EUR/USD Forecast: Euro bulls retain control as focus shifts to Fed

- EUR/USD has gained traction and climbed above 1.1000.

- Fed is widely expected to raise its policy rate by 25 basis points.

- The pair's technical outlook shows that bulls are back in charge.

EUR/USD has gathered bullish momentum and advanced beyond 1.1000 after having declined to the 1.0950 area on Tuesday. As investors wait for the US Federal Reserve (Fed) to announce its policy decisions later in the day, the pair's near-term technical outlook points to a bullish tilt.

EUR/USD stayed under bearish pressure and extended its slide after breaking below 1.1000 on Tuesday. Following Wall Street's opening bell, however, investors started to seek refuge amid resurfacing fears over bank contagion in the wake of First Republic Bank's collapse. In turn, US Treasury bond yields fell sharply and the US Dollar (USD) lost footing, allowing the pair to stage a late rebound.

The Fed is forecast to raise its policy rate by 25 basis points (bps) to the range of 5-5.25% but markets are increasingly convinced that the US central bank could pause its tightening cycle.

According to the CME Group FedWatch Tool, there is virtually no chance that the Fed will raise its policy rate again in June. Furthermore, the probability of the Fed cutting its policy rate by 25 bps at least once by September is now nearly 80%.

In case the Fed outright says that they will pause rate hikes to assess the situation, this would suggest that they are very concerned about the banking situation. Although the latest data unveiled that inflation in the US remains sticky, the Fed is under a lot of pressure to address the tightening in financing conditions. In that scenario, the USD is likely to stay under pressure.

On the other hand, the Fed could leave the door open for additional rate hikes and downplay the banking woes. Although such an approach could help the USD gather strength with the initial reaction, investors could see that as potentially deepening the financial crisis. In turn, another leg lower in the US T-bond yields could limit the USD's potential gains.

At this point, it's difficult to spot a scenario that could trigger a rally in the USD. Even if the Fed were to sound hawkish, investors are unlikely to be convinced that the banking situation will just get better by itself. Nevertheless, FOMC Chairman Jerome Powell's comments could ramp up volatility in the late American session and it might be risky to stick to a position before the dust settles.

EUR/USD Technical Analysis

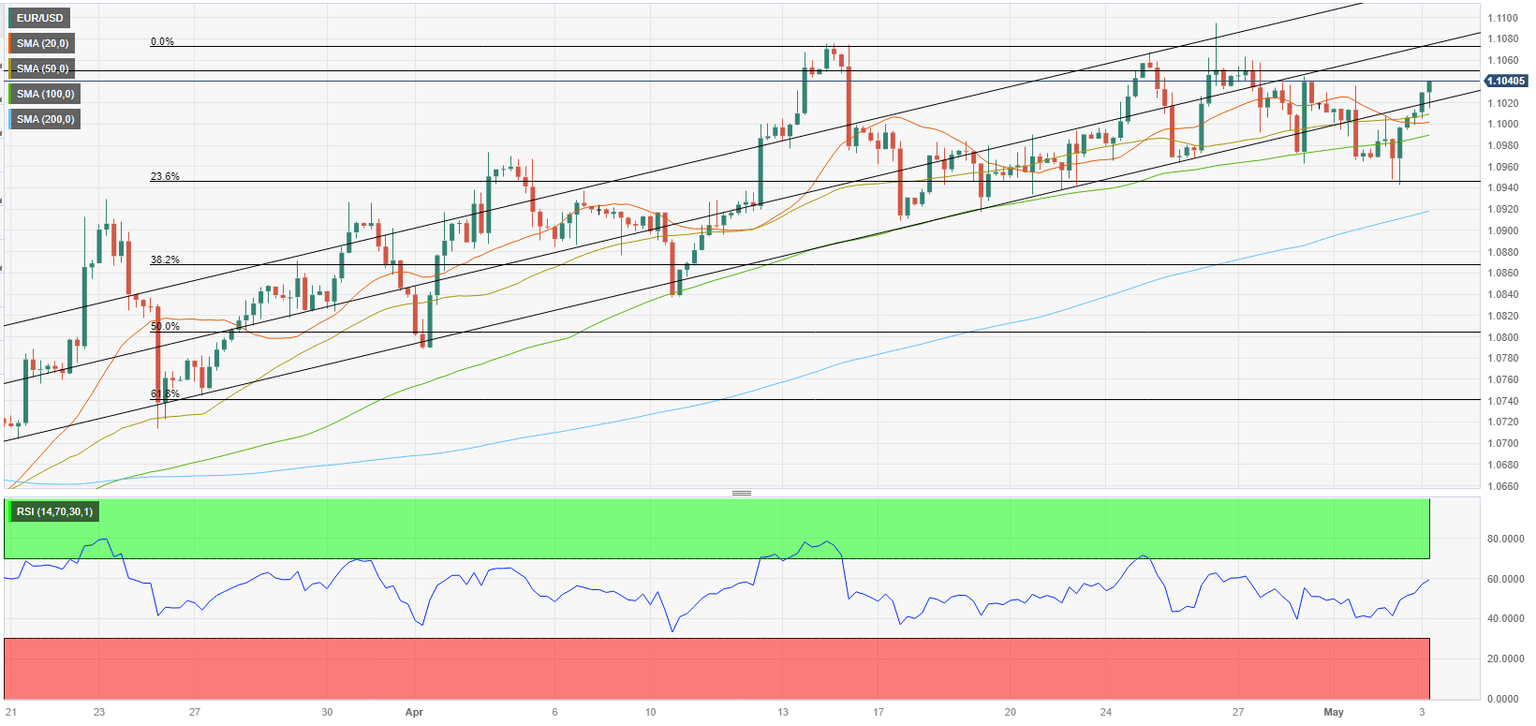

EUR/USD returned within the long-term ascending regression channel and closed the last four-hour candles above the 20-period and the 50-period Simple Moving Averages (SMA) on the four-hour chart, reflecting a buildup of bullish momentum. Additionally, the Relative Strength Index (RSI) indicator on the same chart is back above 50 after having spent the last couple of trading days below that level.

On the upside, 1.1050 (static level) aligns as interim resistance ahead of 1.1070 (end-point of the uptrend, mid-point of the ascending channel) and 1.1100 (psychological level, static level).

1.1000/1.0990 (psychological level, 100-period SMA) could be seen as the first support. A four-hour close below that area could discourage buyers and open the door for additional losses toward 1.0950 (Fibonacci 23.6% retracement) and 1.0920 (200-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.