EUR/USD Forecast: Poised to challenge bears’ determination at 1.1920

EUR/USD Current Price: 1.1880

- US Gross Domestic Product missed expectations by printing 6.5% in Q2.

- German inflation unexpectedly jumped to 3.8% YoY in July.

- EUR/USD is technically bullish, approaches a critical resistance.

The EUR/USD pair hit a three-week high of 1.1879 during European trading hours, fueled by the dollar’s sell-off. The greenback took a hit from the US Federal Reserve, as the central bank kept its current monetary policy on hold while gave no hints on tapering. The statement and Chairman Jerome Powell’s press conference showed optimism about the economic comeback but also indicated that they are in no rush to pull out monetary support. Stocks rallied on relief, with global indexes trading in the green.

The US published the preliminary estimate of the Q2 Gross Domestic Product, which showed an annualized growth of 6.5%, missing expectations of 8.4%. Also, Initial Jobless Claims were worse than anticipated, printing at 400K in the week ended July 23. The dollar came under further selling pressure, with the pair extending its gains toward the 1.1900 figure. Earlier in the day, Germany published the preliminary estimates of July inflation. The annual Consumer Price Index jumped to 3.8%, well above the 3.3% expected.

EUR/USD short-term technical outlook

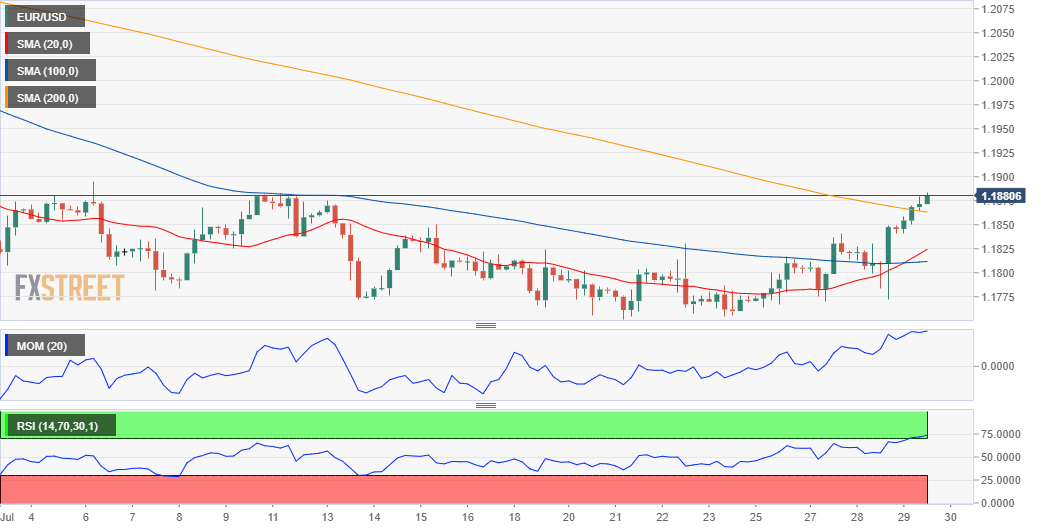

The EUR/USD pair trades near 1.1883, the daily high, and is poised to extend gains towards the next resistance level at 1.1920, the 61.8% retracement of the March/May rally. The 4-hour chart shows that the pair is developing above all of its moving averages, with the 20 SMA crossing above the 100 SMA. Technical indicators aim higher, decelerating as they approach overbought readings. Sellers will likely defend the Fibonacci level, at least on a first approach to it.

Support levels: 1.1840 1.1790 1.1750

Resistance levels: 1.1920 1.1960 1.2000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.