EUR/USD Forecast: Corrective recovery, not out of the woods yet

- Unimpressive macroeconomic data overshadowed by coronavirus concerns.

- Markit final PMI and US official ones to gear up the week.

- EUR/USD is still at risk of re-testing 2019 low at 1.0878.

It was a tough week for EUR/USD traders, as volatility around the pair remained quite low. The pair fell to a fresh 2020 low of 1.0991, recovering to post modest weekly gains by settling at around 1.1050. The EUR/USD pair advanced on the dollar’s weakness rather than on self EUR strength.

Unimpressive data both shores of the Atlantic

Multiple first-tier events got overshadowed by coronavirus-related fears, although unimpressive US developments for sure took their toll on the USD. The US Federal Reserve had a monetary policy meeting, and as widely expected, rates were kept unchanged. The accompanying statement was a copy of that released in December. Powell maintained its optimistic stance on economic developments, saying that growth continues at a moderate pace while noting global economic growth is stabilizing, while trade uncertainties eased.

Also, the US released the first estimate of its Q4 GDP, which came in as expected at 2.1%. On Friday, the country released core PCE inflation for December, which came in as expected at 1.6% YoY.

Things in the EU were not much better, as Q4 GDP missed the market’s expectations by printing 1.0% YoY while the preliminary estimate of January inflation met expectations with 1.4%. German Retail Sales were sharply lower in December, while the IFO survey showed that the Business Climate was down to 95.9 in January.

On Thursday, the WHO offered a presser on the coronavirus, and declared the outbreak a public health emergency of international concern, although, at this point, they believe there is no reason to limit trade or travel to China. A short-lived relief for markets, as news that the virus keeps spreading outside China, spurred risk-off on Friday. At this point, the situation is set to continue escalating. Fears that it would affect global economic growth, will likely keep the market searching for safety, therefore playing against the shared currency.

Growth and Payrolls in the docket

At the beginning of February, Markit will release the final versions of January PMI for both economies. The US will add the official indexes, usually much more relevant for the greenback. The ISM Manufacturing PMI is foreseen at 48 from 47.2, while the ISM Non-Manufacturing PMI is expected at 55.1 from 55 in December. The EU will also release this week, December Retail Sales, seen up, although German data released this week suggest the outcome may disappoint investors.

The star of the week, however, will be the Nonfarm Payroll report to be out on Friday. It has been long since US employment data lost the power of shaking the financial world. Still, the market waits for it with loads of expectations and tends to hold back ahead of the event. The report’s outcome has to diverge sharply from forecasts to actually trigger relevant movements that can even result in trend changes.

Up to today, the US economy is forecasted to have added 156K new jobs in January, while the unemployment rate is seen steady at 3.5%. Wages are seen rising by 0.3% int he month and by 3.0% when compared to a year early, improving modestly from December readings.

EUR/USD technical outlook

The EUR/USD pair is trading around the 38.2% retracement of its latest daily slump, measured between 1.1172 and 1.0991 at 1.1060, the immediate resistance. Therefore, the latest advance could be considered corrective.

In the weekly chart, the pair continues to offer a negative stance. Despite recovering it spent the week below a currently flat 20 SMA, while the 100 SMA extends its decline some 400 pips above the current level. Technical indicators hover within neutral levels, lacking directional strength.

Daily basis, the risk remains skewed to the downside, as the recovery stalled below a directionless 100 DMA, while the 20 DMA keeps grinding lower above it. The Momentum indicator is flat below its mid-line, while the RSI recovered from oversold levels, but holds in the red.

The upside will look more constructive if the pair surpasses 1.1140, with scope then to recover up to 1.1220 first and 1.1280 later. The main support is 1.0980, where it bottomed at the end of November. Once below this last, there are increased odds for a retest of 2019 low at 1.0878.

EUR/USD sentiment poll

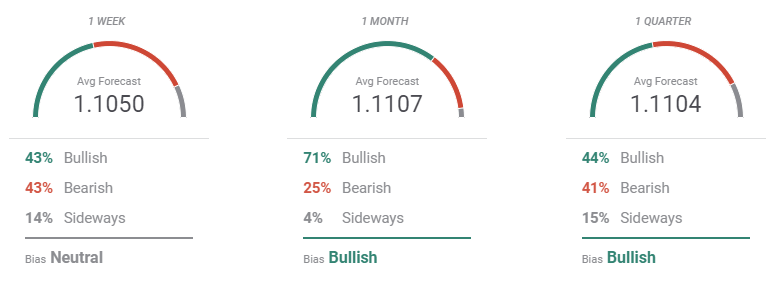

The FXStreet Forecast Poll shows that the market is not willing to resume the dollar’s buying, as the pair is seen neutral-to-bullish in the upcoming weeks. The weekly perspective shows that sentiment is neutral as the number of those betting for a decline matches the one of those waiting for a recovery. Bulls take over in the monthly view, increasing to 71%, although the average target is barely above the 1.1100 figure. The number of those betting for a sustained advance drops in the quarterly perspective, down to 44%, with the average target stuck around 1.1100.

The Overview chart shows that moving averages are quite neutral in all the time frames under study, although the larger accumulation of targets in the monthly perspective is above the current level, suggesting that the pair may continue to grind higher in the next few weeks.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.