EUR/USD Forecast: Falling out of the triangle? Trump's trade decisions are key

- EUR/USD has been trading in a narrowing range amid dual trade tensions.

- Speculation about the eurozone economy is set to move the pair.

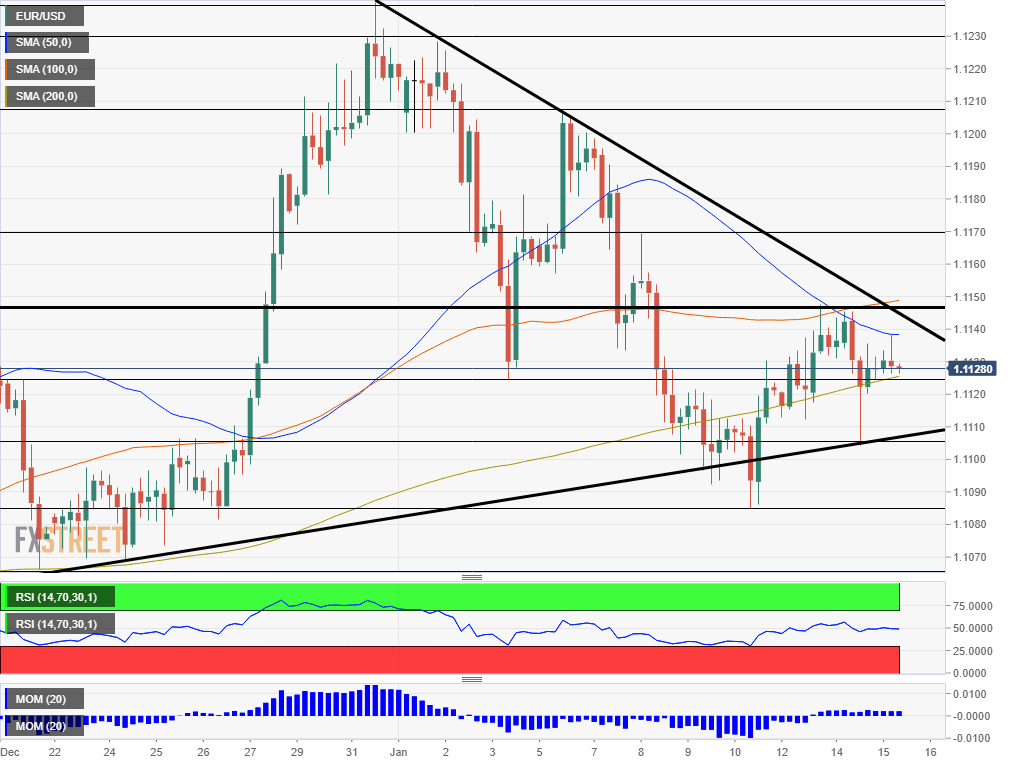

- Wednesday's four-hour chart is showing a narrowing wedge.

Will President Donald Trump hit the eurozone with new tariffs? That threat is looming over the old continent as Phil Hogan of the European Commission continues talking to his American counterparts in Washington.

"Tariff Man" – as Trump called himself – is sending worrying signs for Europe on the Chinese front. The world's largest economies are set to sign Phase One of the trade deal later on Wednesday. While many details are still pending, the administration announced that no further reductions of levies are likely before November – when Presidential elections are due.

Moreover, the US will likely tighten restrictions on Huawei – the Chinese telecom giant. The lack of further tariff removals and the developments around Huawei are both ominous signs for Europe and have both weighed on the market mood.

Back in the old continent, Germany's coalition partners are spurring about what to do with the fiscal surplus that the continent's powerhouse generated in 2019. Angela Merkel's CDU party wants to cut taxes while the center-left SPD desires more spending.

The European Central Bank has repeated its calls on Germany and others to invest more and stimulate the eurozone economies. Growth has been meager in recent quarters.

Mixed data

While the expansion is limited, one ECB member downplayed the chances of an outright downturn. Francois Villeroy de Galhau said that "we can practically rule out a US or EU recession" – in words that may come to haunt him.

The economic calendar features euro-zone industrial output, which carries expectations for a recovery in November after falling in October. US producer prices are set to rise as well. America's headline Consumer Price Index rose to 2.3% and remained unchanged on the core in December, as expected.

See US inflation reinforces the Fed neutral policy.

Overall, trade headlines are set to rock markets on Wednesday.

EUR/USD Technical Analysis

Euro/dollar is trading within a narrowing triangle or wedge. The break below the uptrend support line was a false one – another attempt to move lower bounced exactly at that uptrend line.

Will it break to the upside or the downside? EUR/USD is trading below the 50, 100, and 200 Simple Moving Averages on the four-hour chart. While momentum is to the upside, it is weak.

Overall, bears have an advantage.

The recent lows of 1.1105, 1.1085, and 1.1065 all provide support. The next levels to watch are 1.1040 and 1.0985.

Resistance awaits at 1.1145, which is also the confluence of the 100 SMA. Next, 1.1170, 1.1205, and 1.1230 all capped the currency pair of late and serve as resistance.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.