EUR/USD Forecast: Sellers to remain in control unless euro breaks above 1.1600

- EUR/USD has gone into a consolidation phase after dropping toward 1.1500.

- Rebound attempts are likely to remain limited unless driven by fundamentals.

- Sellers are likely to stay in control of the action unless buyers manage to lift EUR/USD above 1.1600.

EUR/USD has gone into a consolidation phase following the sharp decline witnessed last week and stays relatively quiet around mid-1.1500s to start the week amid a lack of high-tier data releases.

Meanwhile, the fundamental outlook continues to favour the dollar over the common currency in the near term, suggesting that the pair's recovery attempts are likely to remain capped by technical levels.

The monetary policy divergence between the US Federal Reserve and the European Central Bank (ECB) became clearer following the Fed's decision to taper asset purchases. Moreover, ECB policymakers continue to remind markets that they are not looking to hike the policy rate and that they see inflation as being "transitory."

Earlier in the day, European Central Bank (ECB) chief economist Philip Lane noted that the current period of high inflation was very unusual and said that there were no signs of it becoming "chronic."

On the other hand, the data from the US revealed n Friday that Nonfarm Payrolls rose by 531,000 in October following Septembers dismal increase of 194,000. This reading showed that the effects of the Delta variant on the economy are easing off.

Later in the day, FOMC Chairman Jerome Powell will deliver the opening remarks at a virtual conference titled 'Gender and the Economy Conference'. Additionally, New York Federal Reserve President John Williams, Fed Vice Chair Richard Clarida and Fed Governor Bowman will be speaking as well. On the other hand, November Sentix Consumer Confidence data will be featured in the European economic docket.

EUR/USD Technical Analysis

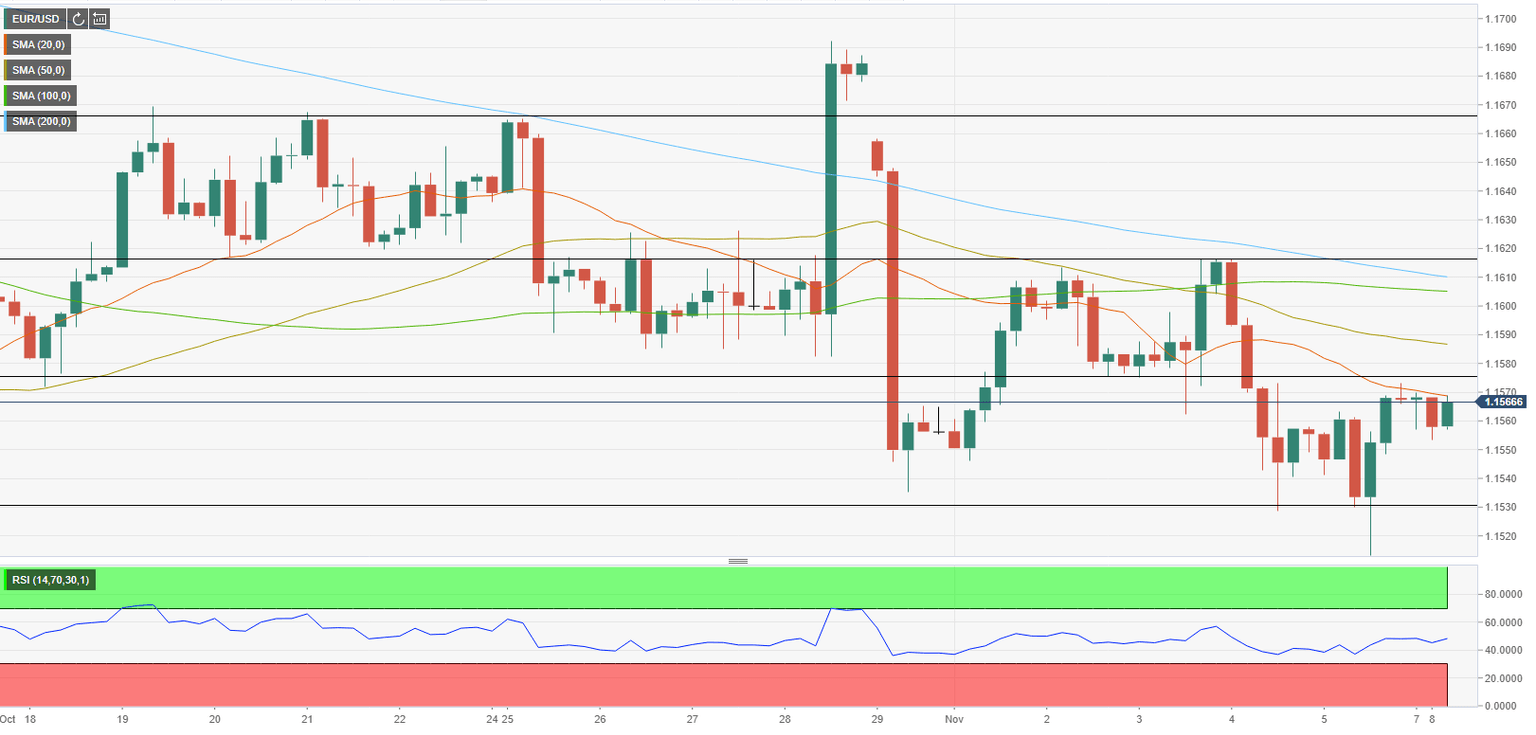

On the four-hour chart, the Relative Strength Index (RSI) indicator is holding near 50, reflecting the pair's indecisiveness. Initial resistance aligns at 1.1575 (20-period SMA, static level) before 1.1600/10 area, where the 100-period and 200-period SMAs form a strong hurdle. A daily close above the latter could attract buyers and open the door for another leg higher toward the next static resistance at 1.1650.

On the downside, supports could be seen at 1.1530 (static level) ahead of 1.1500 (psychological level) and 1.1440 (previous resistance, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.