- EUR/USD has been holding up on hopes for US fiscal stimulus and despite rising eurozone cases.

- An adverse headline from Washington and dovish ECB comments could bring it down.

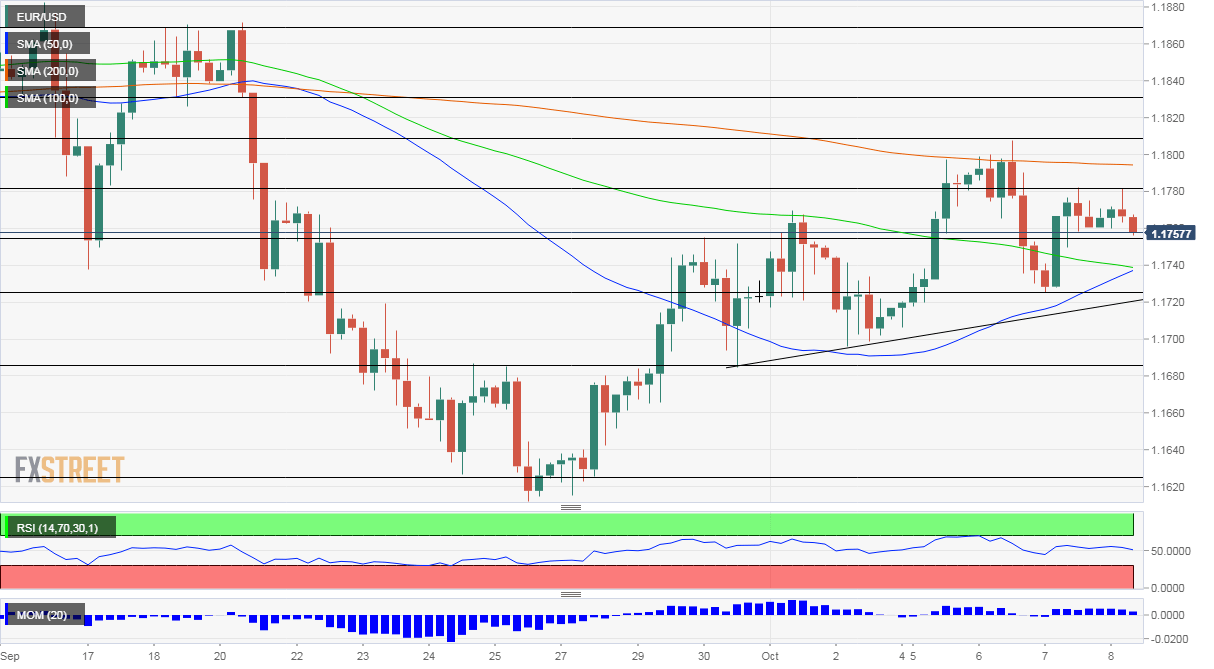

- Thursday's four-hour chart is pointing to a loss of upside momentum and lower highs.

President Donald Trump seems to be recovering from COVID-19 – and EUR/USD should probably focus more on rising cases in the old continent. Germany reported over 4,000 daily cases, the highest since April. Jens Spahn, Germany's Health Minister, said the infection numbers are worrying. Berlin already imposed restrictions, following Paris and Madrid – the latter capital living in lockdown.

Euro/dollar is beginning to reflect the increase in coronavirus cases, failing to hold onto 1.18 despite an otherwise upbeat market mood.

Stocks are on the rise and the safe-haven dollar is broadly lower as US lawmakers continue exchanging ideas – at least publically – for another stimulus package. Trump cut off talks on Tuesday, rejecting the Democrats' $2.2 trillion proposals but he has since offered piecemeal suggestions.

Dems, leading in the polls, are unlikely to cede ground after the president's abrupt move, leaving room for adverse headlines and a strengthening of the greenback.

More Who will be the next president? Markets seem to care more about Congress' actions (for now

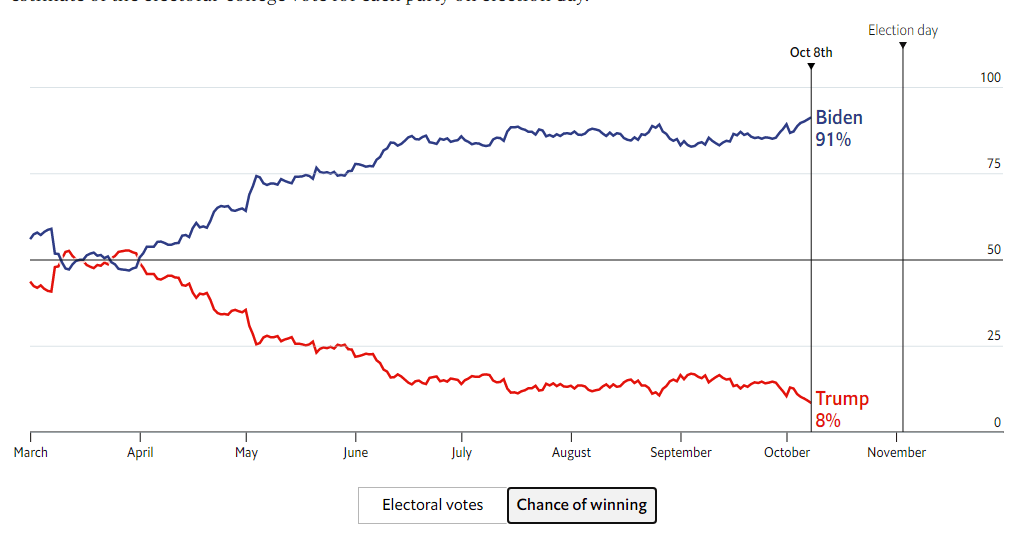

If fresh funds from the government do not come in the upcoming weeks, there is a rising chance for an even larger package after the elections. Former Vice-President Joe Biden is enlarging his lead over Trump in both national and battleground polls.

According to FiveThirtyEight, he has an 84% chance of winning, and The Economist's model gives him 91%.

Source: The Economist

Vice President Mike Pence and Senator Kamala Harris clashed in the Vice-Presidential debate. The encounter was far more civilized than the presidential one and focused on the topics.

It is hard to say who won, as both candidates repeated known attack lines and focused on their rival's bosses rather than on themselves. Trump and Biden are septuagenarians who may need to replaced by their VPs in the age of coronavirus.

More: VP Debate Analysis: What we have learned about Pence and Harris

Central banks have been on the sidelines amid a growing role for politics, but they still have an impact. The Federal Reserve's meeting minutes reflected recent messages from the world's most powerful central bank – low rates for longer, but no imminent action now.

The document revealed that the Fed is cautiously optimistic about the recovery in the third quarter, but that the bank also assumes fiscal stimulus – something that cannot be taken for granted.

The European Central Bank's meeting minutes are due out later on Thursday. They may shed light on the clash between the doves – who advocate more stimulus amid rising COVID-19 cases – and hawks, who prefer waiting for now. Luis de Guindos, Vice-President of the ECB, insisted that the bank still has firepower.

Weekly US jobless claims are also of interest and are set to show a decrease in new applications, reflecting the ongoing recovery.

See US Initial Jobless Claims Preview: Unemployment filing and payrolls reverse in September

Overall, politics in the US and coronavirus in Europe stand as EUR/USD movers.

EUR/USD Technical Analysis

Euro/dollar has found resistance at 1.1780, under the weekly high of 1.1810 – resulting in a lower high and breaking the winning streak of higher highs and higher lows. Moreover, the upside momentum on the four-hour chart is waning. On the other hand, the currency pair is still trading above the 50 and 100 Simple Moving Averages. Losing them would embolden the bears.

Some support awaits at the daily low of 1.1750, followed by 1.1724, which was Wednesday's trough. It is followed by 1.1685 and 1.1625.

Resistance is at 1.1780 and 1.1810 mentioned earlier, followed by 1.1830 and 1.1870, levels that played a role in late September.

See 2020 Elections: How stocks, gold, dollar could move in four scenarios, nightmare one included

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.