EUR/USD Forecast: Strong ahead of key US employment data

EUR/USD Current Price: 1.1875

- German Factory Orders improved by more than anticipated in June.

- US employment data mixed ahead of the Nonfarm Payroll report.

- EUR/USD maintains its bullish tone, up for a seventh consecutive week.

The EUR/USD pair has surged to 1.1915 this Thursday, its highest in two years, amid persistent dollar’s weakness. The market’s mood turned sour throughout the first half of the day, giving the greenback a brief intraday respite. Nevertheless, the pair is ending a third consecutive day with gains a handful of pips below the 1.1900 mark. Concerns surrounding the US currency remain the same, with the focus on tensions with China, the upcoming coronavirus aid package and economic growth.

In the data front, Germany published June Factory Orders, which were much better than anticipated, surging in the month 27.9%. When compared to a year earlier, orders declined 11.3% against the -34% expected. The US published some employment-related figures, relevant ahead of the Nonfarm Payroll report. Initial Jobless Claims improved to 1.18M in the week ended July 31, although US employers announced 262,649 job cuts in the month, up 54% from June, according to the Challenger Job Cuts report.

As for the US NFP report, the market expects that the US has added 1.6 million jobs in July, after adding 4.8 million in the previous month. The unemployment rate is expected to have shrunk from 11.1% to 10.5%, although the participation rate is also seen down, from 61.5% to 61.1%.

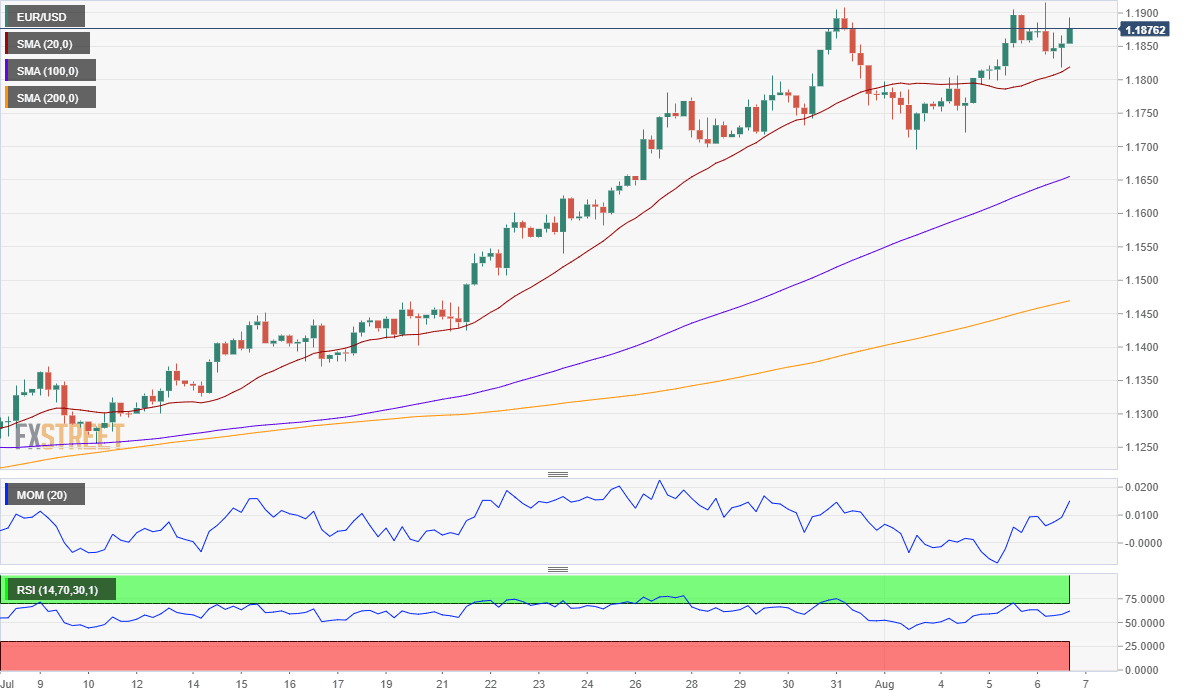

EUR/USD short-term technical outlook

The EUR/USD pair is overbought, but still heading north according to intraday readings. The 4-hour chart shows that a mildly bullish 20 SMA, attracted buyers, providing an immediate support level at around 1.1810 now. Technical indicators, in the meantime, remain within positive levels, the Momentum holding at highs and the RSI losing strength around 58. Overall, the risk remains skewed to the upside, with another attempt above 1.1910 probably anticipating higher highs ahead.

Support levels: 1.1835 1.1790 1.1740

Resistance levels: 1.1910 1.1950 1.1990

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.