EUR/USD Forecast: Sellers to retain control as long as 1.0250 resistance holds

- EUR/USD has recovered toward 1.0200 following Friday's selloff.

- Hawkish Fed bets help the dollar stay resilient against its rivals.

- The pair could struggle to extend its recovery unless it clears 1.0250.

EUR/USD has staged a rebound toward 1.0200 at the start of the week after having suffered heavy losses on Friday. The pair could find it difficult to gather bullish momentum unless it clears the significant resistance that aligns at 1.0250.

The US Bureau of Labor Statistics announced on Friday that Nonfarm Payrolls increased by 528,000 in July, beating the market expectation of 250,000 by a wide margin. Additionally, the publication revealed that wage inflation, as measured by the Average Hourly Earnings, remained unchanged at 5.2% on a yearly basis. This report caused markets to reassess the Fed's rate outlook and the probability of a 75 basis points rate hike in September jumped to 70% from 30% earlier in the week.

Moreover, Fed Governor Michelle Bowman said over the weekend that she strongly supported the 75 bps hike last month and added that "similarly-sized increases" should be on the table until there is a consistent decline in inflation.

The US economic docket will not feature any high-impact data releases on Monday and the risk perception could influence EUR/USD's action in the second half of the day. In the early European session, US stock index futures are up between 0.3% and 0.5%. If risk flows start to dominate the financial markets, the pair could continue to edge higher but hawkish Fed bets should limit its upside.

Meanwhile, the data from the euro area showed on Monday that the Sentix Investor Confidence improved modestly to -25.2 in August from -26.4 in July but this data failed to help the shared currency gather strength.

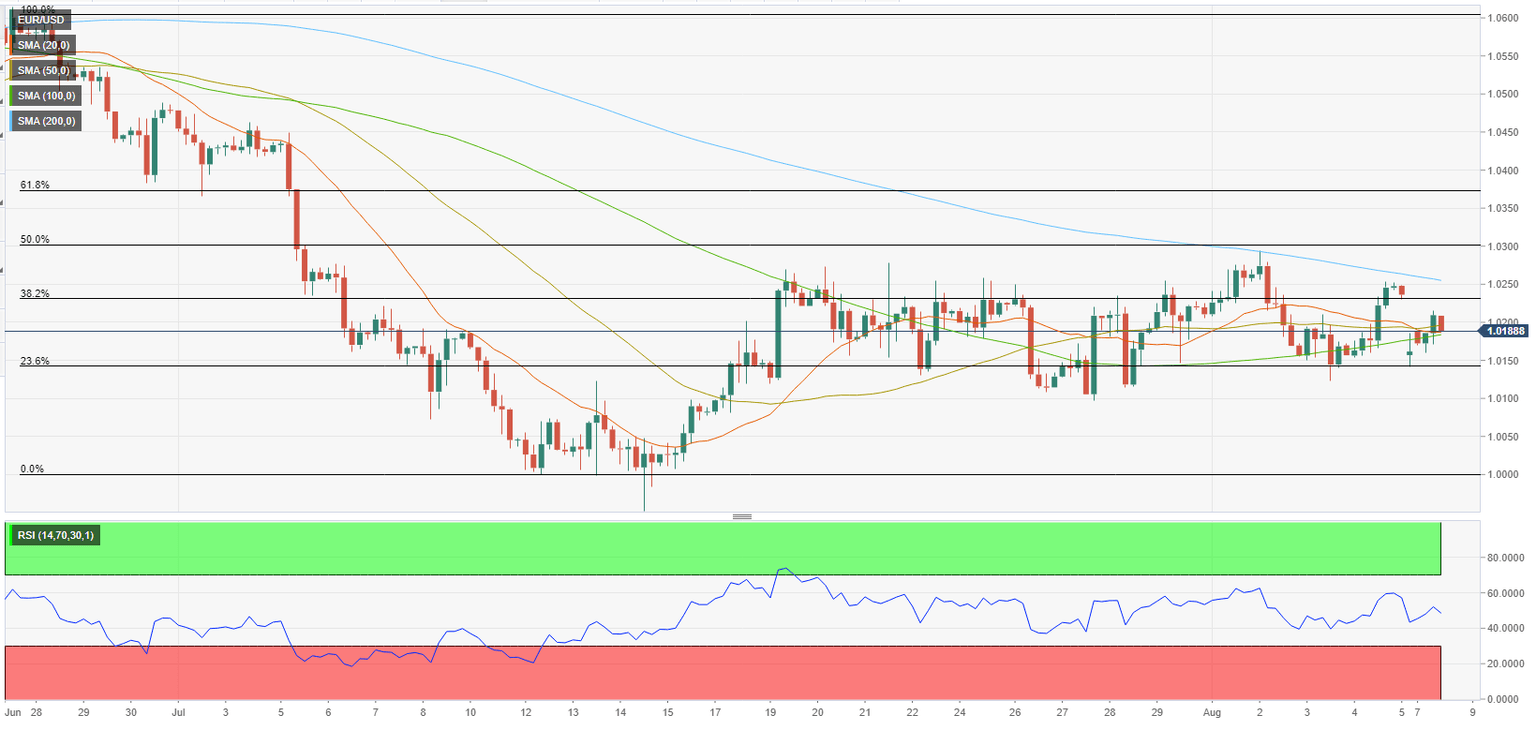

EUR/USD Technical Analysis

EUR/USD faces interim resistance at 1.0230 (Fibonacci 38.2% retracement of the latest downtrend) ahead of 1.0250 (200-period SMA on the four-hour chart). With a four-hour close above the latter, buyers could show interest and open the door toward the next bullish target at 1.0300 (psychological level, Fibonacci 50% retracement).

On the downside, additional losses toward 1.0150 (Fibonacci 23.6% retracement) and 1.0100 (psychological level, static level) could be witnessed in case 1.0200 (100-period SMA, 50-period SMA) is confirmed as resistance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.