EUR/USD Forecast: Poised to correct lower, but still bullish

EUR/USD Current Price: 1.2079

- German IFO survey missed expectations in April, Business Climate contracted to 98.7.

- US Durable Goods Orders posted a modest 0.5% advance in March.

- EUR/USD correcting in the near-term, but bearish interest remains limited.

The EUR/USD pair peaked at 1.2116 at the weekly opening, lacking follow-through amid tinned trading due to holidays in Australia and New Zealand. The pair retreated from the mentioned high as the dollar firmed up, finding strength in higher US government bond yields. The yield on the 10-year Treasury note flirts with 1.60%, while equities in Asia and Europe trade mixed.

Germany published the April IFO survey, which showed that Business Climate unexpectedly contracted to 98.7 from 99.7 and vs the expected 99.7. The assessment of the current situation came in at 94.1, while expectations decreased to 99.5. The US published March Durable Goods Orders, which missed the market’s expectations by raising 0.5% vs the 2.5% expected. Nondefense Capital Good orders ex Aircraft rose 0.9%, improving from -0.8%, but missing the expected 1.5%.

EUR/USD short-term technical outlook

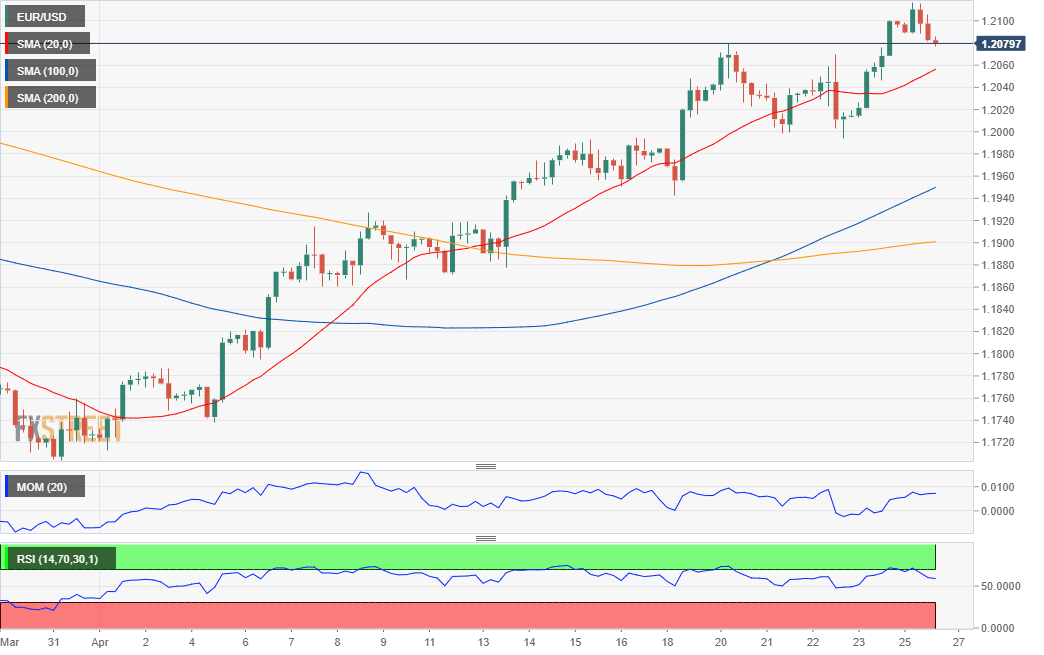

The EUR/USD pair trades around 1.2080 heading into the US opening, poised to correct lower but still far from indicating a tide change. The 4-hour chart shows that the pair remains above all of its moving averages, with the 20 SMA maintaining its bullish slope at around 1.2050. Technical indicators retreat from near overbought levels but remain within positive levels.

Support levels: 1.2050 1.2010 1.1985

Resistance levels: 1.2115 1.2160 1.2200

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.