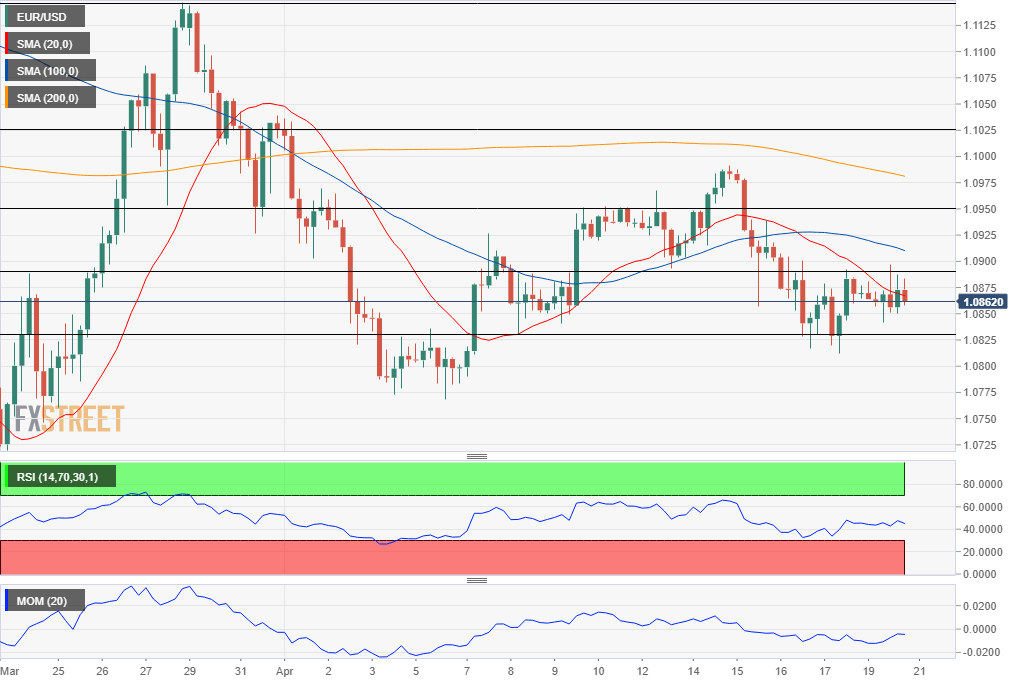

EUR/USD Current Price: 1.0862

- Crude oil prices collapsed, exacerbating the dismal market mood.

- The EU Commission spurred rage after assigning Hungary almost double the relief than to Italy.

- EUR/USD short-term neutral, but the risk is skewed to the downside.

It was a slow start to the week in terms of activity in the FX board, as most major pairs remained confined to familiar levels. Collapsing oil prices, however, were in the eye of the storm. The barrel of WTI plunged to a multi-decade low of $1.00 a barrel, as the coronavirus pandemic erased demand for the commodity, dragging equities lower across the world. As for currencies, major pairs remained within familiar levels, without relevant directional movements across the FX board. The EUR/USD pair is ending the day little changed at around 1.0870, after a failed attempt to recover the 1.0900 threshold.

The European Commission has announced that, within its Coronavirus Response Investment Initiative, Hungary, which has 172 coronavirus fatalities, will get €5.6bn double the amount Italy will receive. With the death toll above 23.6K, Italy will get €2.3bn. The news has spurred rage, and for sure, won’t help the shared currency strengthen.

The macroeconomic calendar was light as if offered minor figures from both shores of the Atlantic, which the market ignored. Nevertheless, the figures continued to reflect the effects of the lockdown in economies. This Tuesday, Germany will publish its April ZEW Survey on Economic Sentiment, expected to have improved, but also to remain near record lows. The US will publish March Existing Home Sales, foreseen down by 8.1%.

EUR/USD short-term technical outlook

The EUR/USD pair has held within a range defined by Fibonacci level, as support is being provided by the 61.8% retracement of the latest daily advance around 1.0830, while sellers surge in the 1.0890 price zone, the 50% retracement of the same rally. The short-term picture is neutral-to-bearish, as, in the 4-hour chart, technical indicators are turning marginally lower but remain around their midlines, as the price struggles with a mild-bearish 20 SMA and below the larger ones.

Support levels: 1.0830 1.0790 1.0750

Resistance levels: 1.0925 1.0960 1.1000

View Live Chart for the EUR/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.