EUR/USD Forecast: Limited bullish potential ahead of central banks’ frenzy

EUR/USD Current price: 1.0895

- Solid gains in stock markets maintain EUR/USD marginally higher on Monday.

- The Eurozone confirmed the February Core Harmonized Index of Consumer Prices at 3.1% YoY.

- EUR/USD struggles around 1.0900, with the risk skewed to the downside in the near term.

The EUR/USD pair trades uneventfully around the 1.0900 mark, up roughly 20 pips in the day. Financial markets started the week cautiously, as multiple central banks will announce their decisions on monetary policy in the upcoming days, including the United States (US) Federal Reserve (Fed).

The US Dollar has been under mild selling pressure since the day started, as stock markets are firmly up. The Nikkei 225 is up roughly 1,000 points or 2.67% amid mounting speculation the Bank of Japan (BoJ) will end its ultra-loose monetary policy early on Tuesday. Meanwhile, government bond yields maintain their positive momentum, limiting USD losses. The 10-year Treasury note currently offers 4.30%, holding near last week’s peak at 4.32%.

Data-wise, the Eurozone published the Trade Balance, which posted a surplus of €28.1 billion in January, pretty much doubling the previous reading. Additionally, the EU confirmed the February Core Harmonized Index of Consumer Prices (HICP) at 3.1% YoY, as previously estimated. The American session will bring the US NAHB Housing Market Index for March.

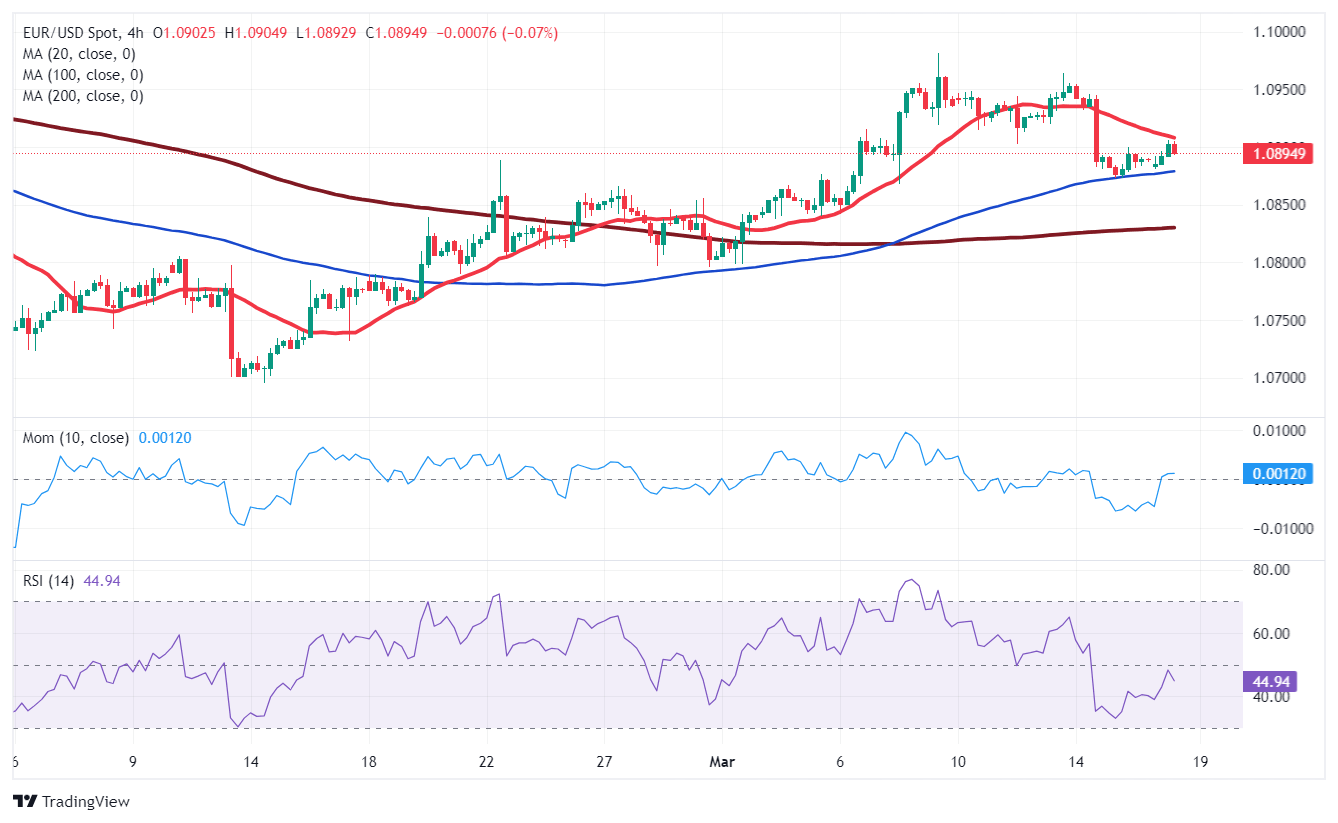

EUR/USD short-term technical outlook

Technically, the EUR/USD pair seems poised to extend its advance. The daily chart shows the pair trades above bullish moving averages as the 20 Simple Moving Average (SMA) gains upward strength above the longer ones. Furthermore, the latter converges with the 38.2% Fibonacci retracement of the 1.1139/1.0694 slide at 1.0865. Meanwhile, technical indicators resumed their advances from around their midlines and after correcting overbought conditions, suggesting the latest decline was just corrective.

For the near term, the 4-hour chart offers limited bullish potential. EUR/USD retreats from a firmly bearish 20 SMA, providing dynamic resistance at around 1.0910. Beyond this level, the 50% retracement of the aforementioned Fibonacci slide comes at 1.0917, meaning the pair would need to advance beyond 1.0920 to gain upward traction. Finally, technical indicators remain within negative levels, losing their upward potential, skewing the risk to the downside.

Support levels: 1.0865 1.0820 1.0775

Resistance levels: 1.0920 1.0970 1.1010

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.