EUR/USD Forecast: Corrective decline loses momentum

EUR/USD Current Price: 1.2034

- Falling equities put a halt to the dollar’s sell-off and helped it recover some ground.

- The absence of relevant macroeconomic data extends into Wednesday.

- EUR/USD corrected overbought conditions but is far from bearish.

The EUR/USD pair extended its monthly advance to 1.2079, retreating afterwards to end the day with modest losses in the 1.2030 region. The dollar took a breath as global equities plunged without a clear catalyst. Generally speaking, the absence of first-tier macroeconomic data and falling oil prices undermined equities demand. The greenback got to recover some ground ahead of the daily close, but there are no signs that the current dollar’s advance could continue.

Germany published the March Producer Price Index, which surprised to the upside by printing at 0.9% MoM and 3.7% YoY. The US had nothing to offer. The macroeconomic calendar will remain empty for both economies this Wednesday.

EUR/USD short-term technical outlook

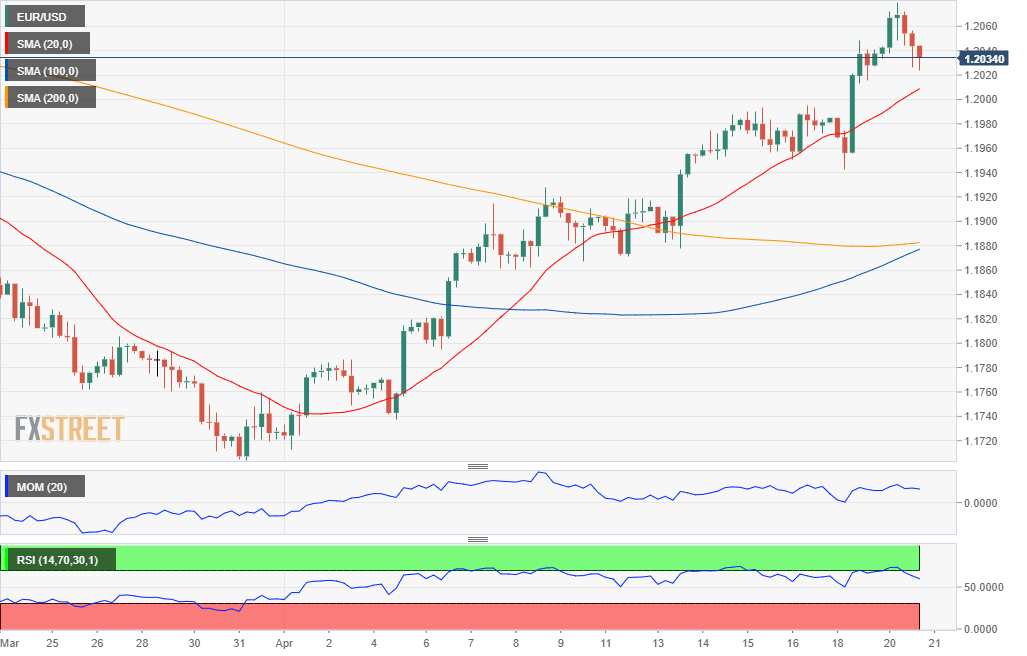

The EUR/USD pair has corrected extreme overbought conditions in the near-term, but the risk of a steeper decline seems limited. The 4-hour chart shows that technical indicators have retreated from extreme overbought readings, currently holding within positive levels and with the RSI already losing bearish momentum. The 20 SMA maintains its bullish slope above the longer ones, providing dynamic support at around 1.1205.

Support levels: 1.2005 1.1960 1.1920

Resistance levels: 1.2045 1.2085 1.2130

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.