EUR/USD Forecast: Rally make or break moment with the ECB and Non-Farm Payrolls back to back

- EUR/USD has been advancing amid European and US optimism.

- The European Central Bank's decision, Non-Farm Payrolls, and disease developments are eyed.

- Early June's daily chart is painting a mixed picture.

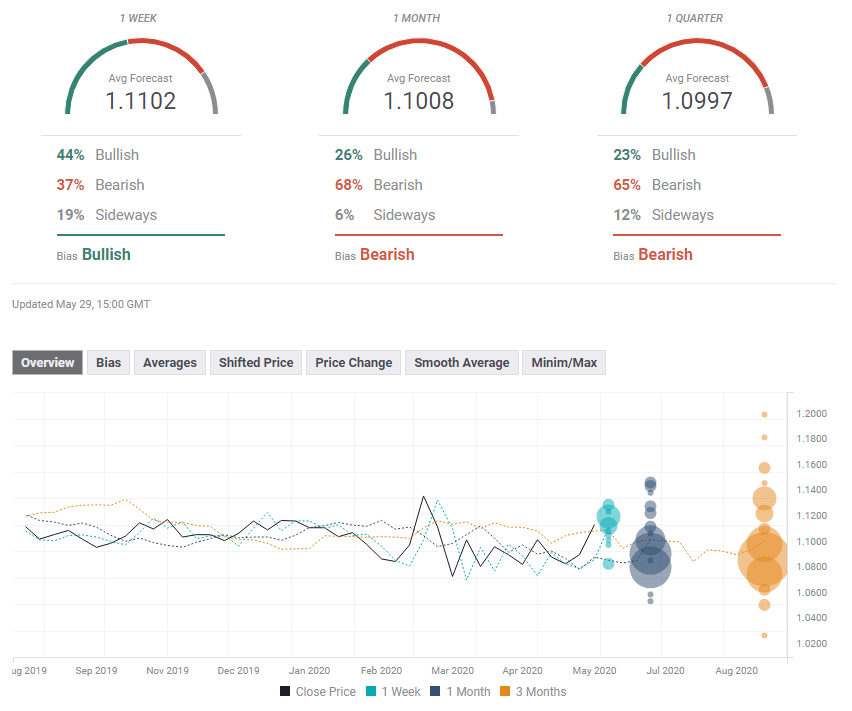

- The FX Poll is pointing to a gradual decline for the currency pair.

EUR/USD is awake, alive, and kicking, hitting the highest in two months. The euro enjoyed hopes for substantial fiscal stimulus, and the dollar mostly suffered hopes for a vaccine and quick reopening while ignoring Sino-American tensions. These market themes and others remain in the spotlight, and they are joined by the all-important ECB decision and potentially another devastating US jobs report.

This week in EUR/USD: Optimism on several fronts

Showing the money: The European Commission presented an ambitious recovery plan, topping the €500 billion Franco-German program of grants with additional loans. Brussels' backing for the generous move seems to outweigh concerns coming from the "Frugal Four" – a group of hawkish countries that wanted to limit EU help to borrowing and wrap it up with conditions. The news boosted the euro.

Improving statistics: COVID-19 figures continue trending lower in Italy and Spain, the continent's hardest-hit countries, which are also moving faster with returning to normal. Germany closely watched the Reproduction indicator is depressed well below 1, the rate at which one sick person infects another one.

Optimism about defeating the disease and returning back to normal also came from the other side of the pond and weighed on the safe-haven greenback. Several American companies such as Novavax and Inovio reported progress on a coronavirus vaccine. While Merck, a pharmaceutical giant, said that caution is warranted, markets cheered this news and also California's quicker removal of restrictions.

Sino-American tensions limit dollar falls: The world's largest economies remain at loggerheads on a long list of issues. The most notable one was Hong Kong's status. China's proposed new security law tightens its grip on the city-state and has angered US lawmakers, which have threatened to remove the financial hub's status.

Another point of contention is technology, where Huawei is under scrutiny, and Oppo, another phone maker, is looking into relieving itself from dependency on American products. On the other hand, while Washington and Beijing both vow to uphold the trade deal, investors seem mostly relaxed.

Mixed economic data: The German IFO Business Climate beat estimates with 79.5, but that remains a low level. In the US, New Home Sales smashed estimates while the Conference Board's Consumer Confidence gauge fell short of forecasts.

US data has gone both ways as well, with Durable Goods Orders showing a plunge in investment in April, while first-quarter Gross Domestic Product was downgraded to a fall of 5%. On the other hand, a surprising drop in continuing jobless claims for the week of May 15 – when Non-Farm Payrolls surveys are held – provides hope.

Eurozone events: ECB in the spotlight

A new month brings new easing of restrictions in several countries and also an opportunity to take stock of any setbacks. Reports about new clusters – as seen in South Korea – may weigh on the euro. Accelerating the reopening, as suggested in Spain, may boost the common currency.

The fiscal front is also of interest. Will the "Frugal Four" acquiesce to the EU plan or most of it? A public seal of approval would be positive for the euro, while another rejection – or worse off, a protracted negotiation – would send it lower.

ECB Preview

The main event scheduled is the European Central Bank's rate decision. The ECB will likely leave the deposit rate unchanged at -0.50% but may opt to enlarge its Quantitative Easing – bond-buying / money-printing – scope. The most recent Pandemic Emergency Purchase Program is worth €750 billion and may run out of cash in the autumn.

Despite objections from the German constitutional court in Karlsruhe, the Frankfurt-based institution may expand it to one trillion euros. Larger sums cannot be ruled out.

Christine Lagarde, President of the European Central Bank, may opt to set the groundwork and hit that additional stimulus will come at the next meeting. However, her recent comment that the most optimistic scenario is becoming unlikely hints of the need for further accommodation by the bank.

Staff at the bank is due to publish new growth and inflation forecasts, as it does every three months – yet some suspect the publication will be suspended because of extreme uncertainty. A gloomier forecast would justify more action, yet painting a dark picture without shedding light – announcing new stimulus – would weigh on the euro.

While printing money usually lowered its value, market reactions to previous ECB and Bank of England stimulus have been different – investors cheered support from central banks, as they allow governments to provide relief and stimulate a recovery sooner rather than later.

Lagarde and her colleagues will likely egg on governments to contribute their share to support the struggling economies, urging them to accept the EC's plan.

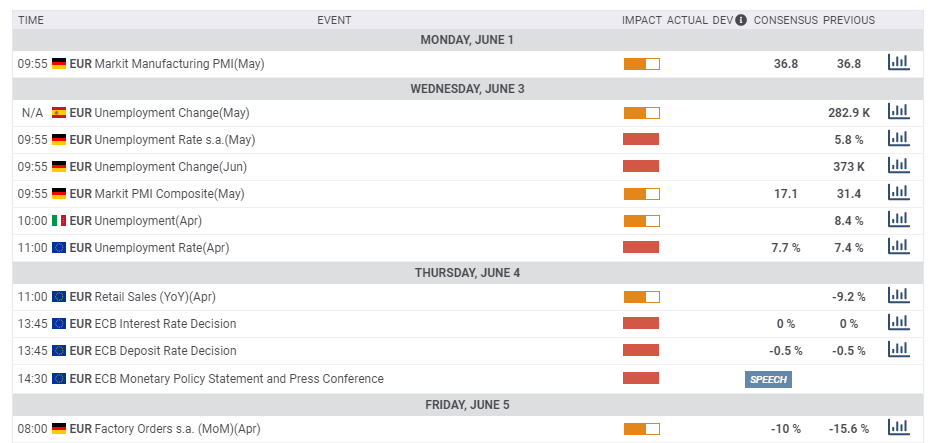

Other events of interest are final Purchasing Managers' Indexes from the eurozone, expected to confirm the recovery, albeit from catastrophic figures to only severely depressed ones. German unemployment numbers and Factory Orders are also of interest, yet the ECB overtowers everything else.

Here are the events lined up in the eurozone on the forex calendar:

US events: Full Non-Farm Payrolls buildup, corona stats

Has quick reopening triggered setbacks in some US states? Small clusters have been reported in rural areas, but nothing earth-shattering. A full month after the White House's guidelines expired, coronavirus statistics remain relevant. Ongoing success in flattening the curve may boost sentiment and push the dollar down, while if COVID-19 rears its ugly head, the greenback may find demand.

Sino-American relations are also of interest. If Hong Kong entirely falls under Beijing's control, investors will shrug it off as long as financial activity remains unharmed. Investors will likely ignore isolated cases and hyperbolic rhetoric as long as the trade deal remains unchanged, and both sides bark, but do not bite. However, any hints of severing ties – or other hostilities – may boost the greenback.

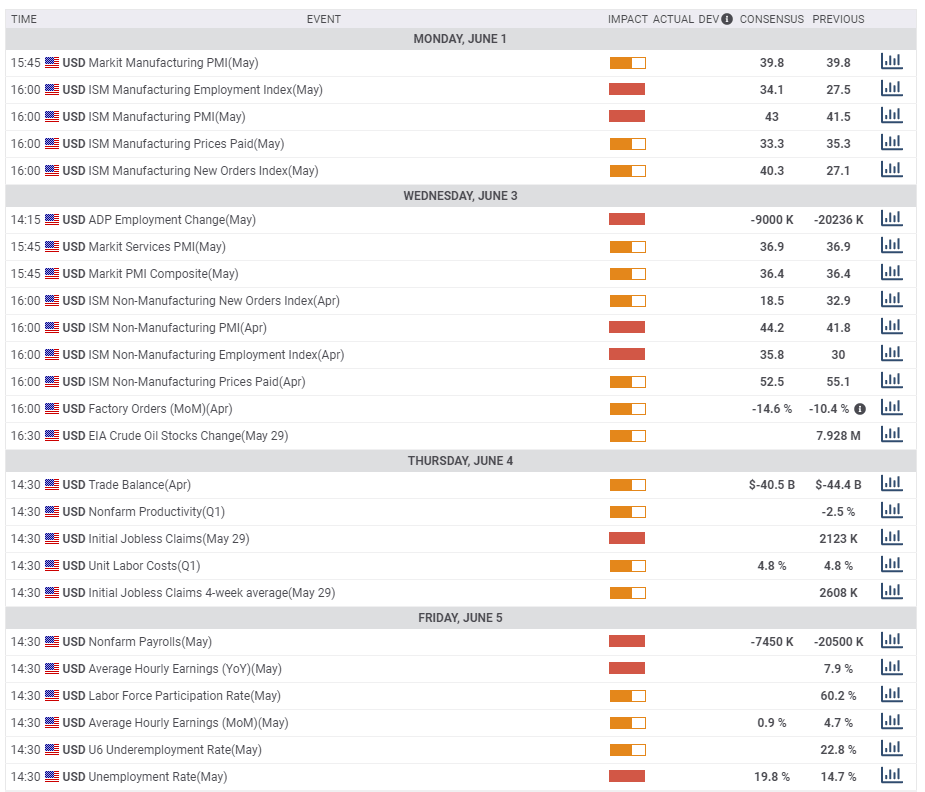

The economic calendar is packed with a full buildup to May's Non-Farm Payrolls coming on Friday. ISM's Manufacturing PMI and its employment component – which carries expectations for a bounce from the lows – provides the first clue early in the week. If it nears 50 – unlikely at this point – markets will cheer.

ADP's private-sector labor figures served as an accurate estimation of the horrible NFP last month. After printing over 20 million job losses in April, a less-horrific plunge of nine million is on the cards for May.

The ISM Non-Manufacturing PMI is another significant precursor to the employment report as most people are employed in the services sector. Both the headline statistic and the employment one are set to remain in the 30s, well below the 50-point mark separating expansion from contraction.

Thursday's weekly jobless claims are of interest but do not reflect the situation at the time of the NFP survey, taken in the middle of the month. Nevertheless, elevated continuing claims will likely serve as a reminder of America's dire job market.

And finally, Non-Farm Payrolls will probably show another massive, multi-million decrease in employment, yet probably better than April's 20.5 million. A significant downward revision for April cannot be ruled out, somewhat dampening any positive surprise in May's numbers.

The Unemployment Rate is set to leap to around 20% – yet still below the Great Depression peak of 25%. Wages, which were skewed to the upside in April, are set to return toward pre-coronavirus levels, and may also undergo revisions.

The dollar remains the safe-haven of choice, rising in response to a depressing figure and falling if America shows signs of getting back to work.

Here are the scheduled events in the US:

EUR/USD Technical Analysis

Euro/dollar has broken above 1.1020, which was a double top and also where the 200-day Simple Moving Average hit the price. That is a significant bullish development. Momentum remains to the upside, and the Relative Strength Index is still below 70 – currently outside overbought conditions.

All in all, bulls are in control, as long as the currency pair remains outside the overbought territory.

Strong resistance awaits at 1.1150, a peak in late March. It is followed by 1.12, which was a stepping stone on the way and down during that turbulent month. It is followed by 1.1240, a swing high from March, and then by 1.1280, which dates back to earlier in the year.

The 1.1020 level switches to support. It is followed by 1.0950, where the 100-day SMA hits the price, and then by 1.10870, a low point in late May. It is followed by 1.0760 and 1.0730.

EUR/USD Sentiment

A mix of fiscal stimulus and ECB monetary stimulus may send the currency pair to new highs – as long as Sino-American tensions do not overboil. Investors have shown resilience to horrendous economic figures. Will they continue ignoring them? Past performance does not promise future gains, but perhaps it will take longer until reality bites in financial markets.

The FXStreet Poll is showing that while average targets have been upgraded – for all timeframes – in the past week – they are lower than current prices. It seems that forecasters are casting doubts about the recent rally.

Related Reads

- Looking toward the recovery: currency drivers and what to watch out for

- GBP/USD Forecast: New month, new falls? Brexit, Non-Farm Payrolls, and coronavirus stats are key

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637263302845016216.png&w=1536&q=95)