EUR/USD Forecast: Correction could extend toward 1.1300

- EUR/USD has lost its traction at the start of the new year.

- Dollar's valuation continues to drive the pair's action.

- Key technical support in the near term aligns at 1.1300.

Following the impressive rally witnessed in the last week of 2021, the EUR/USD pair has started the new year under modest bearish pressure as trading conditions normalize. The pair remains at the mercy of the greenback's market valuation and the correction could extend toward 1.1300.

Year-end flows and some cautious remarks from European Central Bank (ECB) officials on the inflation outlook helped the shared currency find some demand late last week. On the other hand, the dollar selloff picked up steam after the Christmas break and helped the pair push higher.

The underlying fundamental driver, namely the monetary policy divergence between the US Federal Reserve and the ECB, hasn't changed, suggesting that the pair's latest advance was a technical correction fueled by profit-taking.

There won't be any high-tier macroeconomic data releases in the remainder of the day and EUR/USD could find it difficult to regain its traction. The benchmark 10-year US Treasury bond yield is holding above the key 1.5% mark, helping the dollar stay resilient against its major rivals.

Investors will also keep a close eye on headlines surrounding the coronavirus Omicron variant. The number of confirmed cases continues to rise at a strong pace both in the US and Europe but, as it currently stands, European countries are more likely to tighten restrictions. A slowdown in the eurozone's economic activity due to tighter restrictions will put additional bearish pressure on EUR/USD in the near term.

EUR/USD Technical Analysis

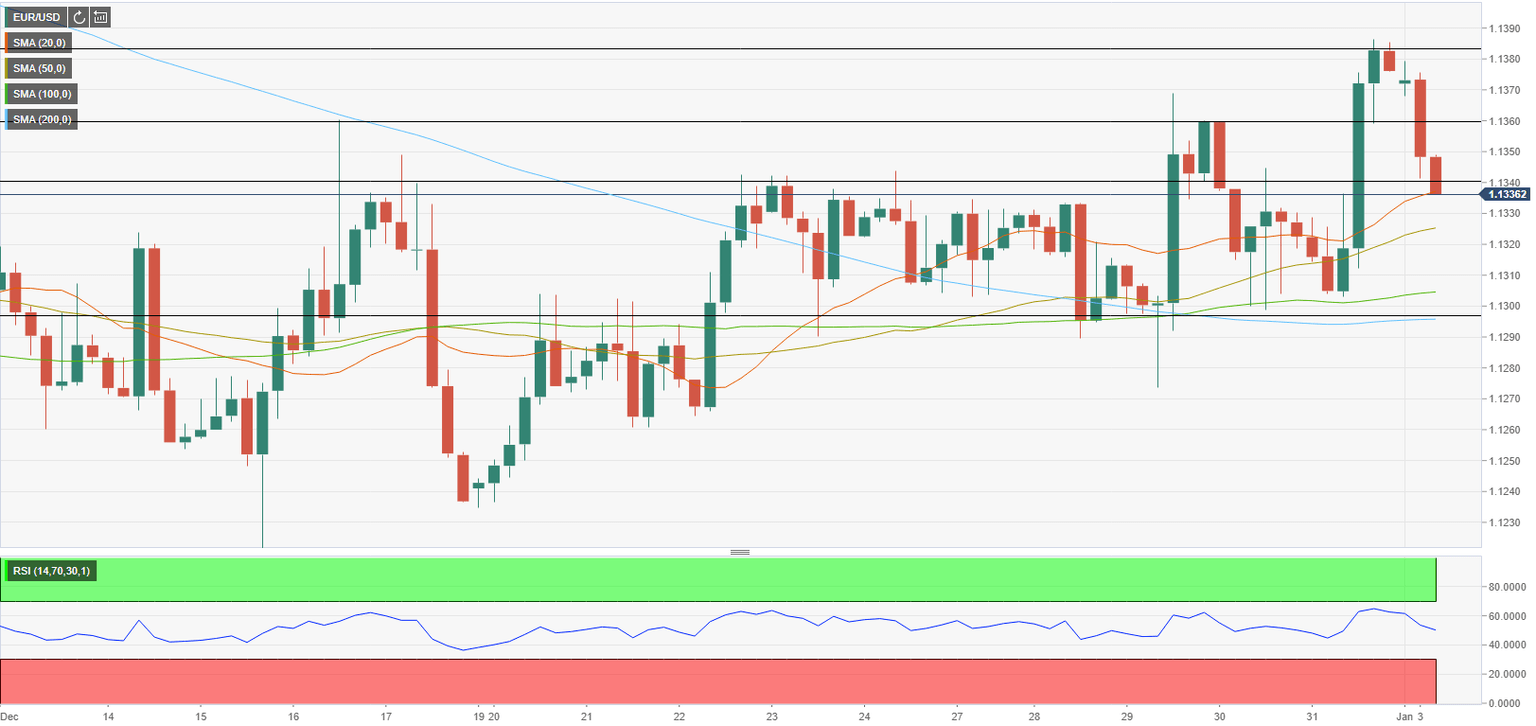

On the four-hour chart, the Relative Strength Index (RSI) indicator retreated below 50, confirming the view that bullish pressure is fading away.

As of writing, the pair is testing 1.1340 (former resistance, static level). In case a four-hour candle closes below that level, additional losses toward 1.1300 (psychological level, 200-period SMA) could be witnessed in the near term.

On the upside, 1.1360 (static level, post-ECB high on December 16) aligns as initial resistance before 1.1385 (December 31 high) and 1.3400 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.