EUR/USD Forecast: Recession fears fuel dollar’s demand

EUR/USD Current Price: 1.0210

- Softer-than-anticipated Chinese data undermined the market mood.

- Stocks struggle to post gains while government bond yields pressure their recent highs.

- EUR/USD is technically bearish in the near term, with support in the 1.0150 price zone.

The American dollar is in recovery mode at the beginning of the week, appreciating across the FX board. The EUR/USD pair trades around the 1.0200 threshold, not far from a daily low of 1.0185. Renewed recession concerns overshadowed inflation-related relief amid signs of slowing economic activity in China. Retail Sales in the country were up 2.7% YoY in July, while Industrial Production rose by 3.8% in the same period, both missing the market’s expectations. At the same time, the central bank unexpectedly cut a key policy interest rate and drained liquidity.

Stock markets struggle to post gains, with European indexes trading mixed at around their opening levels. Demand for US government bonds, on the other hand, is keeping yields at the upper end of their latest range, reflecting fears of an economic setback.

Data-wise, Germany published the July Wholesale Price Index, which fell by 0.4% MoM. The US released the August NY Empire State Manufacturing Index, unexpectedly contracting to -31.3 from 11.1 in the previous month. The figure put some pressure on the greenback ahead of Wall Street’s opening. The calendar will remain light for the rest of the day.

EUR/USD short-term technical outlook

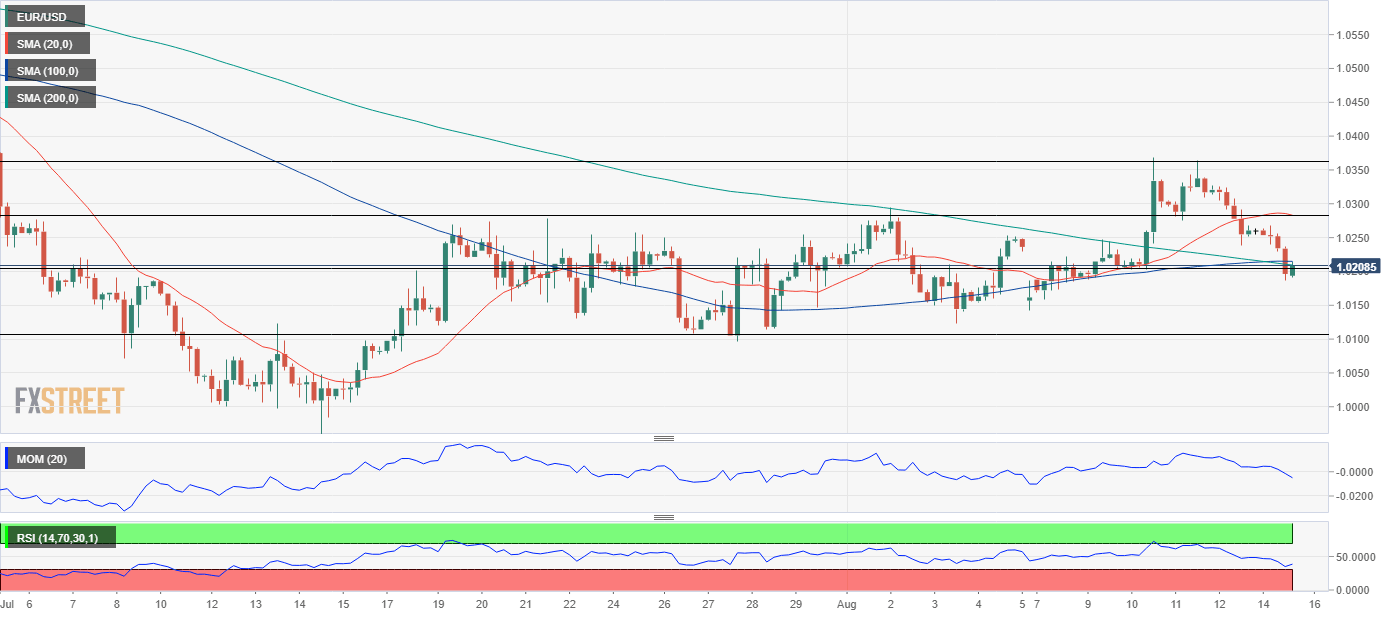

The EUR/USD pair is down for a second consecutive day, and technical readings show an increased risk of a bearish breakout. The daily chart shows that the Momentum indicator seesaws around its midline but also that the RSI indicator has accelerated south, maintaining its bearish slope at around 46. Meanwhile, the pair is crossing below a now flat 20 SMA, while the longer ones keep heading lower, far above the current level.

The near-term picture is bearish. The 4-hour chart shows that technical indicators have extended their declines within negative levels, maintaining their downward slopes. Also, the price is currently developing below all of its moving averages, with the 100 and 200 SMA lacking directional strength and converging at around 1.0210. Further declines could be expected should the pair be below the 1.0150 price zone.

Support levels: 1.0155 1.0105 1.0070

Resistance levels: 1.0240 1.0280 1.0325

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.