EUR/USD Forecast: Euro needs to clear 1.0940 to extend recovery

- EUR/USD has been fluctuating in a narrow channel above 1.0900.

- Risk perception is likely to continue to impact euro's valuation in near term.

- EUR/USD needs to clear 1.0940 resistance for an extended rebound.

After having ended the previous week in negative territory near 1.0900, EUR/USD has started the new week on a firm footing but has lost its bullish momentum near 1.0940. The pair stays relatively quiet above 1.0900 in the early European session and the shared's currency's performance against its major rivals largely depends on developments surrounding the Russia-Ukraine crisis.

On Sunday, Ukrainian negotiator and presidential adviser Mykhailo Podolyak said in a video statement that Russia understood that Ukraine wouldn't concede on any positions and added that talks had become more constructive.

Russian and Ukrainian officials are expected to hold the next round of talks at 0830 GMT on Monday. According to RIA news agency, Russian delegate Leonid Slutsky thinks that the latest progress in talks could open the door for an agreement in the coming days.

The market reaction to changes in the mood has been pretty straightforward since the beginning of the war. A renewed optimism for a diplomatic solution is likely to help the euro gather strength. On the flip side, the shared currency is likely to continue to face selling pressure in case market participants price in a prolonged conflict.

The economic calendar will not feature any high-tier data releases on Monday and investors will keep a close eye on geopolitical headlines.

EUR/USD Technical Analysis

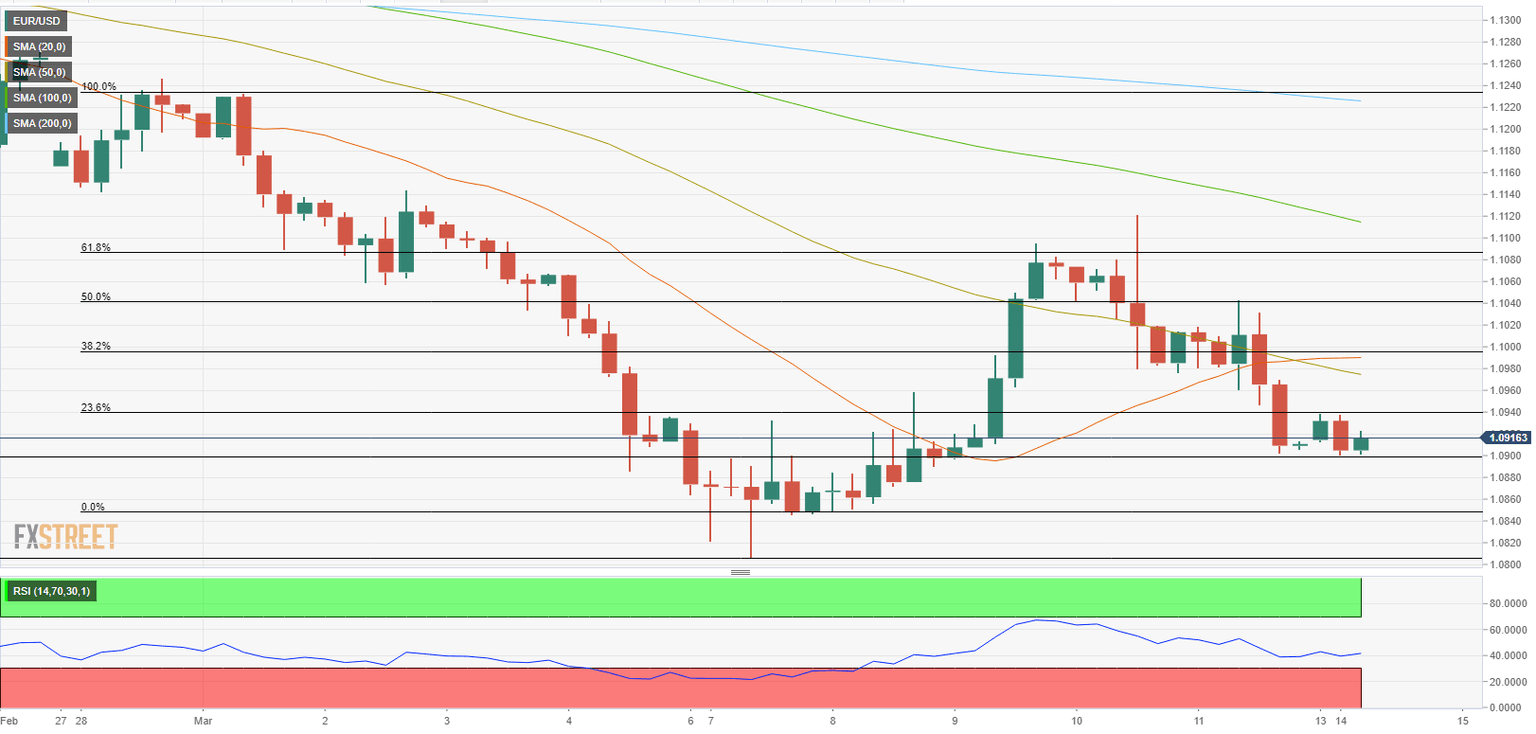

EUR/USD met resistance at 1.0940 (Fibonacci 23.6% retracement of the latest downtrend) during the Asian session on Monday. In case the pair rises above that level and starts using it as support, additional gains toward 1.0970 (50-period SMA on the four-hour chart) and 1.1000 (psychological level, Fibonacci 38.2% retracement) could be witnessed.

On the other hand, 1.0900 (psychological level, static level) aligns as the first support before 1.0850 (static level) and 1.0800/05 (psychological level, March 7 low).

On a bearish note, the Relative Strength Index (RSI) indicator on the four-hour chart is staying below 50, suggesting that buyers are yet to dominate the pair's action.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.