EUR/USD Forecast: Pressure mounts ahead of Fed

EUR/USD Current Price: 1.2105

- ECB could cut rates, take measures against EUR’s strength, according to Klass Knot.

- US Durable Goods Orders rose 0.2% in December, exacerbated the dismal mood.

- EUR/USD is technically bearish and poised to challenge the 1.2060 level.

The EUR/USD pair is plunged mid-European session, following comments from ECB’s Government Council member, Klass Knot. He said that the central bank could decide to cut its deposit rate further below zero if that proved necessary to keep its inflation target in sight, adding that the ECB has tools to counter the EUR’s appreciation if needed, in an interview with Bloomberg TV. His words spurred risk aversion, with the greenback making the most of it, appreciating against all of its major rivals.

Germany published the GFK Consumer Confidence Survey, which contracted to -15.6 from -7.5. As for the US, the country has just released December Durable Goods Orders, which were up by a modest 0.2% in December, well below expected. The sour headline further fueled the dismal market mood, with the dollar retaining its strength and Wall Street plummeting ahead of the opening.

The focus shifts to the upcoming Federal Reserve’s announcement. The central bank is having a monetary policy meeting and will unveil its latest decision later today. Policymakers are expected to maintain the current policy unchanged and remain open to speed up stimulus if needed.

EUR/USD short-term technical outlook

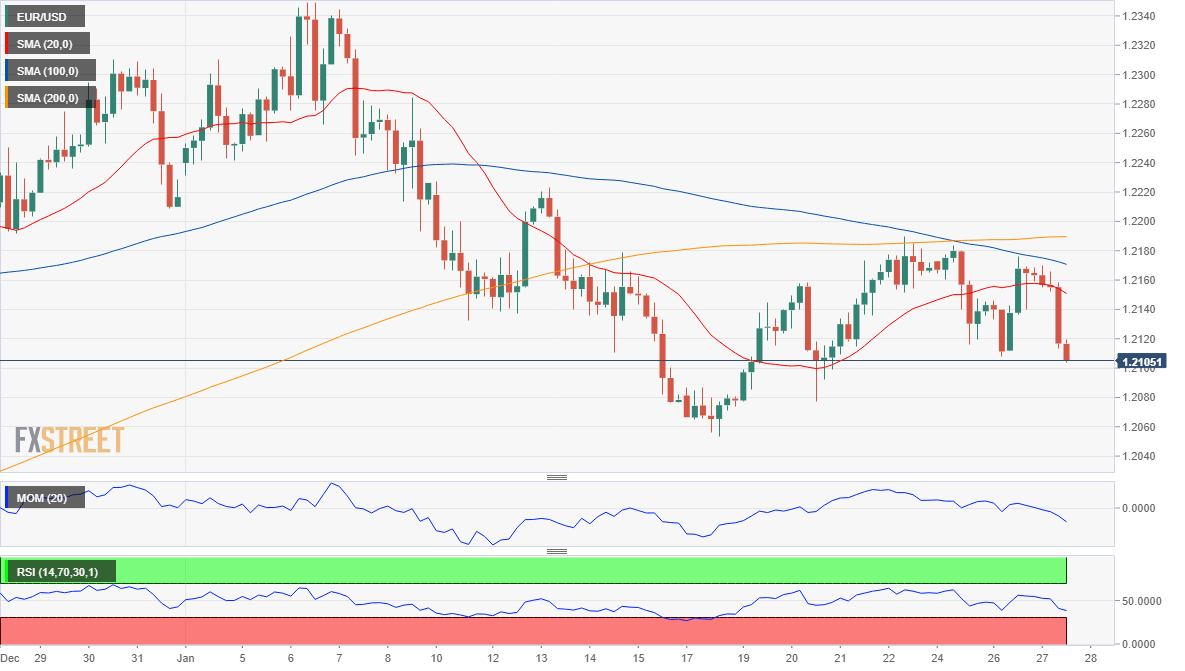

The EUR/USD pair is about to challenge the 1.2100 level and firmly bearish in the near-term. The 4-hour chart shows that it has accelerated its slump below all of its moving averages, with the 20 SMA gaining bearish strength below the larger ones. Technical indicators head firmly lower within negative levels, supporting further slides ahead. A critical support level is 1.2060, where the pair has the 38.2% retracement of its November/January rally.

Support levels: 1.2100 1.2060 1.2020

Resistance levels: 1.2145 1.2180 1.2225

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.