EUR/USD Forecast: Fed fuel keeps euro afloat, vaccine issues may shoot it down

- EUR/USD is trading below 1.19 after topping that line on Wednesday.

- The US Fed's dovish message is weighing on the dollar while vaccine snags weigh on the euro.

- Thursday's four-hour chart is painting a bullish picture.

"It is too early to start talking about talking about a QE taper" – the words of Charles Evans, President of the Chicago branch of the Federal Reserve, reflect the general message from the world's most powerful central bank. It is set to continue printing dollars for some time, pushing the currency lower. The FOMC Meeting Minutes also reflected the Fed's commitment to supporting the economy, despite acknowledging its recent recovery and improving prospects.

After several Fed members spoke on Wednesday, Chair Jerome Powell will take the stage on Thursday and he will likely reiterate the same message. That will likely keep the downward pressure on the greenback, but upbeat data could push it higher.

US jobless claims are set to drop below 700,000 in data for the week ending on April 2, after rising in the previous week. Other labor figures such as the Nonfarm Payrolls and the JOLTs job openings showed an upbeat employment market.

See US Initial Jobless Claims Preview: Running on parallel tracks

In the old continent, hopes for a quicker exit from the covid crisis remain elusive. While the US reached a third of its population with at least one jab, EU countries are barely at half that pace. Moreover, Europe heavily depends on AstraZeneca's jab, where a line between rare blood clots and the jab was confirmed.

Member states' health ministers failed to agree on a uniform approach, one that would allow sending a clear message. Some countries have banned inoculations with AZ's immunization for younger people. Even if authorities clear the vaccine for all, confidence has been shattered.

In the meantime, Germany is considering extending its lockdown, France remains under severe restrictions and Italy is also paralyzed. The virus continues spreading, weighing on the recovery.

The European Central Bank's meeting minutes are also due out on Thursday, and will likely reiterate the bank's pledge to keep long-term yields at lower levels.

All in all, while the dollar is pressured by the Fed, concerns about Europe's recovery may push the euro lower, potentially turning the currency pair's trajectory back down.

EUR/USD Technical Analysis

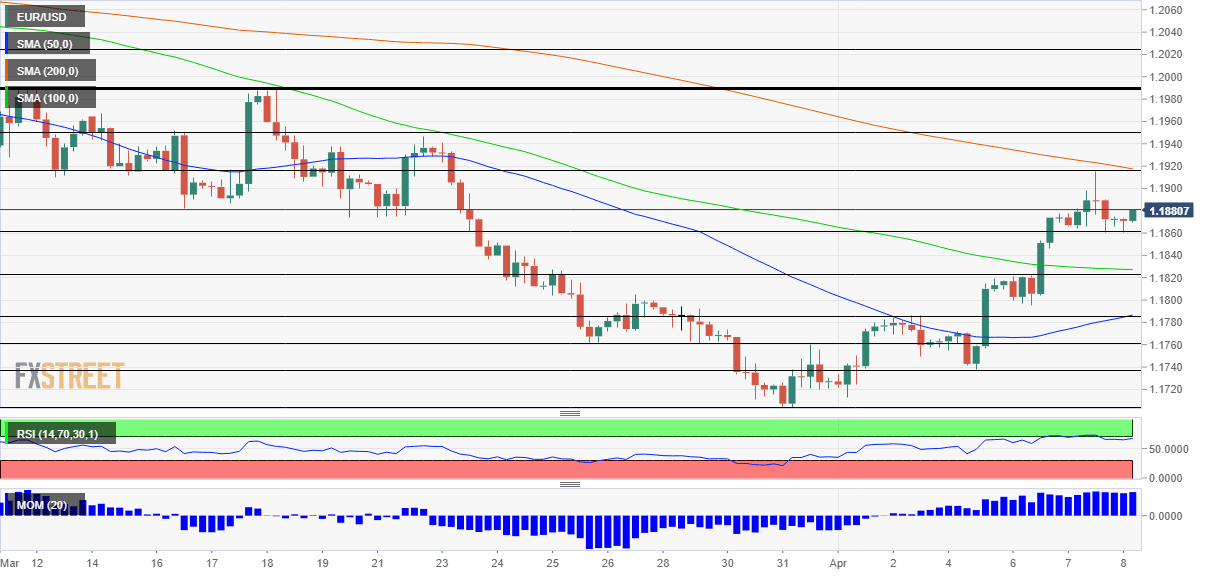

Momentum on the four-hour chart is to the upside and EUR/USD is trading above the 50 and 100 Simple Moving Averages, both bullish signs. However, it is capped by the 200 SMA. The Relative Strength Index is just below 70, outside overbought conditions.

Some support awaits at 1.1860, the daily low. It is followed by 1.1820, which capped euro/dollar early in the week, and then by 1.1785 and 1.1760.

Resistance is at 1.1920, which is where the 200 SMA hits the price, and then by 1.1945 and 1.1990.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.