EUR/USD Forecast: US inflation soars, dollar rocks

EUR/USD Current Price: 1.2095

- The US Consumer Price Index jumped to 4.2% YoY in April.

- Stocks accelerate their declines while government bond yields advance with the news.

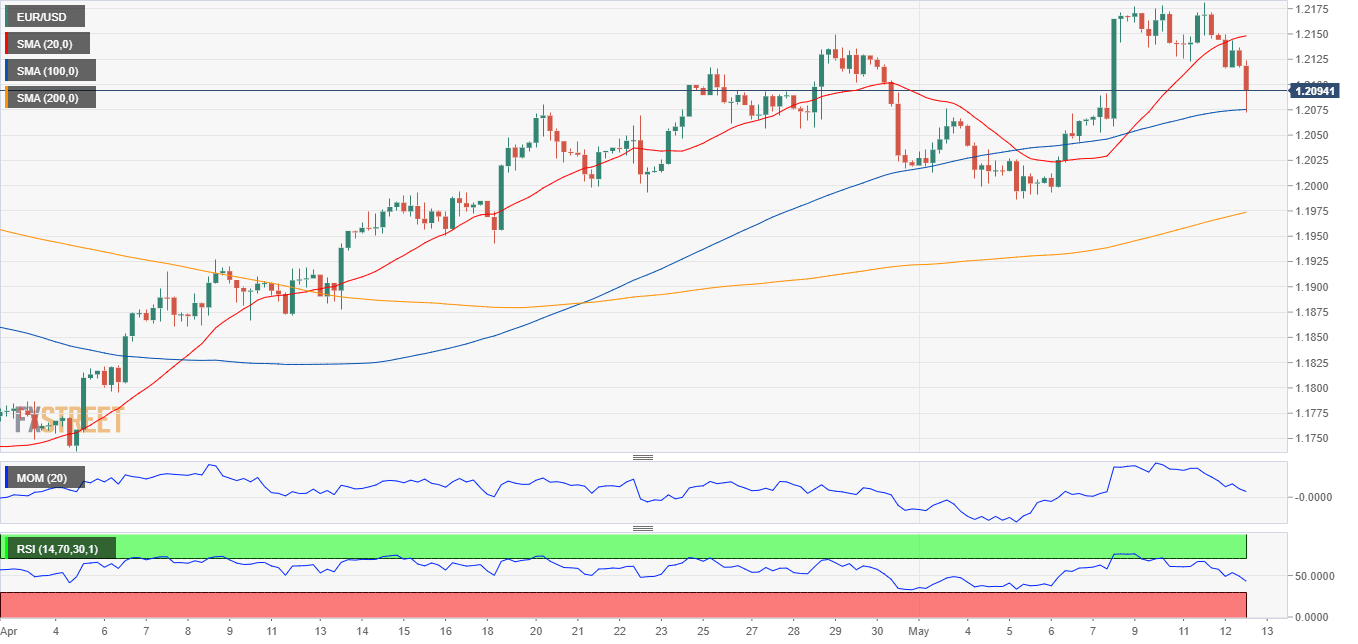

- EUR/USD is technically bearish and could fall further once below 1.2070.

The EUR/USD pair fell within range through the first half of the day, as the dollar’s selling paused ahead of the release of US inflation data. The EUR/USD pair traded around 1.2120 ahead of the event, plummeting afterwards as the US annual Consumer Price Index hit 4.2%, higher than the 3.6% expected. The core reading jumped to 3%, also surpassing expectations. Stocks are under pressure, and government bond yields higher, as speculative interest prices in higher chances of monetary policy tightening.

Earlier in the day, Germany published April inflation figures, which showed that the annual CPI was up 2% as expected. Fed’s Vice-chair Clarida will shorty offer a speech and may reinforce the Fed’s stance of being tolerant with inflation upticks.

EUR/USD short-term technical outlook

The EUR/USD pair is trading in the 1.2090 price zone after posting a weekly low of 1.2071 with the news. The near-term picture is bearish, as the 4-hour chart shows that technical indicators accelerated north well into negative levels, without signs of giving up. The pair bounced from a mildly bullish 100 SMA but remains well below the 20 SMA, which lost its bullish strength. Further declines are to be expected on a break below the mentioned daily low.

Support levels: 1.2070 1.2025 1.1980

Resistance levels: 1.2110 1.2150 1.2190

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.