ECB Meeting Preview: Lagarde set to hit euro with dovish hike, four reasons to expect EUR/USD to tumble

- The European Central Bank is set to raise rates by 75 bps.

- Falling gas prices have boosted the euro but may cause ECB to signal looser policy.

- President Lagarde will find it hard to reject recession forecasts.

Winter is still coming – even if temperatures are unusually high in Europe, the drop in gas prices could still bite the common currency. That is only one factor in my assessment that the European Central Bank's decision will be a downer for EUR/USD.

First is first – the rate decision. Economists expect the ECB to raise borrowing costs by 75 bps for the second time in a row. That would put the main refinancing rate at 2% and the deposit rate – what commercial banks receive when parking funds at Frankfurt – at 1.50%. Officials at the bank made their intentions clear.

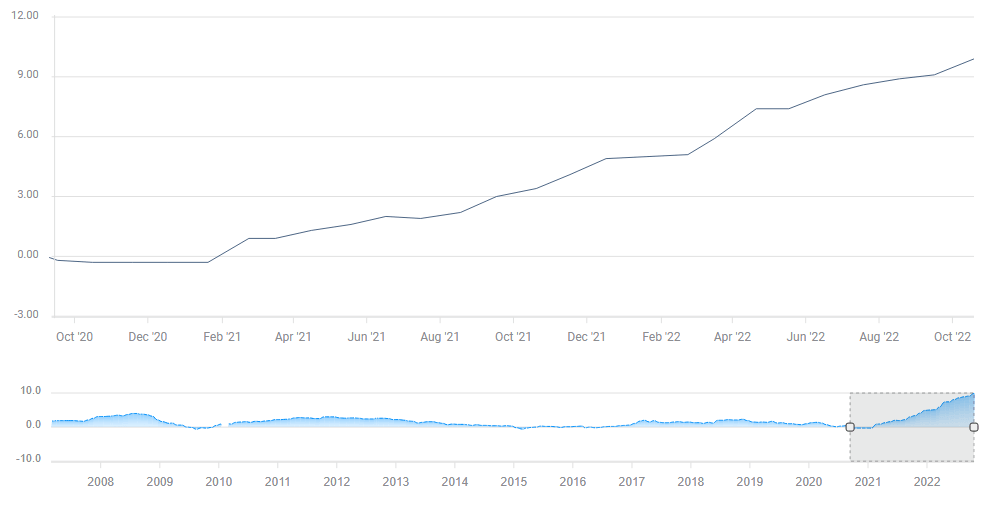

Source: FXStreet

While Europe's rising prices are primarily driven by soaring energy costs, Core CPI has been too high as well. An increase in more-unionized Europe and an ongoing post-pandemic recovery have put underlying inflation at 4.8%. Both figures mean more rate rises.

As the main rate reaches and matches the ECB's 2% target, the big question is: is there more in store? In September, ECB President Christine Lagarde signaled that the tightening cycle would end in February. Markets have priced that borrowing costs will peak at 3%, but there is a high degree of uncertainty.

The ECB's next moves hinge on economic developments and the euro depends on what Lagarde says. She is unlikely to provide straight answers to questions about the bank's next decision in December, especially as new staff forecasts will be available only then. Nevertheless, her comments on the current situation – and her tone – are critical.

That is where gas prices come to the front burner amid Russia's de-facto embargo. The unusually warm autumn has diminished demand for heating and pushed electricity costs lower. Gas storage is above seasonal levels, and fears of blackouts or rationing have almost disappeared. However, higher costs and uncertainty have still taken their toll.

Economists are falling over themselves to downgrade forecasts for the old continent alongside talk of higher interest rates despite lower gas prices. Forecasting a recession has become common, especially for Germany, which relies heavily on gas. The highly regarded German IFO think-tank projected a "winter recession."

The ECB has been careful to refrain from using the R-word when discussing the next developments. If Lagarde puts such an option on the table, it will imply a slower path of rate hikes starting from December. Arguably, more importantly, expectations for the peak rate would also decline. That would push the euro lower.

If she surprises and denies a recession is coming, it will be insufficient to shore up the euro. To lift the common currency, she would need to pledge raising rates beyond February. I am certain a reporter will ask her about that, and only if she opens the door to additional moves would the euro rise.

What to expect from EUR/USD

I expect EUR/USD to react negatively to the ECB decision. Why?

First, a 75 bps hike is fully priced in and there is little the bank could do on the hawkish side to add to euro strength.

Secondly, it would be hard for Lagarde to deny a European recession is coming due to elevated energy costs. The fall in gas prices is insufficient to create a production and consumption boom. Their current drop only means less pressure on the ECB to hike rates, implying a weaker euro. A double-edged sword.

Third, EUR/USD's recent rise has been fueled by the Federal Reserve's "pivot" toward slowing down the pace of rate hikes in America. Nevertheless, the US economy is still in better shape, and the ECB's statement would put things in proportion.

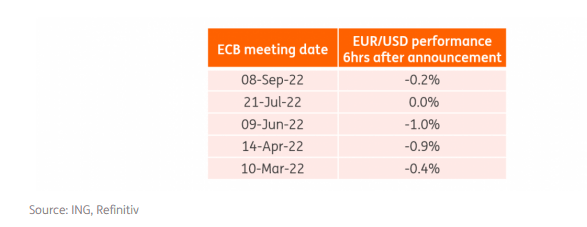

Fourth, recent history speaks for itself. EUR/USD has failed to take advantage of recent ECB hawkishness. The best it could do was to stay unchanged in July, which dropped in response to all the other rate decisions. It is hard to bet in favor of EUR/USD this time.

EUR/USD previous responses:

Source: ING

Final thoughts

I expect the ECB's 75 bps hike to be the bank's last big rate hike. One more is likely in mid-December, and then winter is officially upon us – and potentially an official recession. Warmer temperatures will be of little comfort to the euro if the economy cools down.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.