EUR/USD Forecast: Sellers take action as Euro pierces through key support area

- Euro stays under heavy selling pressure at the beginning of the week.

- Political uncertainy following the European Parliament election weighs on sentiment.

- EUR/USD could extend its slide while 1.0790-1.0800 resistance area holds.

EUR/USD started the new week with a bearish gap and slumped to its weakest level in a month below 1.0750. The pair's technical outlook points to oversold conditions but the Euro could have a difficult time staging a rebound in the current risk-averse market atmosphere.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.38% | 0.03% | 0.11% | 0.11% | -0.11% | -0.04% | -0.07% | |

| EUR | -0.38% | -0.01% | -0.02% | 0.00% | -0.22% | -0.17% | -0.20% | |

| GBP | -0.03% | 0.00% | 0.12% | -0.01% | -0.21% | -0.16% | -0.20% | |

| JPY | -0.11% | 0.02% | -0.12% | 0.00% | -0.29% | -0.25% | -0.13% | |

| CAD | -0.11% | -0.01% | 0.01% | -0.00% | -0.18% | -0.14% | -0.19% | |

| AUD | 0.11% | 0.22% | 0.21% | 0.29% | 0.18% | 0.06% | 0.02% | |

| NZD | 0.04% | 0.17% | 0.16% | 0.25% | 0.14% | -0.06% | -0.04% | |

| CHF | 0.07% | 0.20% | 0.20% | 0.13% | 0.19% | -0.02% | 0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The US Dollar (USD) capitalized on the strong jobs report on Friday and forced EUR/USD to erase its weekly gains. Nonfarm Payrolls in the US rose 272,000 in May. This print surpassed the market expectation of 185,000 and April's increase of 165,000 by a wide margin. In turn, US Treasury bond yields surged higher ahead of the weekend and provided a boost to the USD.

Preliminary results of the European Parliament election triggered a flight to safety at the beginning of the week and caused the Euro to weaken against its rivals.

The European People's Party became the clear winner, gaining 8 seats to secure a total of 184 seats in the European Parliament.

In France, National Rally won 31.5% of the vote against the Besoin d'Europe alliance's - including President Macron's Renaissance - 14.5%. French President Emmanuel Macron said that far-right parties in Europe were "progressing across the continent" and called for a snap election. Meanwhile, in Germany, Chancellor Olaf Scholz’s SPD became the third party behind the main opposition conservative party, CDU, which received 30% of the vote, and the far-right Alternative for Germany (AfD) party, which got nearly 16% of the vote.

Assessing the outcome of the European Parliament election, analysts BBH said that things could get complicated or delayed with regards to the progress towards a deeper Eurozone integration. "It may take weeks before political alliances are shaped and a centrist “super grand coalition” remains the most likely scenario," analysts noted and added: "The centre-right European People’s Party (EPP) are still the parliament's biggest group followed by the centre-left Socialists and Democrats (S&D), and the centrist Renew Europe (RE)."

The economic calendar will not offer any high-tier data releases on Monday and the risk perception could continue to drive EUR/USD's action ahead of the US Consumer Price Index (CPI) data and the Federal Reserve's (Fed) monetary policy announcements on Wednesday.

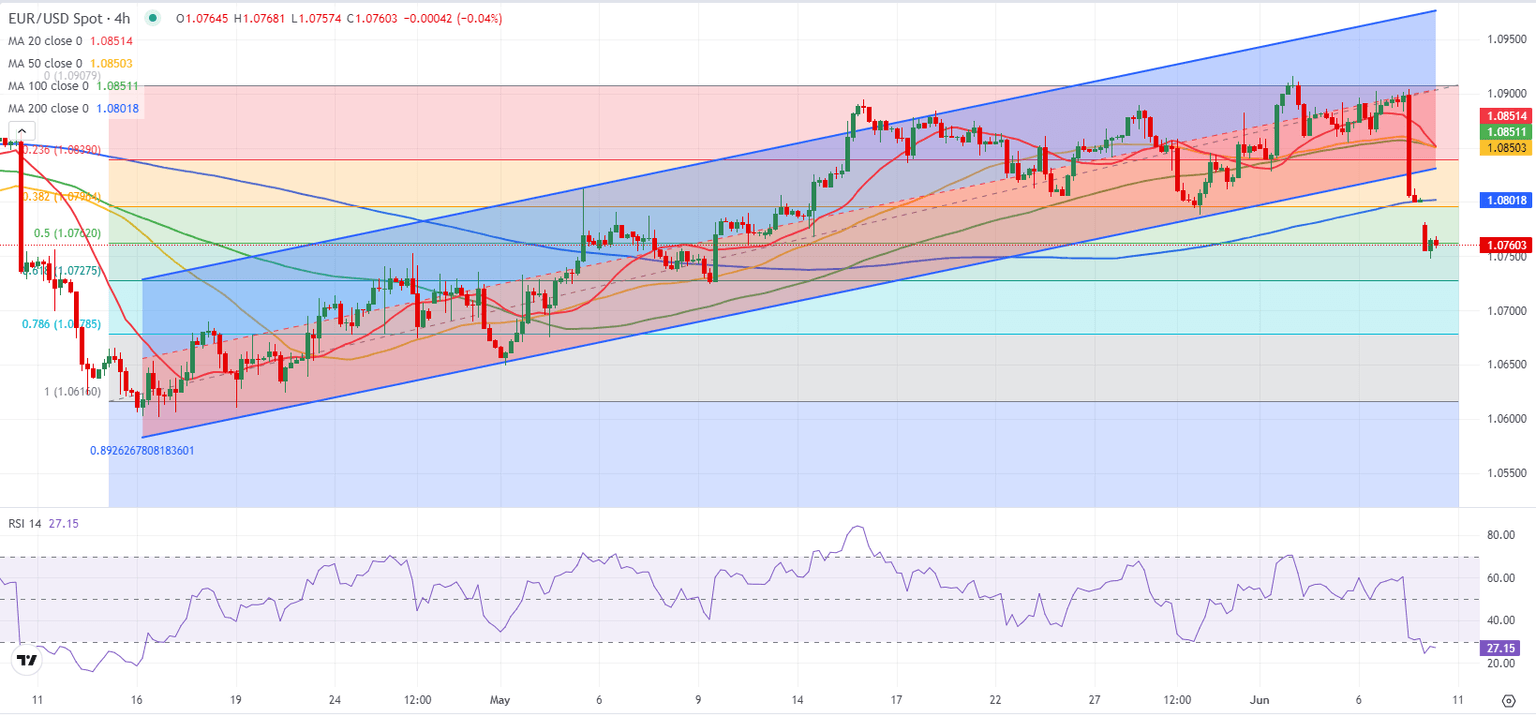

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart dropped below 30, pointing to oversold conditions in the near term. In case EUR/USD stages a correction, 1.0790-1.0800 area, where the Fibonacci 38.2% retracement of the latest uptrend meets the 100-day and the 200-day Simple Moving Averages (SMA), could act as stiff resistance. If the pair rises above that level and confirms it as support, an extended recovery toward 1.0850 (static level, 100-period SMA on the 4-hour chart) could be seen.

On the downside, interim support seems to have formed at 1.0750 before 1.0730 (Fibonacci 61.8% retracement) and 1.0700 (psychological level, static level).

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.