EUR/USD Forecast: Holding near the highs, bullish

EUR/USD Current Price: 1.1859

- Wall Street set to open lower, following the lead of its overseas counterparts.

- US weekly unemployment claims surprised to the upside, other employment-related data missed.

- EUR/USD is trading around 1.1850 after reaching a new yearly high.

The EUR/USD pair surged to 1.1915, a fresh multi-month high, only to retreat to the current 1.1850 area. The American currency remains the weakest across the FX board, despite the latest modest recovery. Investors turned cautious ahead of US employment data, and the upcoming Nonfarm Payroll report to be out on Friday.

US Initial Jobless Claims for the week ended July 31 surprised to the upside, as those claiming for unemployment benefits accounted for 1.18 million, better than the previous 1.43M and also beating the market’s expectation. Challenger Job Cuts, however, were up to 262.649K in July, from 170.219K in the previous month.

Meanwhile, Wall Street is set to open lower, weighed by the sour tone of its overseas counterparts, while US Treasury yields flirt with their recent lows, somehow suggesting a dismal market mood.

EUR/USD short-term technical outlook

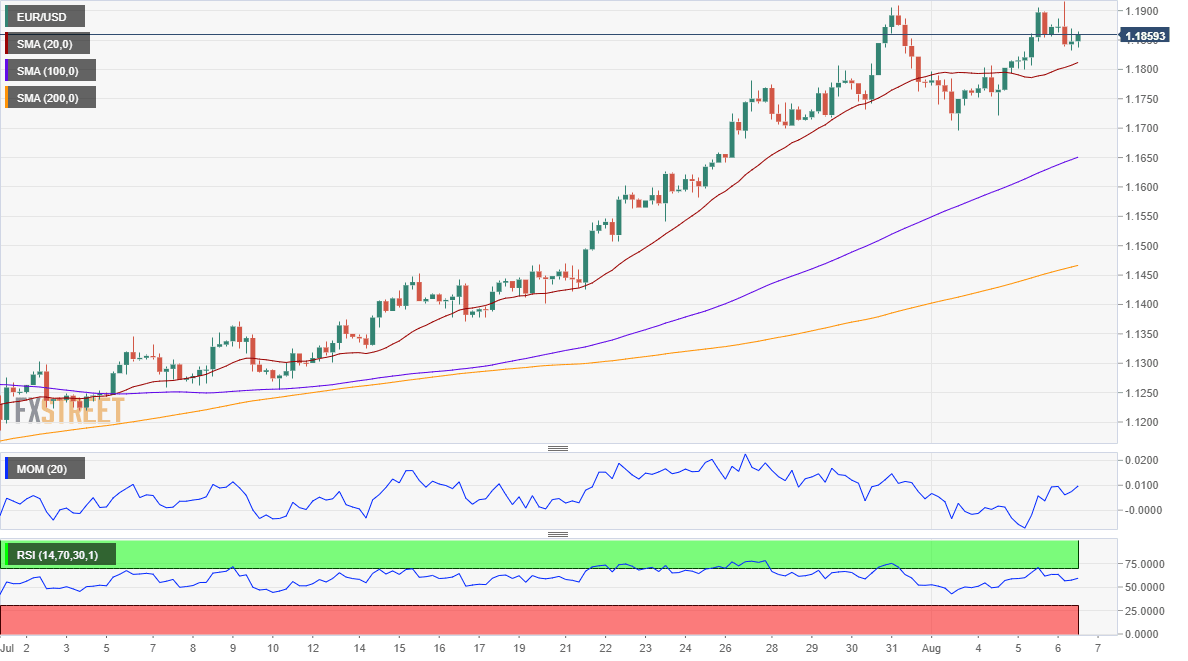

From a technical point of view, the EUR/USD pair retains its bullish stance. The 4-hour chart shows that it keeps developing above bullish moving averages, with the 20 SMA providing dynamic support around 1.1800. Technical indicators, in the meantime, remain within positive levels, with uneven bullish strength. As long as the pair remains above the 1.1800 mark, the risk of a bearish movement will remain well limited.

Support levels: 1.1835 1.1800 1.1760

Resistance levels: 1.1910 1.1950 1.1990

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.