EUR/USD Forecast: New week, new gains? Only overbought conditions can halt the euro

- EUR/USD has been on as markets focus on the vaccine-led recovery.

- US Durable Goods Orders and virus news are set to dominate trading.

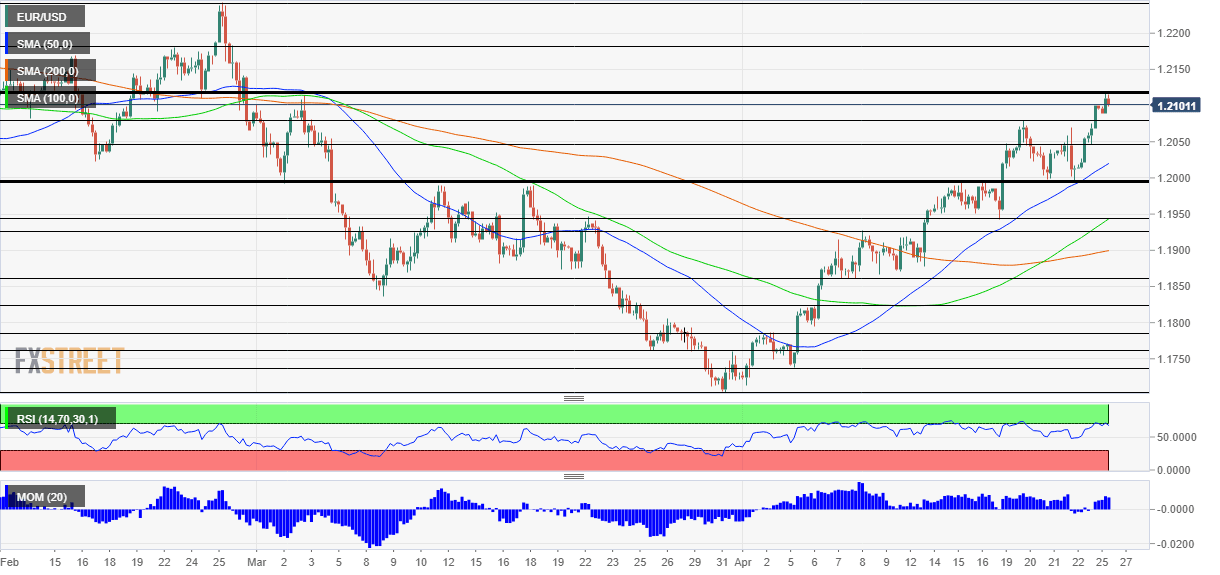

- Monday's four-hour chart is showing the currency pair is on the verge of overbought conditions.

US dollars are coming to Europe – the EU is set to welcome vaccinated American tourists in the summer, which is just around the corner. Apart from having a positive direct effect on EUR/USD, the potential revival of the old continent's tourism sector is one of the reasons the euro is on the rising.

Monday's loosening of restrictions in Italy and France is another positive development. More importantly, the pace of inoculations has substantially picked up in Europe with another acceleration on the cards during the remainder of April and throughout May. Roughly 42% of Americans have received at least one jab, and the rate is only half across the pond – but picking up much-needed steam.

The European Central Bank's cautiously optimistic message on Thursday – upgrading its risk assessment to balanced instead of to the downside – is another boost to the euro.

See ECB Analysis: Lagarde offers four subtle changes that may send the euro higher

Broader markets are also favoring additional EUR/USD gains. The safe-haven dollar is on the back foot as investors refocus on recovery rather than on India's horrific COVID-19 crisis, which has implications well beyond South Asia. The US, the UK, and other countries are sending support to Delhi and Mumbai as infections set daily records, partially in self-interest to prevent a slowdown that may come back to haunt developed economies.

The focus is later set to shift to US Durable Goods Orders. Investment has probably picked up in March after a drop in February. The 2.5% expected pickup in the headline figure and the projected 1.5% rise in Nondefense ex Aircraft – aka "core of the core" – feed into Thursday's all-important growth figures.

The Federal Reserve is also eyeing the data. The world's most powerful central bank is set to leave its policy unchanged on Wednesday, but to take stock of the surge in US economic activity and perhaps begin signaling a decrease in its massive bond-buying. Printing fewer dollars would boost the greenback. However, at least on Monday, the notion of ongoing fed support is weighing on the currency.

Overall, fundamentals point to extended gains for EUR/USD.

EUR/USD Technical Analysis

Euro/dollar is trending higher since late March, as the four-hour chart shows. On its way up, the currency pair topped the early-March peak of 1.2110 and hit a new high of 1.2116 – a level last seen in late February.

Momentum is to the upside and the Relative Strength Index (RSI) is just under 70. If this indicator tops that level, it would enter overbought conditions and signal a correction. However, bulls currently remain in control.

Above 1.2116, the next levels to watch are 1.2170 and 1.2250.

Support awaits at the previous April peak of 1.2180, followed by the battle line of 1.2050 and then by the psychological barrier of 1.20.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.