EUR/USD Forecast: Double bottom in danger as bears accumulate ammunition

- EUR/USD has been attempting to stabilize at lower ground as US yields take a breather.

- Europe's vaccine issues and US retail sales may trigger a fresh fall.

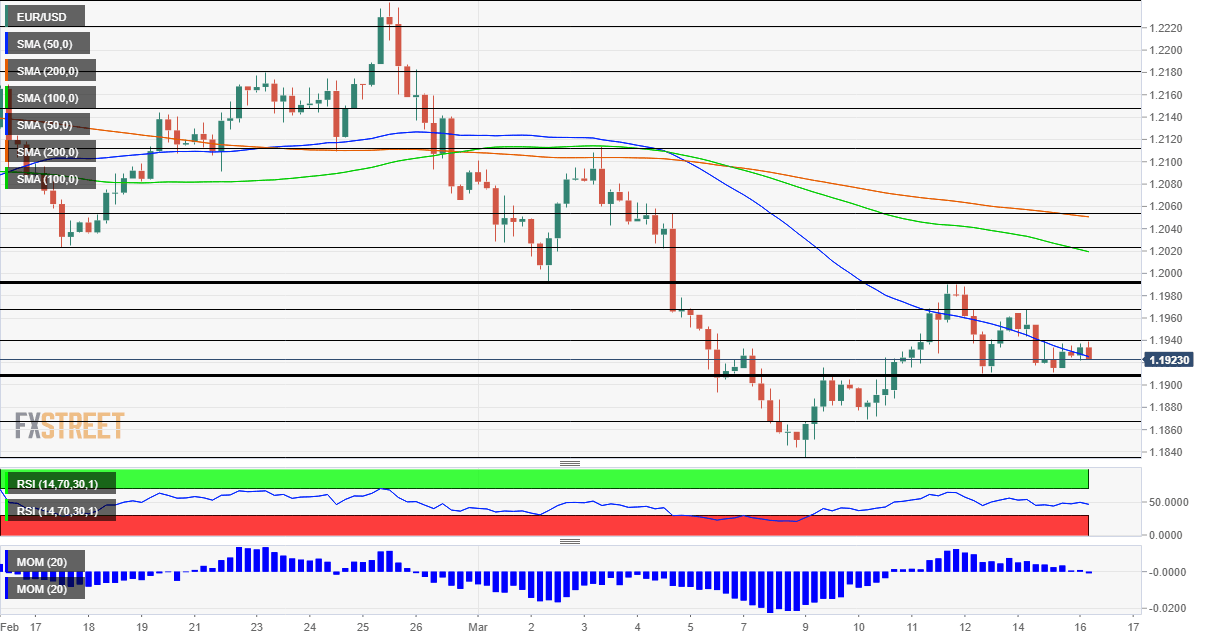

- Tuesday's four-hour chart is showing a double bottom is eyed.

Is the only way down? The current calm in markets is one preceding a storm – and it is impossible to find one bullish argument in favor of EUR/USD. The only question seems to be one of timing – before or after the Federal Reserve's decision?

Here are the main weights on EUR/USD:

Vaccine issues: All of Europe's large countries followed Germany in suspending the rollout of AstraZeneca's COVID-19 vaccines after several cases of blood clots related to the inoculations. As millions of doses have been successfully administered in Europe, the UK, and elsewhere, some suspect that a specific batch is a culprit. On the other hand, the European Medicines Agency dismisses these concerns.

For markets, any delay in Europe's vaccinations – which had already been advancing at a snail's pace – the meaning is a postponement in the economic recovery. That is a key downside driver for the euro.

Moreover, the Astra crisis comes just as Italy is undergoing a new lockdown, and Germany is worried by an exponential increase in coronavirus cases. That compares with acceleration in US immunization and an ongoing downtrend in infections there.

The German ZEW Economic Sentiment is set to show ongoing optimism about a vaccine-led recovery as it has probably been unable to capture the recent developments. The survey was also mostly taken before the weekend's regional elections, which dealt a blow to Chancellor Angela Merkel's center-right party. Political uncertainty may also weigh on the common currency.

On the other side of the pond, tension is growing toward the Federal Reserve's decision on Wednesday. Will the world's most powerful central bank release subtle hints of raising rates earlier than expected. The Fed will likely walk a fine line between acknowledging the economic improvement without scaring investors of rising borrowing costs. The "dot-plot" of new forecasts – including for rate hikes – is set for minor upgrades.

The dollar let go of some of its gains as US ten-year yields dropped below 1.60% – but that looks temporary. Stock investors are gradually getting used to higher returns on safe US debt and seem to fear rapid moves – but not the general direction of travel.

Ahead of the Fed, US Retail Sales figures will be closely watched on Tuesday. The data for February is forecast to show a minor drop after a leap back in January – driven partially by the previous stimulus checks. Nevertheless, the power of the US consumer cannot be underestimated – another upside surprise may come.

See US Retail Sales February Preview: Will the real consumer please stand up?

All in all, the euro has reasons to fall and the dollar to rise.

EUR/USD Technical Analysis

Euro/dollar bounced off the 1.1905 level twice – creating a double-bottom. Can it keep up? Momentum on the four-hour chart has turned to the downside while the currency pair is struggling to hold onto the 50 Simple Moving Average on the four-hour chart.

Below 1.1905, the next cushion is at 1.1865, followed by 1.1836, which is the 2021 trough.

Some resistance awaits at the daily high of 1.1940, followed by 1.1965 and then 1.1990, which worked both as resistance and support so far in March.

Five factors moving the US dollar in 2021 and not necessarily to the downside

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.