EUR/USD Forecast: Pressure on the shared currency continues

EUR/USD Current price: 1.1596

- Financial markets are in a better mood amid solid Q3 earnings reports in the US.

- US Treasury yields stand at the lower end of their weekly range, weighing on the USD.

- EUR/USD is at risk of resuming its decline and reaching fresh 2021 lows.

The EUR/USD pair retreated from a fresh weekly high of 1.1623, now trading in the 1.1590 price zone. The American currency is down across the board, as US government bond yields remain depressed, although it is up against the EUR and the CHF. Financial markets were in a better mood on Thursday amid solid Q3 earnings reports in the US. Even further, the US published the September Producer Price Index, which was up 0.5% MoM and 8.6% YoY, higher than the August readings although below the market’s expectations, while Initial Jobless Claims for the week ended October 8 printed at 293K, much better than the 319K expected.

Upbeat US data provided additional support to the market’s mood. The EU did not publish relevant macroeconomic data. The week with finish with a higher note, as the US will release September Retail Sales, foreseen at -0.2% MoM, and the preliminary estimate of the October Michigan Consumer Sentiment Index, expected at 73.1 from 72.8 previously. The EU will publish the August Trade Balance, expected to post a surplus of €16.1 billion.

EUR/USD short-term technical outlook

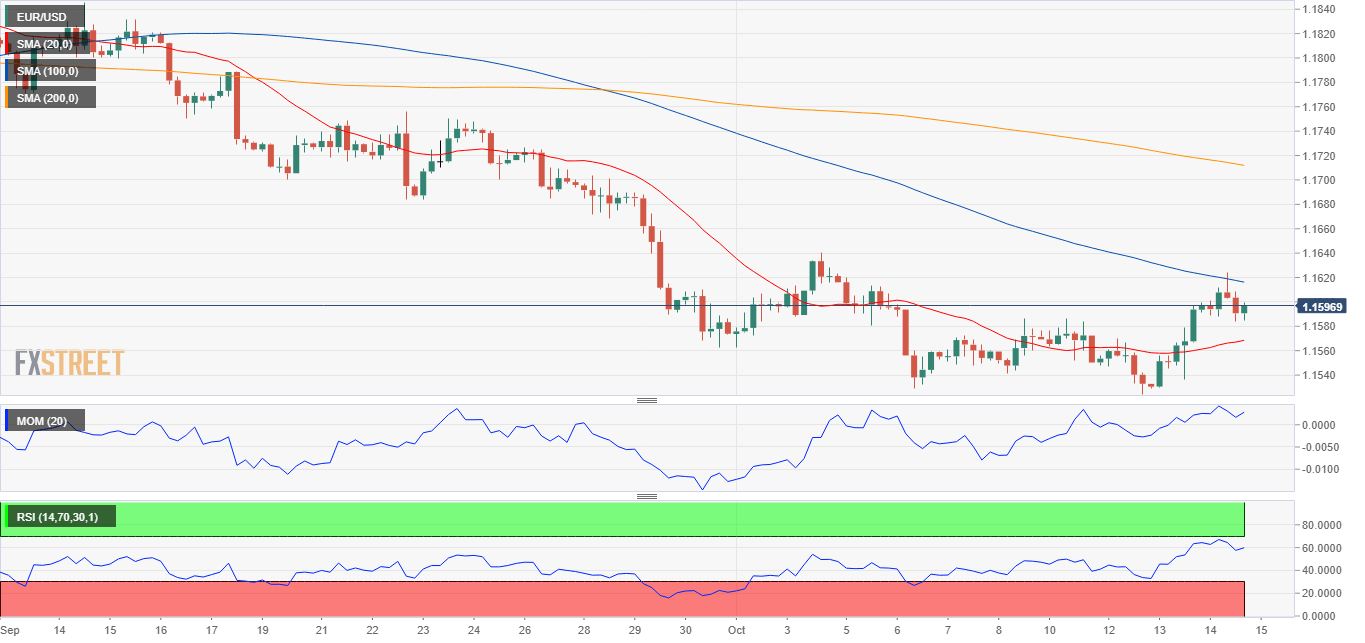

The EUR/USD pair is unchanged on a daily basis and may soon resume its slide. The daily chart shows that the pair met sellers around a firmly bearish 20 SMA, while technical indicators remain flat within negative levels. The long upward tail of the daily candle also supports a new leg lower ahead.

The 4-hour chart shows that the pair retreated after testing a bearish 100 SMA, which keeps sliding below an also bearish 200 SMA. The 20 SMA provides dynamic support at around 1.1550, while technical indicators hold into positive levels, with the Momentum advancing and the RSI consolidating. The pair needs to break above 1.1640 to turn bullish and shrug off the negative stance evident in the daily chart.

Support levels: 1.1550 1.1520 1.1475

Resistance levels: 1.1640 1.1685 1.1730

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.