EUR/USD Forecast: Euro could clear 1.0100 on a hawkish ECB surprise

- EUR/USD has gone into a consolidation phase following Wednesday's upsurge.

- ECB is widely expected to hike key rates by 75 bps.

- Stiff resistance for the pair seems to have formed at 1.0100.

EUR/USD has gone into a consolidation phase early Thursday after having reached its highest level since mid-September at around 1.0100 during the Asian trading hours. In case the European Central Bank (ECB) delivers a hawkish surprise later in the day, the pair could gather enough bullish momentum to extend its recovery.

On Wednesday, the broad-based selling pressure surrounding the greenback fueled EUR/USD's rally. The Bank of Canada's dovish 50 basis points rate hike caused global bond yields to push lower and the dollar suffered heavy losses against its major rivals with the US Dollar Index losing 1% for the second straight day.

The ECB is widely expected to hike its key rates by 75 basis points following the October policy meeting. Rather than the rate decision, the ECB's language should impact the shared currency's valuation.

In case the bank communicates policymakers' willingness to stick to an aggressive tightening stance with another super-sized rate increase in December, EUR/USD is likely to gain traction. On the other hand, the euro could have a hard time finding demand in case the policy statement reveals that some policymakers leaned toward a 50 bps rate hike in October or that they didn't anticipate another big rate increase before the end of the year. Although inflation in the euro continues to run uncomfortably hot, renewed concerns over a severe recession put the ECB between a rock and a hard place.

ECB Preview: Lagarde set to hit euro with dovish hike, four reasons to expect EUR/USD to tumble.

In the meantime, the US Bureau of Economic Analysis will release its first estimate of the third-quarter Gross Domestic Product (GDP) growth. The market expectation points to a 2.4% annualized expansion following the 0.6% contraction recorded in the second quarter. Since the beginning of the week, markets observed a dollar selloff whenever there was a disappointing data release. Hence, a similar, straightforward, reaction could be expected with a weaker-than-expected GDP print weighing on the USD and vice versa.

It's worth noting that the pair could fluctuate wildly with investors assessing the ECB language and the implications of the US data on the Fed's rate outlook.

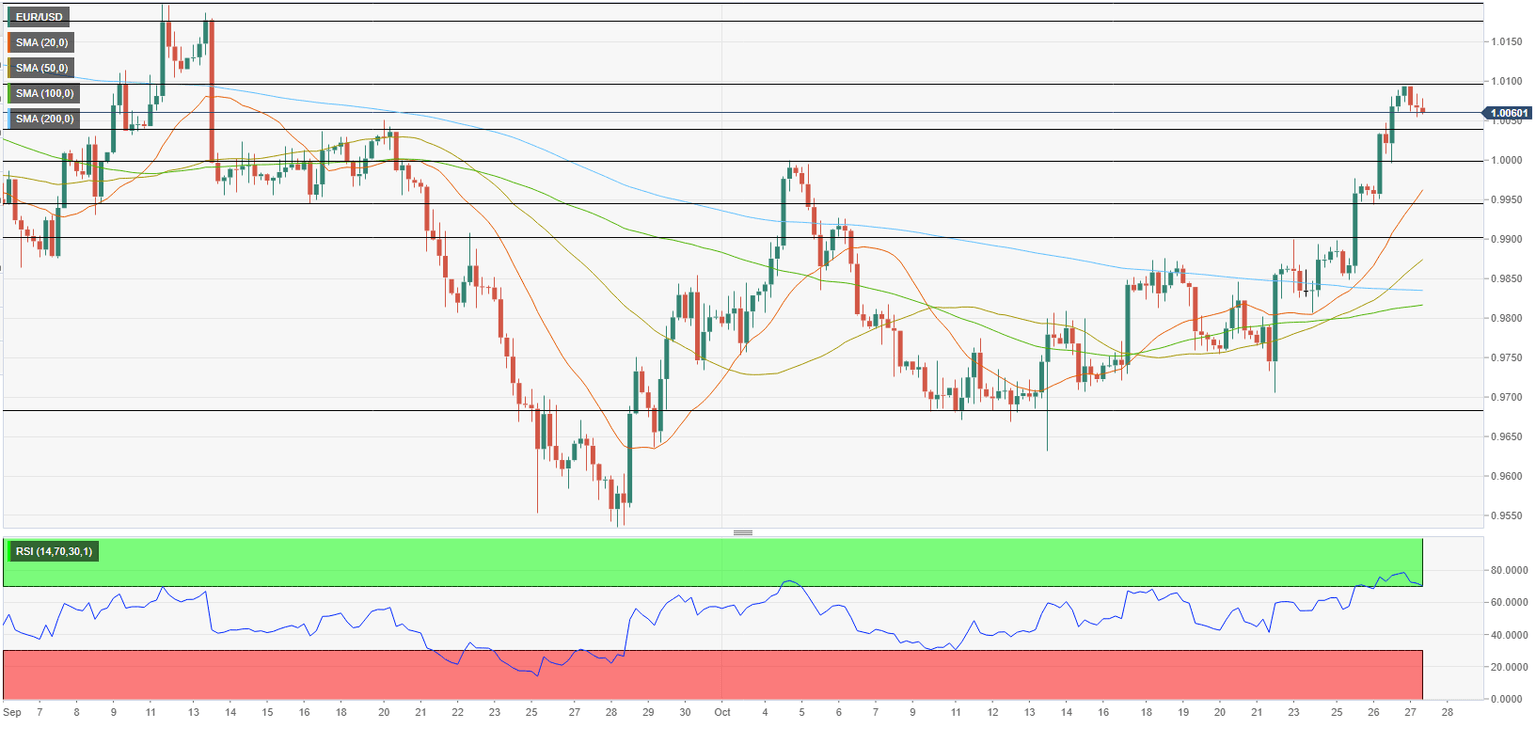

EUR/USD Technical Analysis

On the downside, 1.0050 (static level, former resistance) aligns as initial support before the all-important 1.0000 level. In case a dovish ECB message triggers a euro selloff, a drop below parity could bring in additional sellers and cause the pair to slide toward 0.9950 (static level, 20-period SMA).

Key resistance seems to have formed at 1.0100 (static level, psychological level). If the pair rises above that level and confirms it as support, it could target 1.0175 (static level) and 1.0200 (September high).

Meanwhile, the Relative Strength Index (RSI) indicator on the four-hour chart stays slightly above 70, suggesting that there is more room on the downside for the pair to correct its overbought conditions.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.