EUR/USD Forecast: Euro could have a hard time extending recovery

- EUR/USD has gone into a consolidation phase at around 1.0600.

- Euro faces several resistance levels that could cap the upside.

- Focus shifts to ADP's December private sector employment report for the US.

EUR/USD has been moving sideways in a tight channel near 1.0600 early Thursday after having managed to snap a two-day losing streak on Tuesday. The pair's technical outlook doesn't yet point to a buildup of recovery momentum and the Euro could have a difficult time finding demand in case markets remain cautious ahead of Friday's key data releases.

The selling pressure surrounding the US Dollar softened in the second half of the day on Wednesday after the data published by the ISM showed that employment in the manufacturing sector grew unexpectedly in December. Additionally, the US Bureau of Labor Statistics reported that the number of job openings on the last business day of November stood 10.45 million, much higher than the market expectation of 10 million.

Later in the session, ADP Employment Change is forecast to rise modestly to 150K in December from 127K in November. In case employment in the private sector grows at a stronger pace than expected, the US Dollar could gather strength in the early American session with investors reassessing the probability of a 25 basis points Fed rate hike in February.

Meanwhile, the minutes of the Fed's December meeting minutes didn't offer any fresh insights into the policy outlook. The statement showed that policymakers needed to see substantially more evidence of progress before confirming that inflation is on a downward path.

It's also worth noting that US stock index futures are down between 0.25% and 0.4% in the European morning. Unless there is a positive shift in risk sentiment in the second half of the day, EUR/USD should stay on the back foot.

The European economic docket will feature Producer Price Index (PPI) but this data is unlikely to trigger a significant reaction, especially ahead of Friday's Eurozone inflation report.

EUR/USD Technical Analysis

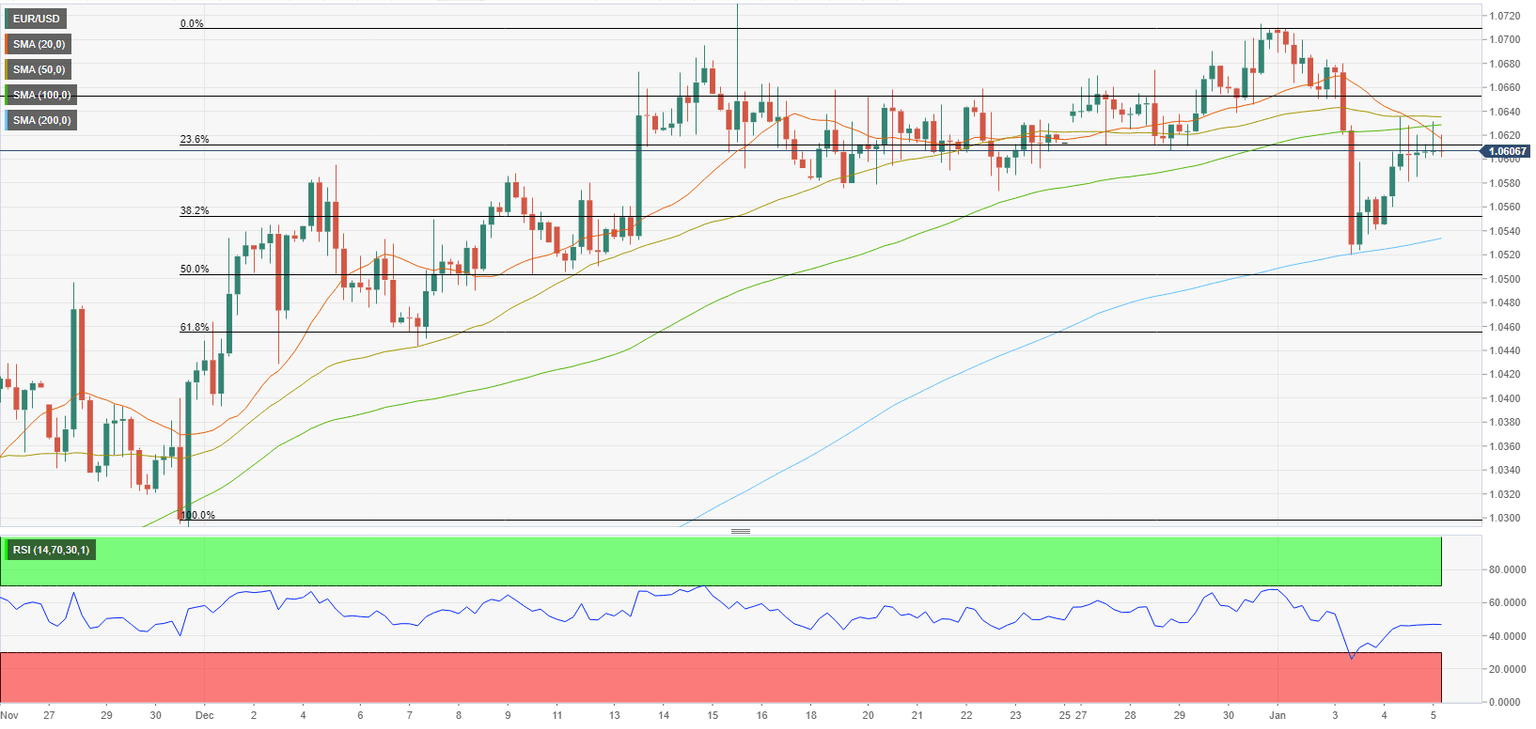

EUR/USD faces several resistance levels in a relatively narrow area. The Fibonacci 23.6% retracement of the latest uptrend aligns as first hurdle at 1.0610 before 1.0630 (100-period Simple Moving Average (SMA)), 1.0640 (50-period SMA) and 1.0650 (static level). Once the pair stabilizes above that area, it could target 1.0700 once again.

On the downside, 1.0550 (Fibonacci 38.2% retracement) could be seen as first support ahead of 1.0530 (200-period SMA) and 1.0500 (psychological level, Fibonacci 50% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.