EUR/USD Forecast: Dollar in trouble after dismal ADP

EUR/USD Current Price: 1.1884

- The ADP report showed that the US private sector added just 330K jobs in July.

- Markit downwardly revised the EU services output in July.

- EUR/USD is at the upper end of its weekly range with limited bullish potential

The EUR/USD pair holds within familiar levels this Wednesday, trading below the 1.1900 level. The pair bottomed at 1.1841 and currently trades around the 1.1880 mark, following the release of dismal US employment figures. The ADP report showed that the private sector added 330K new jobs in July, much worse than the 695K expected of the previous 680K.

Earlier in the day, Markit published the final readings of the Markit Services PMI, which suffered downward revisions in the Union. The German index was confirmed at 61.8, while the EU one printed at 59.8, below the previous estimate of 60.4. The final Markit Composite PMI for the EU printed at 60.2. Also, Retail Sales in June increased by 1.5% MoM, slightly below expected, although the annual reading beat expectations with 5%.

The US session will bring the Markit Services PMI and the official ISM services index, foreseen at 60.4 in July from 60.1 in the previous month.

EUR/USD short-term technical outlook

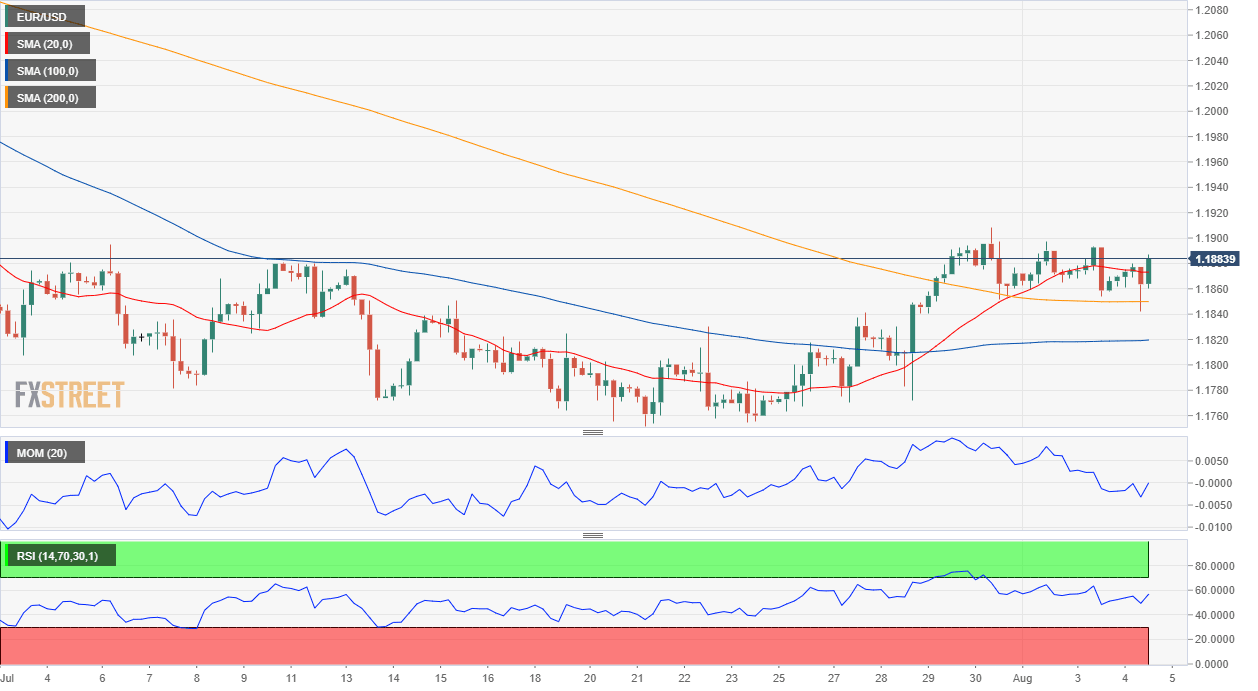

The EUR/USD pair nears the 1.1900 level, but its bullish potential is limited. The 4-hour chart shows that the pair is trading above all of its moving averages but also that the MAs are directionless. Technical indicators picked up, crossing into positive levels, but rather reflecting the current advance than suggesting a bullish continuation ahead. Bulls will have better chances if the pair breaks above 1.1920, the 61.8% retracement of the March/May rally.

Support levels: 1.1840 1.1790 1.1750

Resistance levels: 1.1920 1.1960 1.2000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.