EUR/USD Forecast: Next stop, 1.20? Overbought conditions and a vaccine scare may cause a pause

- EUR/USD has been riding higher after US inflation fell short of investors' fears.

- The halting of J&J's vaccine distribution may delay Europe's exit from the covid crisis.

- Wednesday's four-hour chart is showing overbought conditions.

No stopping the printing press – fears that the Federal Reserve would taper its bond-buying scheme have proved premature after Tuesday's developments and the dollar is under growing pressure.

First, highly anticipated inflation figures for March bumped higher, but not as much as the hype had suggested. The Core Consumer Price Index hit an annual level of 1.6% – as estimated and below the Fed's 2% target. Moreover, most of the increase in headline CPI came from energy prices which may stabilize in the next few months.

See US Inflation Analysis: Doomsday will wait, but second “sell the fact” on the dollar looks near

Secondly, the Treasury successfully auctioned 30-year bonds, the second consecutive smooth offering of US debt in as many days. High demand pushed yields lower, thus making the dollar less attractive.

Jerome Powell, Chair of the Federal Reserve, will speak later on and may feel vindicated that his insistence that inflation will be transitory is proving correct – at least for now. His colleagues John Williams, Richard Clarida, and Raphael Bostic have also slated the speak and the Fed also publishes its "Beige Book" providing insights about the economy.

The world's most powerful central bank has not only urged patience with inflation but also wants to see a substantial increase in employment before moving. That may take a long time. In the meantime, the dollar could remain under ongoing pressure.

However, the greenback's decline could have been even more significant if the safe-haven currency would not react to the latest vaccine concerns. The US FDA recommended pausing injecting the firm's immunizations after six cases of rare blood clots among 6.8 million people that were inoculated. The investigation will likely take several days.

The euro was hit as J&J promptly decided to pause sending its vaccines to European countries, in an "abundance of caution." While the US does not depend on the firm's single-shot solution to reach its goals, the old continent may suffer a delay of 3-4 months to reach 70% of its population. Losing another summer season could be devastating. So far, the common currency is moving with caution, as the postponement could prove temporary.

All in all, the upbeat market mood favors more gains, yet the next upswing hinges on vaccine developments.

EUR/USD Technical Analysis

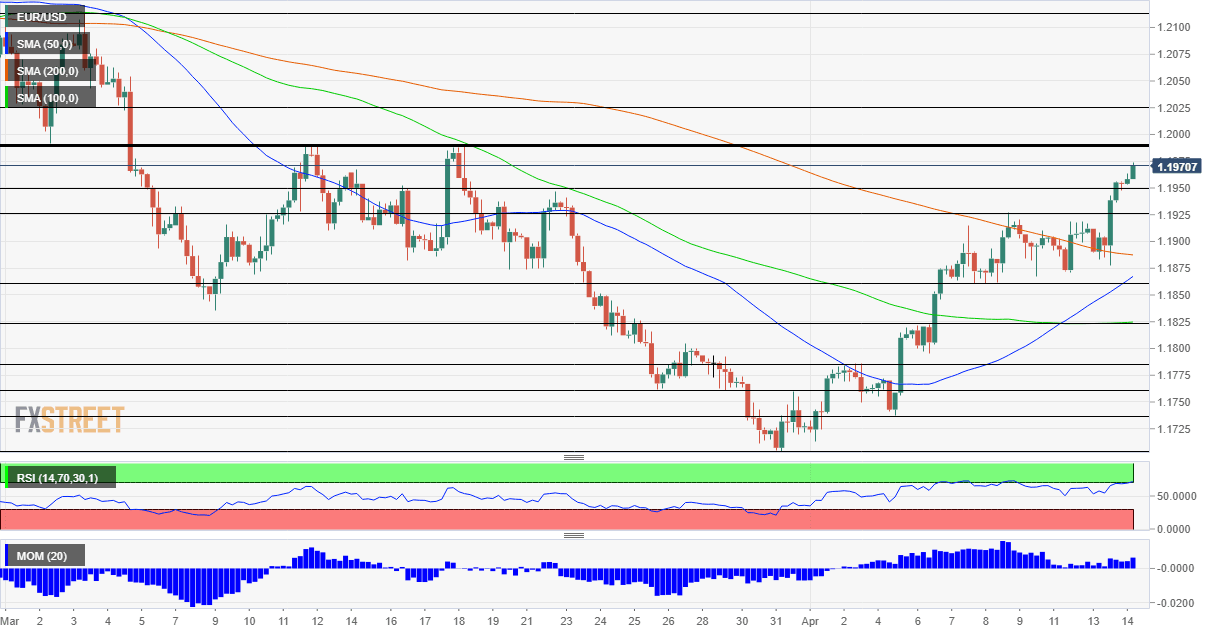

Euro/dollar has already risen some 270 pips from the lows and has surpassed the 50, 100 and 200 Simple Moving Averages (SMAs) on the four-hour charts. Another bullish sign is upside momentum. However, the Relative Strength Index is flirting with 70 – on the verge of overbought conditions and signaling a potential drop.

Critical resistance is at 1.1990, which is a double-top from March. It is followed by 1.2025 and 1.2110, levels seen earlier in the year.

Support awaits at 1.1950, a resistance line from late March, followed by 1.1925, a cap from last week. Further down, 1.1860 was a support line before the recent surge and is now a crucial cushion.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.