EUR/USD Forecast: Struggling to extend gains beyond 1.2100

EUR/USD Current Price: 1.2095

- Weakening US Treasury yields pushed the American dollar sharply lower.

- The German Trade Balance posted a surplus of €16.1 billion, below expected.

- EUR/USD is trading at one-week highs, losing bullish strength.

The EUR/USD pair is up this Tuesday, retreating just modestly ahead of Wall Street’s opening from a daily high of 1.2115. The dollar accelerated its slump as US Treasury yields retreated further from almost one-year highs reached this Monday. European indexes are mixed, stuck around their opening levels, leading to some pre-opening losses in Wall Street.

Germany published the December Trade Balance, which posted a surplus of €16.1 billion, below expected. In the same month, the Current Account Balance was also below expected but improved to €28.2 billion from €21.2 billion in November. The US published the NFIB Business Optimism Index, which printed in January at 95, down from the previous 95.7. Later into the session, the country will release the December JOLTS Job Openings.

EUR/USD short-term technical outlook

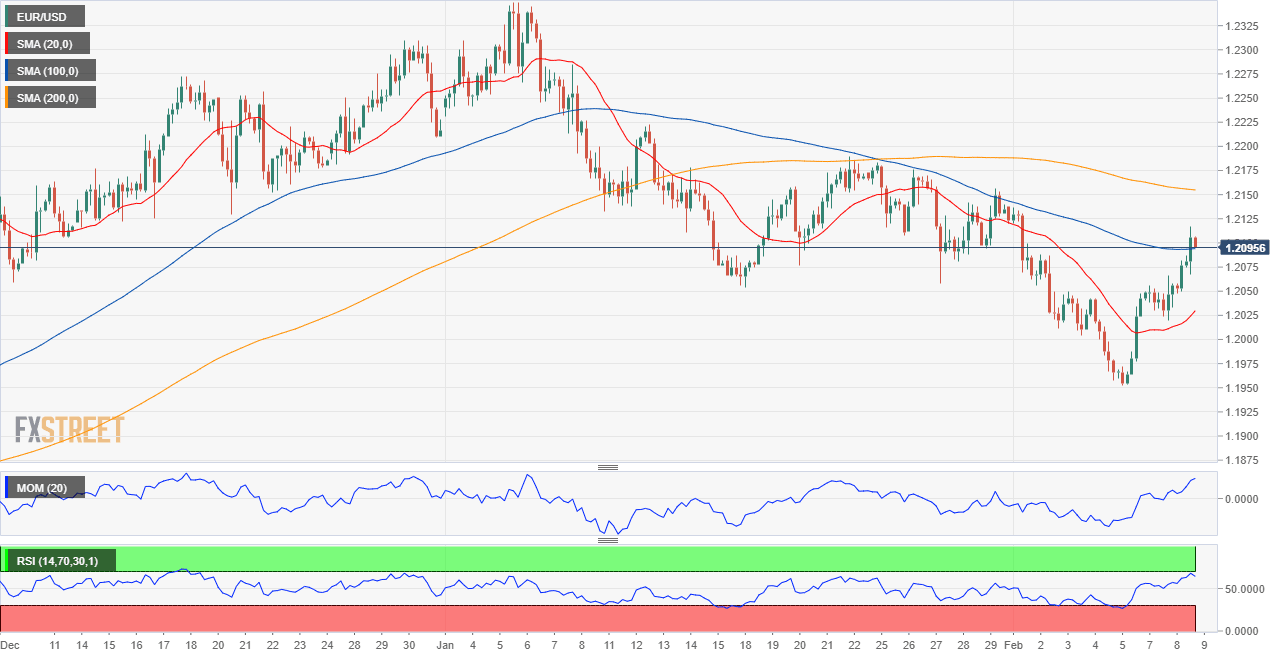

The EUR/USD pair has surged past the 38.2% retracement of its November/January rally at 1.2070, the immediate support level. Now trading around 1.2100, the 4-hour chart shows that technical indicators are losing bullish momentum after reaching overbought levels. The pair is currently developing above a directionless 100 SMA, while the 20 SMA slowly turns higher far below the current level.

Support levels: 1.1970 1.1925 1.1885

Resistance levels: 1.2120 1.2160 1.2205

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.