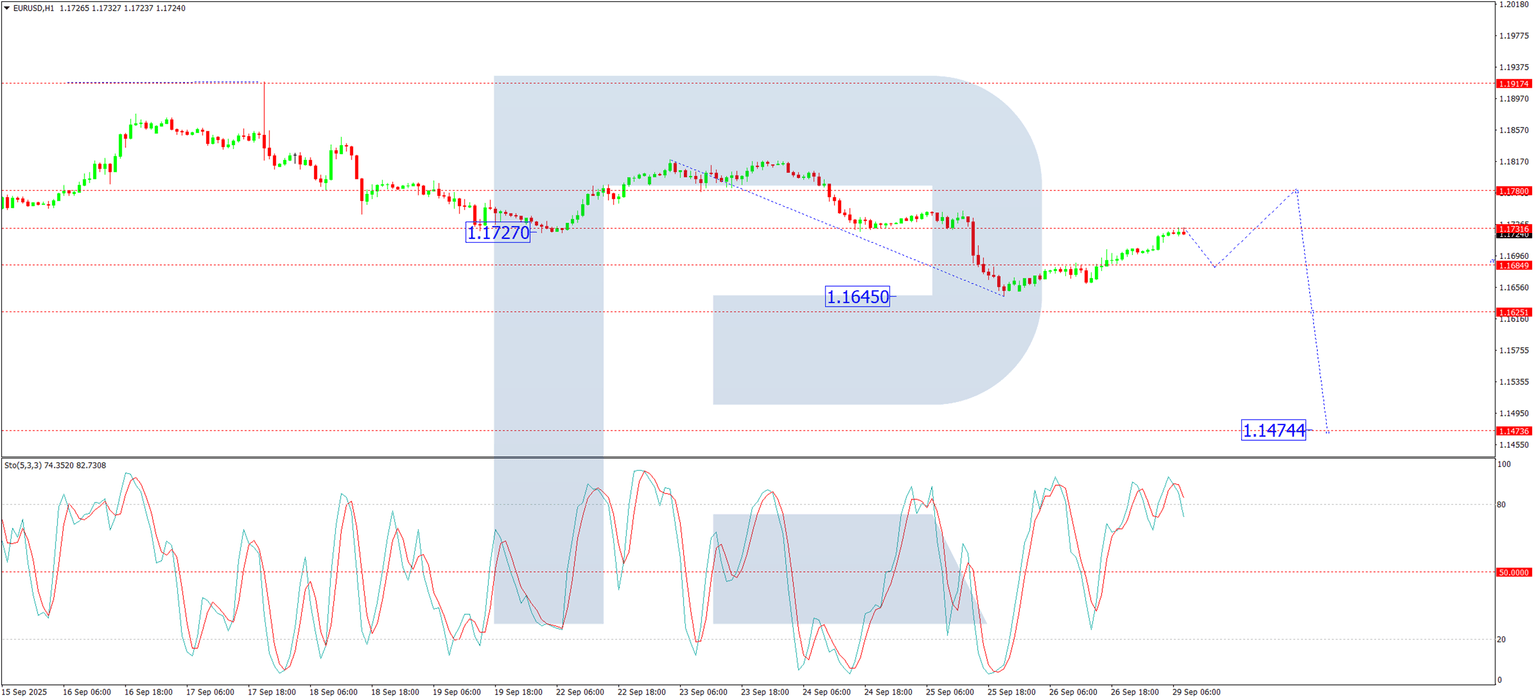

H1 Chart:

The H1 chart shows the completion of a decline to 1.1645, followed by the formation of a corrective structure. The initial advance to 1.1730 appears complete. A dip toward 1.1695 is possible before another rise toward 1.1780. Once this correction concludes, a new decline toward 1.1625 is expected. A break below this level could open the way toward 1.1470. The Stochastic oscillator aligns with this outlook, with its signal line above 80 and turning downward toward 20.

Conclusion

EUR/USD is drawing support from US fiscal uncertainty and a softer dollar, though the broader technical structure remains corrective. Traders are likely to remain cautious ahead of critical US employment and activity data, which may determine the near-term direction for the pair.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.