EUR/USD Forecast: Light at the end of the tunnel?

- EUR/USD regained poise and surpassed 1.0900.

- Advanced PMIs lent support to the single currency.

- The ECB is largely expected to keep rates unchanged.

The surprising intense sell-off in the greenback allowed EUR/USD to leave behind part of the recent weakness and refocus on the upside, surpassing the 1.0900 hurdle to print new multi-day highs.

The USD Index (DXY) suffered the prevailing risk-friendly environment and dropped to the sub-103.00 region despite the move higher in US yields across the curve, while speculation kept pointing to dwindling bets of a Fed’s rate cut in March, favouring instead a reduction of rates in May.

Also contributing to the resurgence of the buying interest in the pair, advanced PMIs in Germany and the euro bloc came in on the strong side for the month of January, exposing some reactivation of the economic activity in the region and hinting at the idea of a potential soft landing of the region’s economy.

Ahead of the upcoming ECB event, it is important to highlight that market participants have already factored in approximately 120 bps in rate cuts for the current year. However, there is a growing debate between market participants and the rate-setters at the ECB regarding the timing of the central bank's decision to implement a reduction in the policy rate for the region. Furthermore, President Lagarde has hinted at the possibility of a potential move during the summer.

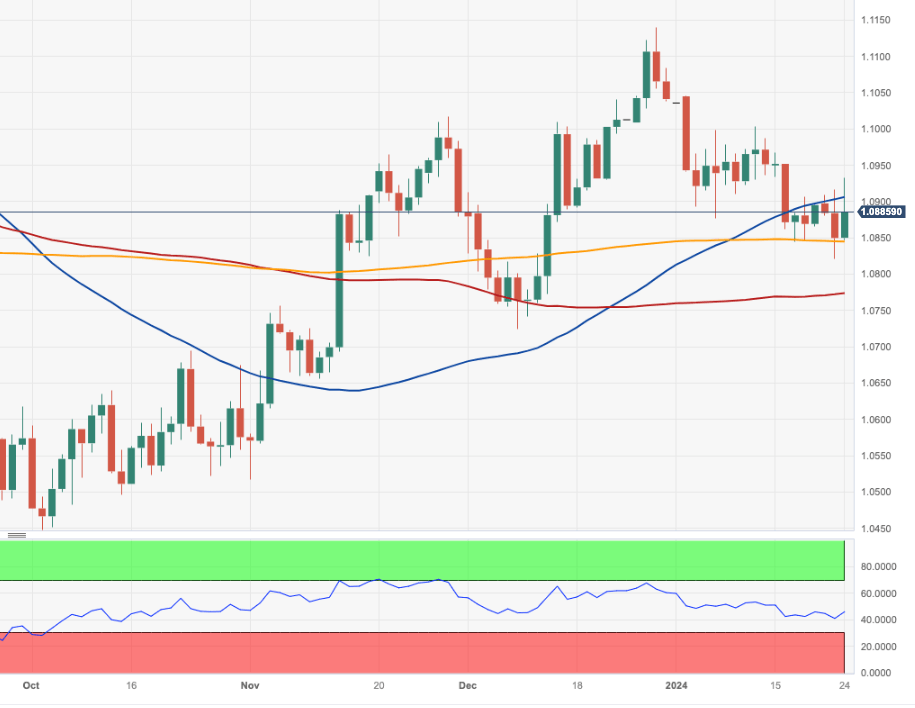

EUR/USD daily chart

EUR/USD short-term technical outlook

If the EUR/USD falls further and hits the 2024 bottom of 1.0821 (January 23), it may approach the temporary 100-day SMA at 1.0773 before reaching the December 2023 low of 1.0723 (December 8). The breach of this level should not have any significant support until the weekly low of 1.0495 (October 13, 2023), which is ahead of the October 2023 low of 1.0448 (October 3) and the round level of 1.0400.

The pair's outlook is predicted to become bearish if it clears the important 200-day SMA, now at 1.0844, in a sustained manner.

On the upside, spot needs to leave behind the weekly high of 1.0998 (January 11), to open the door to a possible visit to the December top of 1.1139 (December 28).

Based on the 4-hour chart, the pair appears to have returned to the consolidative phase. However, the initial support level will be at 1.0821, which comes ahead of 1.0723. Bullish efforts, on the other hand, could seek for a challenge of 1.0932 prior to 1.0998. The MACD remains slightly negative, but the RSI returned to the 50 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.