EUR/USD Forecast: Negative outlook should persist below the 200-day SMA

- EUR/USD gapped lower and tested five-week lows near 1.0730.

- The US Dollar picked up strong pace and advanced to multi-week tops.

- Political uncertainty in Europe resurged after Parliamentary elections.

On Monday, the US Dollar (USD) maintained its post-NFP uptrend well and sound, prompting EUR/USD to extend its downward momentum to five-week lows in the 1.0735–1.0730 band.

The firm price action in the Greenback, however, could not avoid part of the risk complex to regain some balance after Friday’s sharp losses and was exclusively derived from weakness in the European currency in response to results from parliamentary elections in the old continent and the call for snap elections by French President E. Macron to be held on June 30.

Monday, in the meantime, saw some ECB board members, including board member P. Kazimir, J. Nagel, and President C. Lagarde, urging caution in considering further interest rate cuts due to uncontrolled inflation and potential price pressures. They compared the bank's interest rate trajectory to a mountain ridge, suggesting policymakers may wait multiple meetings before implementing further cuts.

Regarding the Federal Reserve (Fed), the latest Nonfarm Payrolls numbers in May (+272K) hurt bets on anticipated interest rate hikes and now suggest the likelihood of such a move in November or December.

The CME Group's FedWatch Tool now suggests a nearly 65% probability of lower interest rates by the November 7 meeting and around 49% in September.

In the short term, the ECB's recent rate cut widened the policy gap with the Fed, potentially exposing the EUR/USD to further weakness. However, in the longer term, the emerging economic recovery in the Eurozone, coupled with perceived slowdowns in the US economy, should mitigate this disparity, offering support to the pair.

Looking ahead, the next big events for the pair will be the release of US inflation figures tracked by the CPI and the FOMC meeting, both due on June 12.

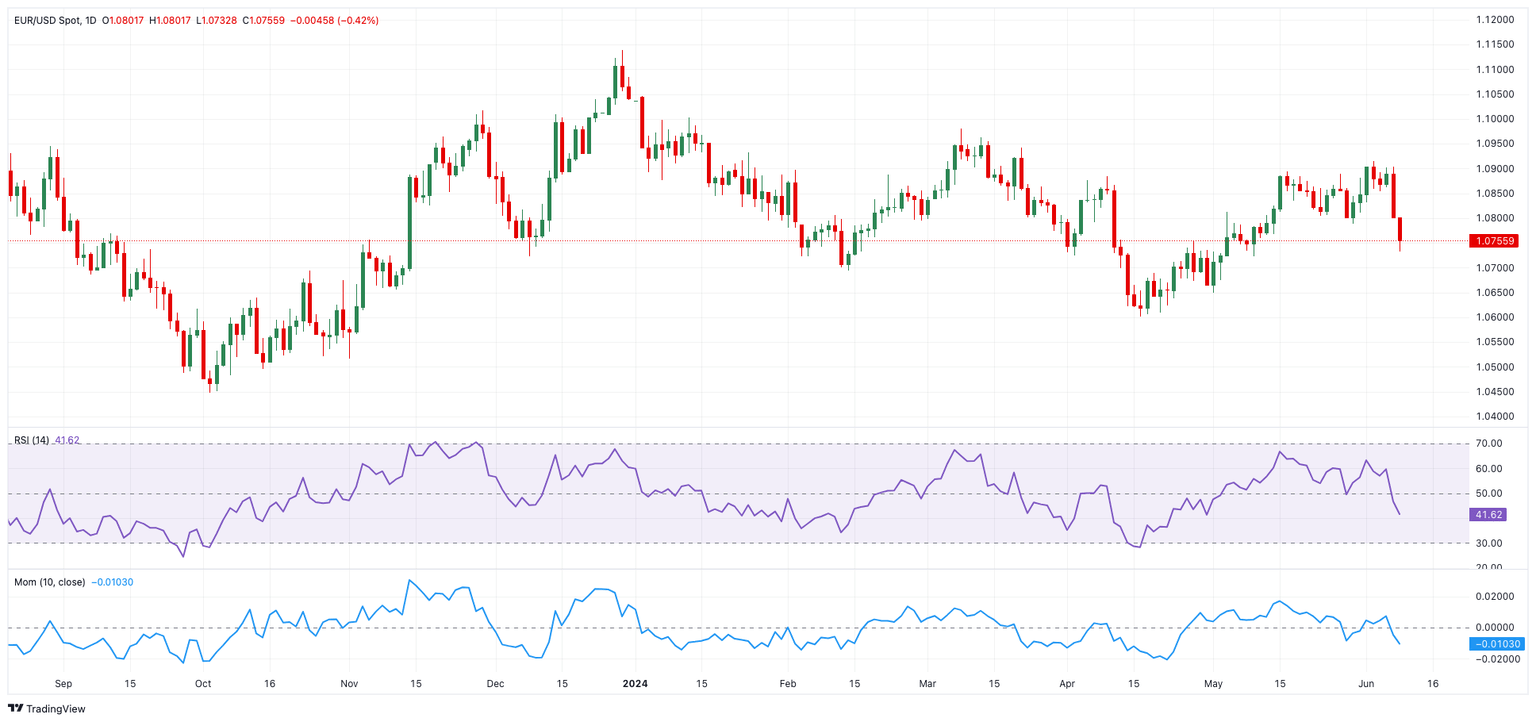

EUR/USD daily chart

EUR/USD short-term technical outlook

If the bearish tone persists, EUR/USD may initially target the June low of 1.0732 (June 10), before the May low of 1.0649 (May 1), and the 2024 bottom of 1.0601 (April 16).

If bulls regain some composure, spot may test the June high of 1.0916 (June 4), seconded by the March top of 1.0981 (March 8), and the weekly peak of 1.0998 (January 11), all before reaching the important 1.1000 level.

So far, the 4-hour chart indicates some signs of life following the recent sharp drop. That said, the next hurdle is the 200-SMA (1.0802), ahead of the 55-SMA of 1.0846. On the flip side, 1.0732 comes first prior to 1.0723 and 1.0.649. The relative strength index (RSI) bounced to around 30.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.