EUR/USD forecast: Euro slides -200 pips as Fed decision and NFP loom – Recovery or more downside?

- Euro breaks down -200 pips after invalidating the 4H FVG at 1.1739–1.1745, sliding toward the 1.1556 support zone.

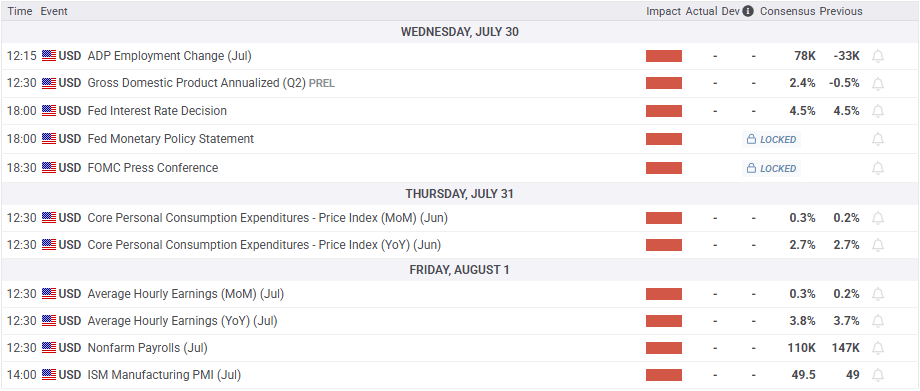

- Rate differentials and strong U.S. data continue to favor the dollar, as the Fed’s 4.50% hold contrasts sharply with the ECB’s 2.15%.

- Fed rate decision and NFP on deck could act as the catalyst for either a euro recovery from 1.1556 or further downside toward 1.1446.

Euro breaks and slides down -200 pips

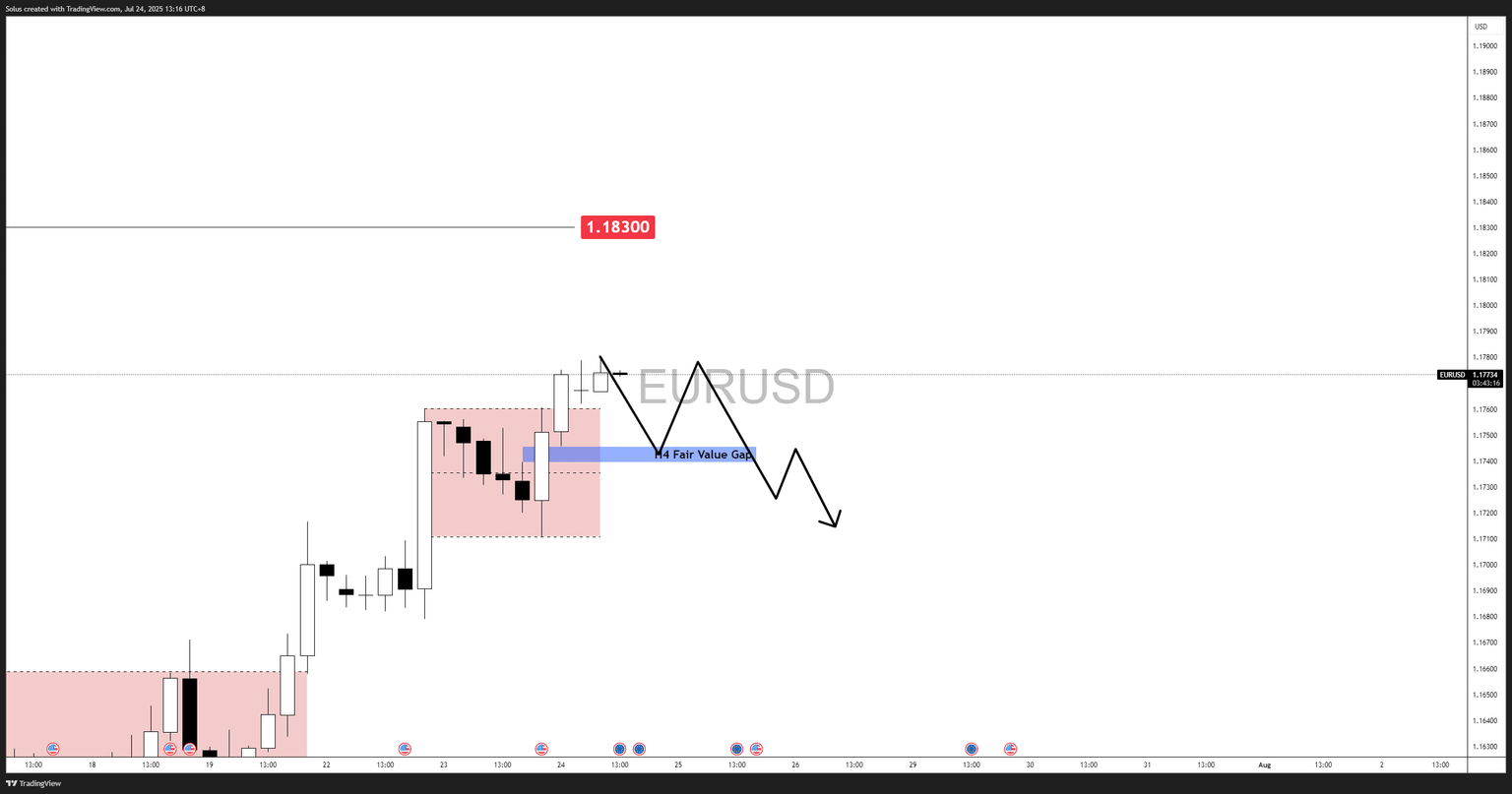

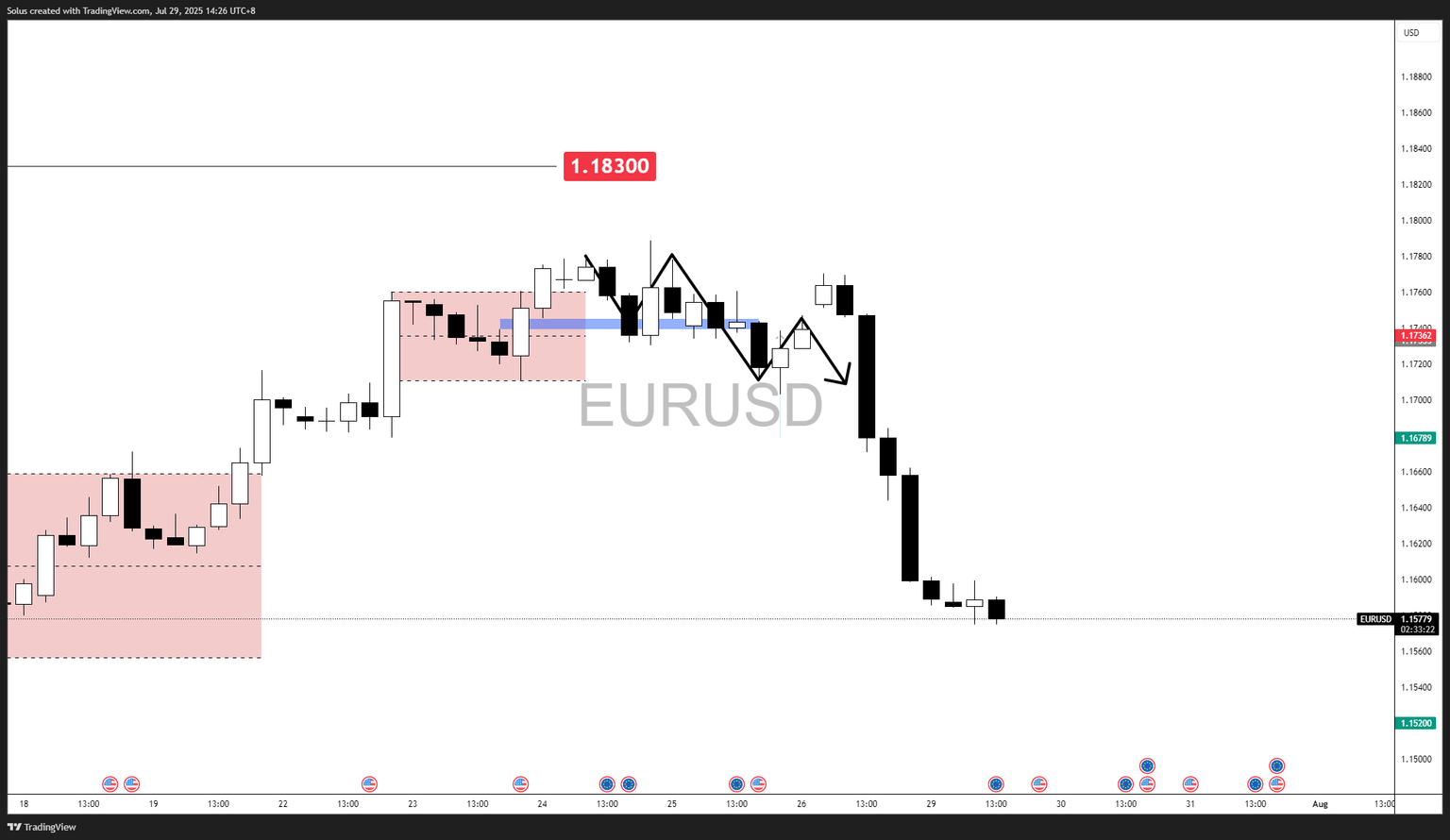

EUR/USD has followed through perfectly on the bearish scenario outlined in our July 24 forecast: EUR/USD forecast: Bullish breakout targets 1.1830 as Dollar weakness deepens.

After sweeping liquidity above the 1.1780 level, EUR/USD failed to hold its gains and reversed sharply, breaking back below at extreme price ranges 1.1600–1.1550. Prior to this move, it invalidate the 4H Fair Value Gap (FVG) resting between 1.17395-1.17457. This failure marked the start of a clean distribution structure, which has now accelerated lower, pushing the pair into deeper downside targets.

This development reflects a shift from the prior accumulation and breakout phase to full bearish continuation as the euro struggles under a backdrop of relative growth divergence, a stronger U.S. dollar, and Fed–ECB policy imbalance.

Drivers pulling the Euro for extreme downside

So, why did EUR/USD roll over so aggressively? Three big macro catalysts helped push it lower:

- The EU–US trade deal just didn’t impress

Yes, the 15% tariff deal grabbed headlines and temporarily reduced trade uncertainty. But markets quickly shrugged it off. Why? Because it doesn’t really solve the bigger picture. Europe’s growth is still sluggish, and capital continues to flow out. That’s not a recipe for a stronger euro. - Interest rate differentials are crushing the Euro

This is the big one. The ECB is holding its benchmark rate at 2.15%, and there’s no clear path for hikes anytime soon. Contrast that with the Fed: markets are fully pricing in a hold at 4.50% in Thursday’s rate decision. That’s a massive 235-basis point gap in favor of the U.S. dollar, making the greenback a far more attractive avenue for yield-seeking capital. Until this differential narrows, EUR/USD will stay under pressure. - US data keeps surprising to the upside

Strong jobless claims and durable goods numbers just reminded everyone that the U.S. economy isn’t slowing as much as some expected. The stronger the data, the more the dollar rallies—and the more pressure there is on the euro.

Technical outlook

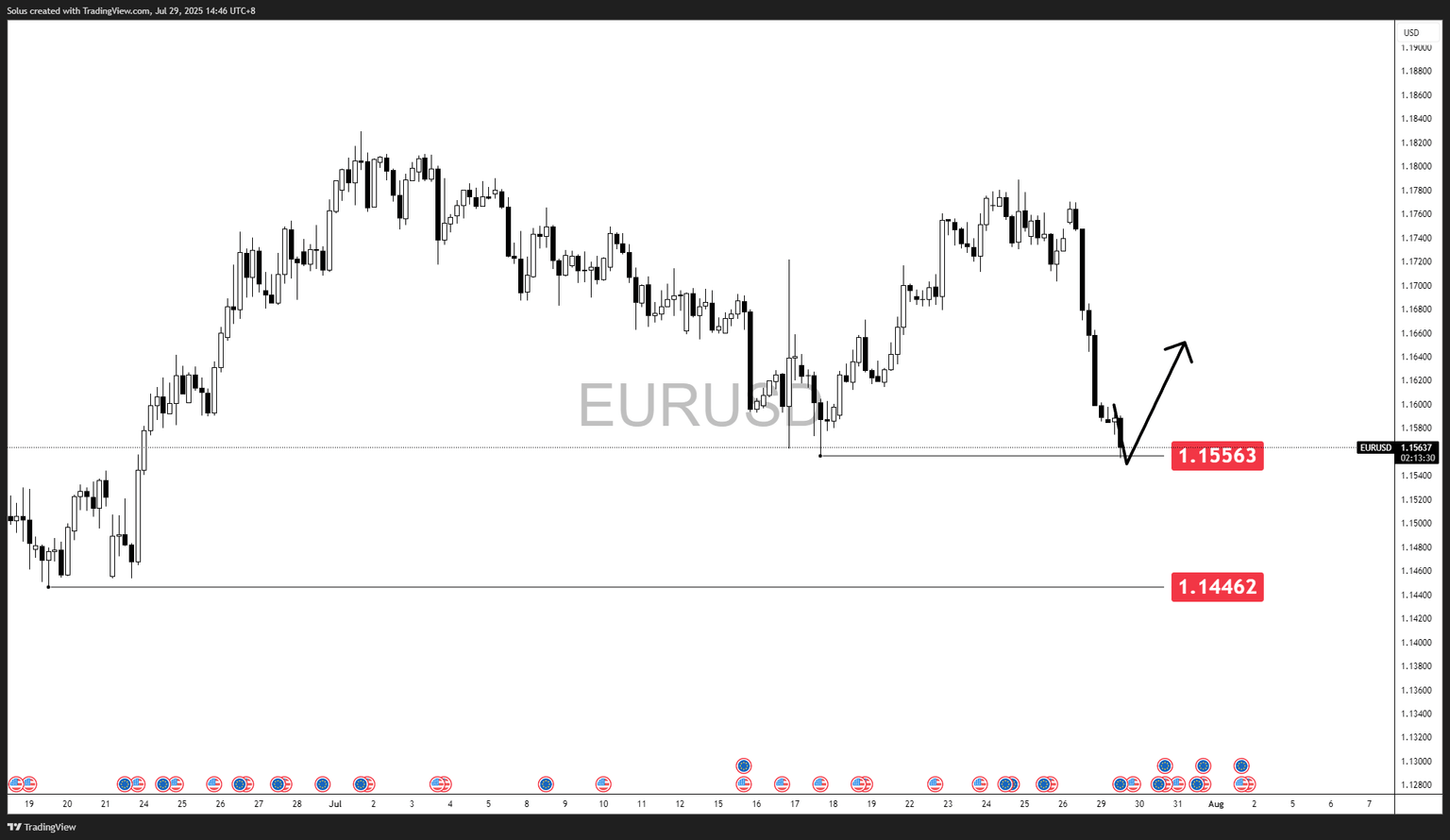

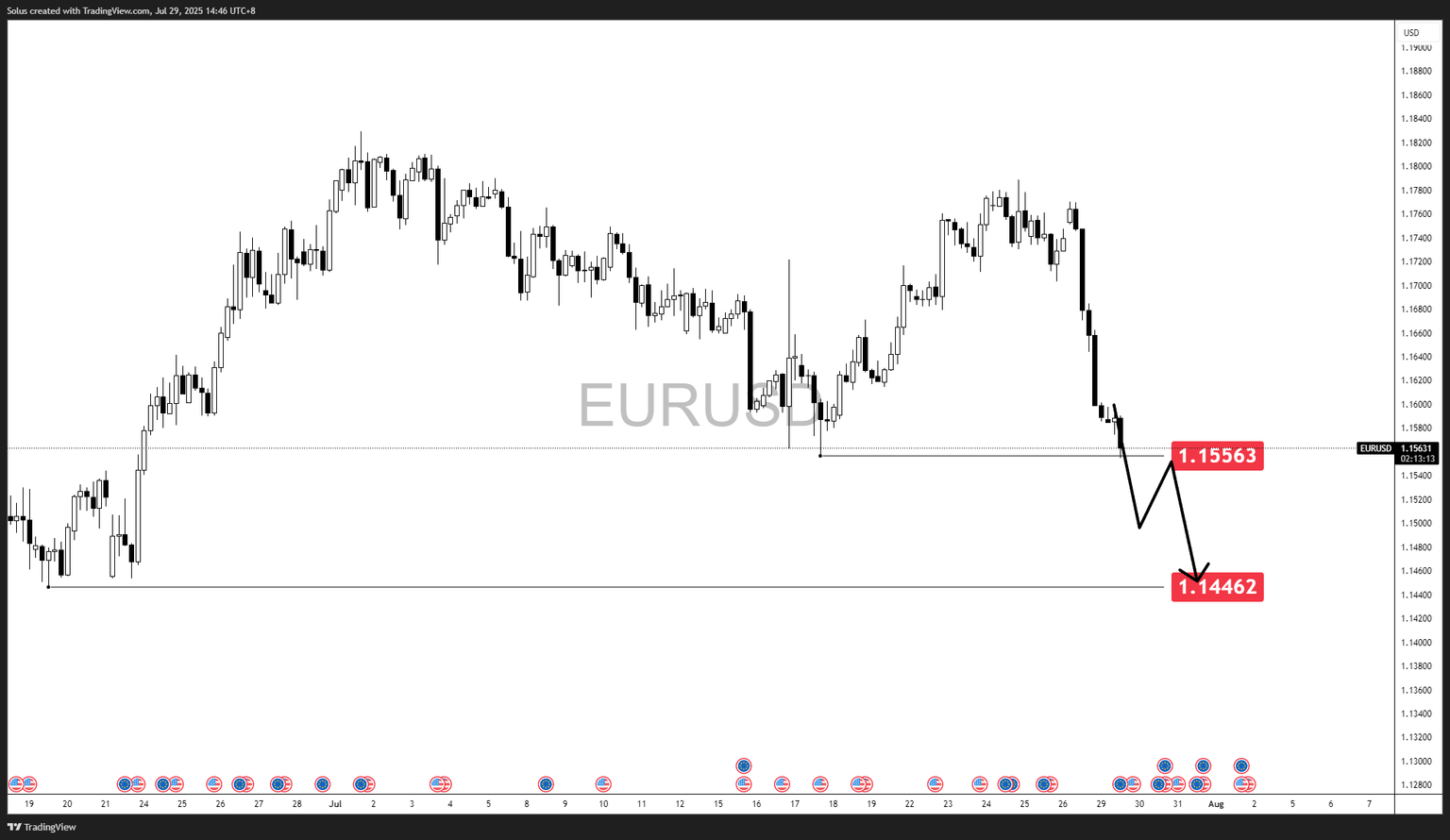

EUR/USD is sitting at a pivotal level around 1.1556, following a sharp breakdown from the 1.1790–1.1830 highs. Euro is currently testing the support level as Dollar continues to weigh down on Euro, making it a key decision point.

- Immediate support: 1.1556.

- Next downside liquidity zone: 1.1446.

- Nearest resistance: 1.1600.

Bullish scenario – Relief rally from support

A strong defense and bounce from 1.1556 with clear bullish momentum and a confirmed support will be established if price closes above 1.1600 level, reclaiming the prior breakdown area.

- Targets:

- 1.1678: First key resistance from prior support zone.

- 1.169–1.175: 4H Fair Value Gap level or imbalance

A daily close below 1.1556 would invalidate the bullish setup and shift focus back to the downside.

Bearish scenario – Continuation toward deeper liquidity

If Euro fails to hold 1.1556, breaking and closing below on strong volume and a retest of 1.1556 as resistance, followed by a rejection, would strengthen the bearish bias.

- Targets:

- 1.1500–1.1480: Short-term profit-taking zone, psych level

- 1.1446: Major liquidity target and next structural support.

A sustained recovery above 1.1620–1.1640 would invalidate the immediate bearish outlook.

Fed decision and jobs report loom as key catalysts for EUR/USD’s next move

All eyes now turn to this week’s Fed rate decision and Non-Farm Payrolls report, which could set the tone for EUR/USD. A hawkish Fed and strong jobs data could reinforce the dollar’s dominance and extend the downside, while softer prints may finally give the euro room to recover from its 1.1556 support zone.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.