EUR/USD Forecast: Euro faces two-way risk, markets await clarity on Russia-Ukraine conflict

- EUR/USD has gone into consolidation following Tuesday's rebound.

- Investors move to the sidelines while hoping for a de-escalation of the Russia-Ukraine conflict.

- January Retail Sales and FOMC Minutes will be featured in US economic docket.

EUR/USD has started to move sideways in a narrow band following Tuesday's rebound with investors turning cautious while waiting for fresh developments on the Russia-Ukraine conflict. The pair could target 1.1400 next in case risk flows start to dominate markets.

After Interfax news agency reported on Tuesday that Russian troops were expected to return to barracks, investors breathed a sigh of relief and the improving market mood helped the shared currency find demand.

Later in the day, however, Russian President Vladimir Putin noted that they were not satisfied with the assurance that Ukraine will not become a NATO member in the near future. Additionally, US President Joe Biden warned that a Russian invasion of Ukraine was still very much a possibility. These headlines limited EUR/USD's upside and forced market participants to move to the sidelines before continuing to price a de-escalation of geopolitical tensions.

In the American session, the US Census Bureau will release January Retail Sales data and the US Federal Reserve will publish the minutes of its January policy meeting. Unless there is clarity on the Russia-Ukraine conflict, markets could refrain from reacting to the US events.

A negative tilt in risk sentiment could make it difficult for the euro to continue to gather strength against the dollar and vice versa.

EUR/USD Technical Analysis

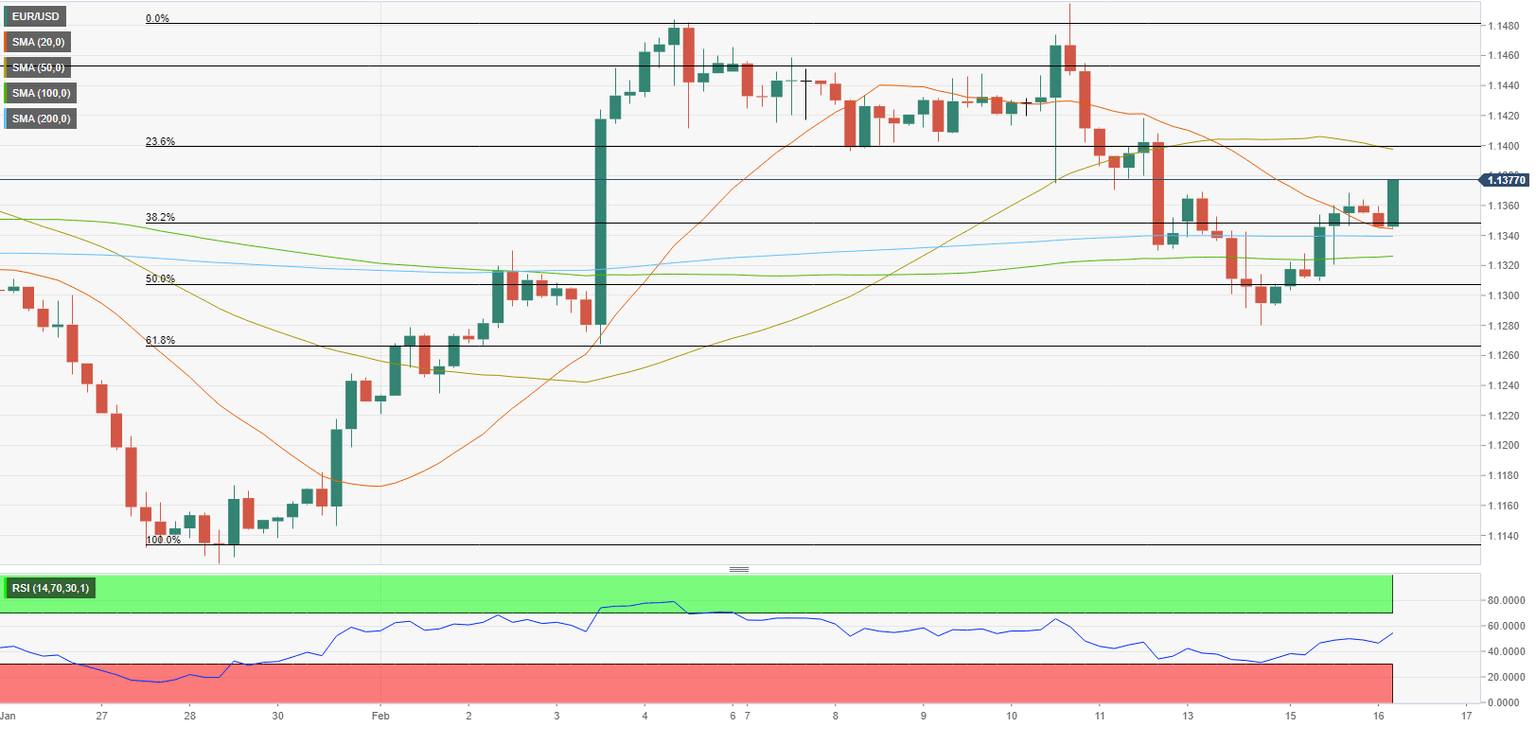

The near-term technical outlook points to a bullish shift with EUR/USD trading above the 100-period and the 200-period SMAs on the four-hour chart. Moreover, the Relative Strength Index (RSI) indicator on the same chart climbed above 50, confirming the view that bears show no interest in the pair for the time being.

1.1400 (psychological level, Fibonacci 23.6% retracement of the latest uptrend, 50-period SMA) aligns as the next bullish target ahead of 1.1450 (static level) and 1.1480 (static level).

On the downside, the Fibonacci 38.2% retracement and the 200-period SMA seem to have formed key support in the 1.1340/1.1350 area ahead of 1.1320 (100-period SMA) and 1.1300 (psychological level, Fibonacci 50% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.