EUR/USD Forecast: EUR steadies after Jackson Hole as Fed cut bets rise

- EUR/USD holds inside 1.1583–1.1742 H4 Fair Value Gap as Jackson Hole dovish tone and Fed independence concerns weigh on USD.

- CME FedWatch shows 87.3% odds of a September cut, with Friday’s Core PCE inflation release as the key volatility trigger.

- Technical outlook: breakout above 1.1665–1.1742 opens 1.1780–1.1820, while pivot rejection risks 1.1550–1.1500.

Jackson Hole aftermath and Fed political shock

The Jackson Hole symposium set the stage for a renewed dovish shift in global markets. Fed Chair Jerome Powell’s remarks - emphasizing labor market softness and openness to easing - were read as a green light for September rate cuts. This was further amplified by political turbulence: the U.S. President’s move to block Fed Governor Lisa Cook rattled investor confidence in the Fed’s independence, a rare development that undermined the dollar’s stability.

Together, these factors have kept EUR/USD from breaking lower despite eurozone weakness, as markets lean heavily toward a dollar-softening policy shift.

Fundamental drivers: CME FedWatch and policy odds

The latest CME FedWatch tool underscores how markets are positioned:

- 87.3% chance of a 25bps cut at the September 17 FOMC meeting, which would bring the Fed funds rate into the 400–425bps band.

- Only 12.7% odds of no change, while 0% probability of a hike remains firmly priced out.

This overwhelming conviction reflects not only Powell’s Jackson Hole tone but also the broader sense that the Fed will prioritize cushioning growth over fighting residual inflation.

Upcoming high-impact data: PCE and spending (Aug 29)

Friday’s U.S. Core PCE Price Index (July) - the Fed’s preferred inflation gauge - will be crucial for EUR/USD direction.

- Expected 0.3% MoM (steady with prior) → A soft read could reinforce cut expectations, weakening USD and lifting EUR/USD above resistance.

- Upside surprise (0.4% or higher) → Would undermine September cut conviction, sparking a USD rebound and pressure toward 1.1550.

Alongside this, Personal Spending (0.5% prior, forecast 0.3%) and Personal Income (0.4% prior, forecast 0.3%) will offer insights into U.S. consumer resilience. Stronger data could delay Fed cuts, while weakness supports the dovish case.

In short, these releases are the last major inflation/consumption checkpoint before September FOMC, making them a likely volatility trigger for EUR/USD.

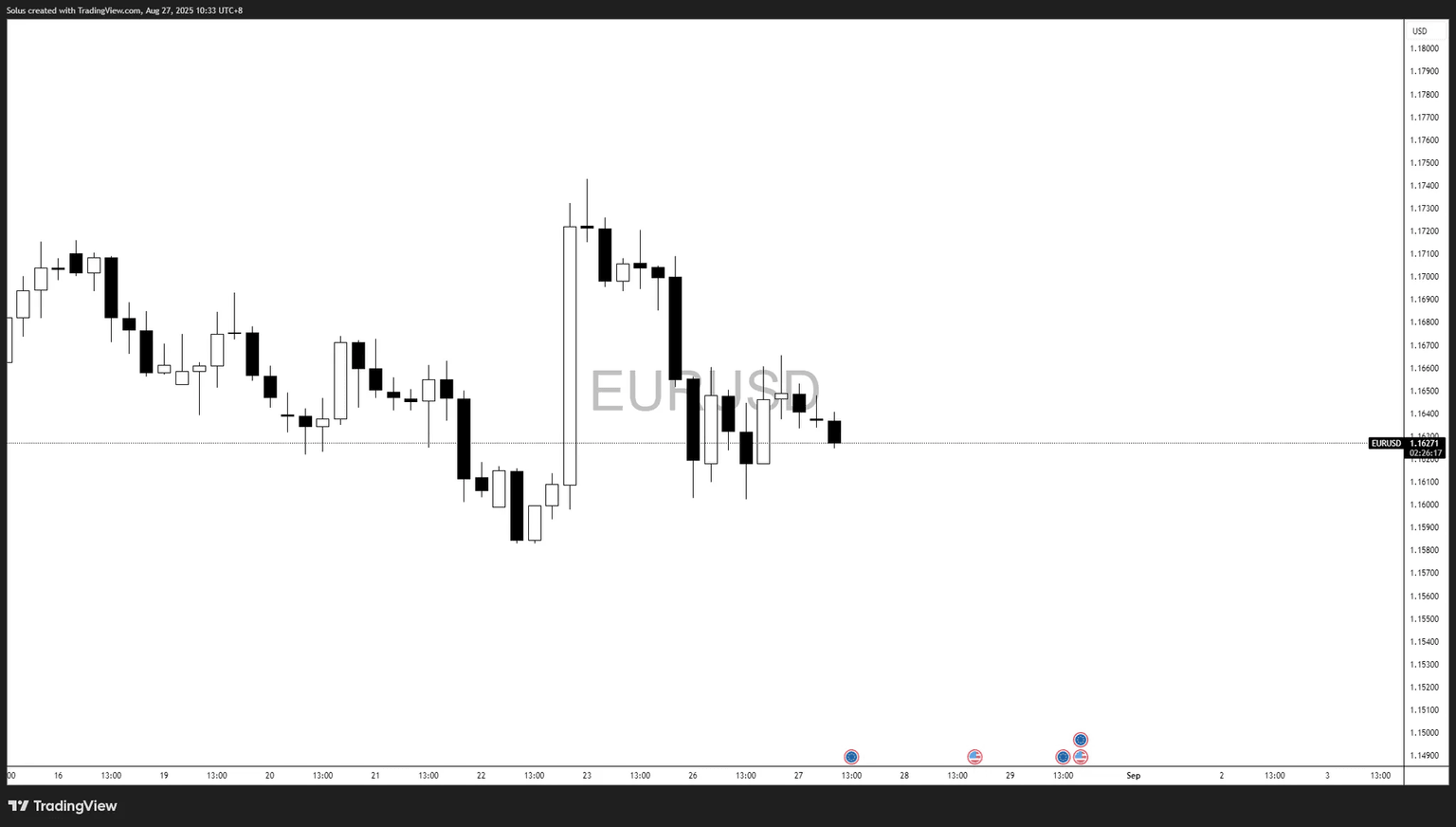

Technical outlook: EUR/USD holding inside H4 fair value gap

EUR/USD is currently trading around 1.1628, consolidating within a clearly defined H4 Fair Value Gap (1.1583 – 1.1742). This imbalance is dictating near-term flows, with buyers and sellers battling over whether price will sustain within or break out of the zone.

- The resistance at 1.1742 coincides with the post–Jackson Hole spike high, acting as a key resistance.

- The midpoint zone near 1.1665 is a short-term pivot, where rejection could fuel another leg lower.

- On the downside, 1.1602 – 1.1583 is immediate support, where liquidity could be swept before any bullish continuation attempt, or even a downside breakdown.

Bullish narrative: Sweep into expansion

EUR/USD could dip into the 1.1602–1.1583 liquidity pocket before snapping higher. A reclaim of the 1.1665 pivot would set up a drive toward the 1.1742 FVG top, with potential extension to 1.1780–1.1820. Softer U.S. Core PCE data would reinforce this upside case.

- Sweep of 1.1602–1.1583 then rebound

- Break above 1.1665 pivot

- Targets: 1.1742 → 1.1780–1.1820

Bearish narrative: Pivot rejection

If EUR/USD fails at the 1.1665 pivot, sellers may regain control. A break below 1.1602 would expose 1.1583, and losing that level risks a slide toward 1.1550–1.1500. Stronger U.S. inflation or spending data would favor this bearish path.

- Rejection at 1.1665 pivot

- Break below 1.1602 → 1.1583

- Downside: 1.1550 → 1.1500

Final thoughts

EUR/USD is sitting at a crossroads inside the H4 Fair Value Gap (1.1583–1.1742). With markets already pricing an 87% chance of a Fed cut, the dollar’s next move hinges on whether Friday’s Core PCE data validates or challenges that dovish outlook.

Until then, expect liquidity sweeps around 1.1600–1.1665 to shape intraday flows. A breakout above the FVG could unlock further upside, while a pivot rejection risks dragging the pair back toward 1.1550–1.1500. Traders should remain flexible, treating the upcoming U.S. data as the key volatility trigger that decides whether EUR/USD resolves higher or lower.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.