- EUR/USD is under pressure amid coronavirus concerns.

- Data from both sides of the Atlantic, Powell's testimony, and more COVID-19 statistics are awaited.

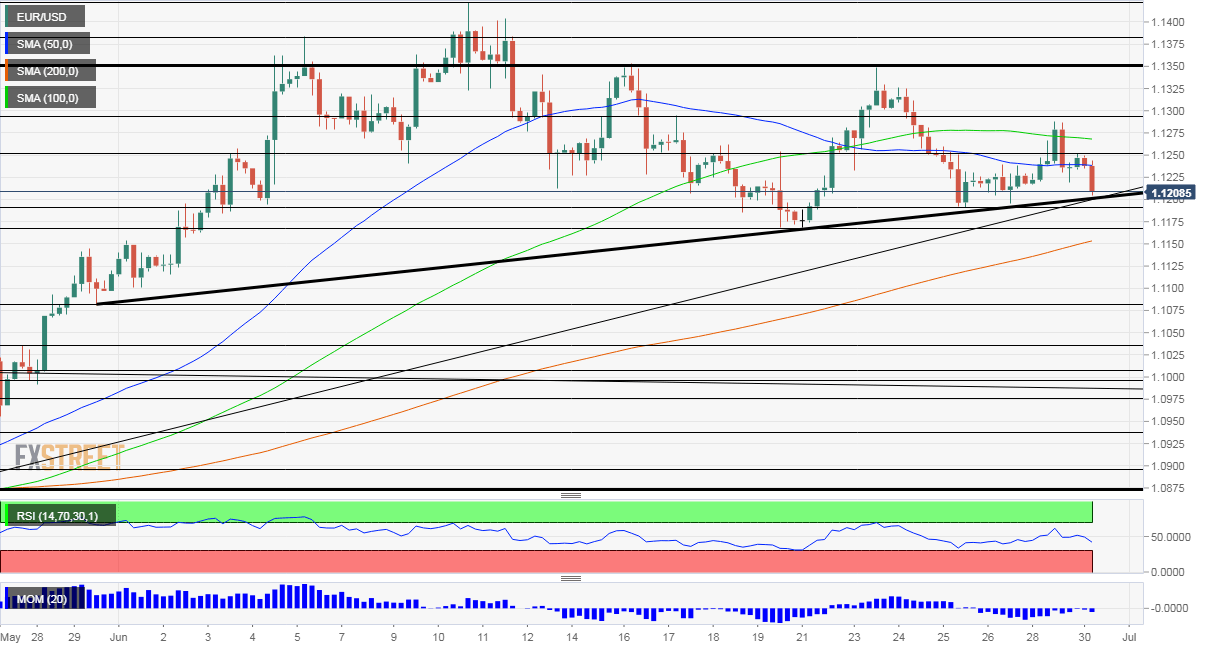

- Tuesday's four-hour chart is showing that uptrend support is being challenged.

Will a successful quarter end on a high note for EUR/USD or will it correct to the downside? The last day of the first half of the year has kicked off with downside pressure stemming from fears about the spread of coronavirus, especially in the US.

Several US states are either reimposing restrictions or halting their reopening. Going to the beach will be forbidden for those living in Los Angeles and also Miami and Texas – where hospitals are coming under immense pressure – is also shutting down bars. New Jersey, which has successfully crushed COVID-19, is delaying indoor dining – with New York set to follow. The news is boosting the safe-haven dollar.

Jerome Powell, Chairman of the Federal Reserve, has released remarks from his upcoming testimony later on Tuesday – and the focus is on the virus. Powell reiterated that a return to pre-pandemic output levels is unlikely without beating the disease and that uncertainty is high. Treasury Secretary Steven Mnuchin will appear alongside the Fed Chair and will likely address demands for further fiscal stimulus.

Can Powell's invigorate the risk trade? Don't miss our experts' preview!

Kansas is one of the states obliging people to wear masks in public places, partially following the example of Vice President Mike Pence. The VP made a U-turn, after having previously refused to endorse face covering.

Will President Donald Trump follow and also wear a mask in public? Goldman Sachs, a bank, notes that such a basic measure could substitute lockdowns and lift Gross Domestic Product by as much as 5%. The incumbent president winning card for reelection was the economy, so he may finally ditch the culture wars and put on a mask.

Trump is trailing rival Joe Biden by around nine points ahead of November's elections as a new scandal emerges. The latest scandal to engulf the president revolves around intelligence reports that showed Russia is paying bounty hunters to kill US personnel in Afghanistan – information that became known to Trump in February and which he denies receiving.

Looking to the second half of the year, investors' nightmare scenario is a clean sweep by Democrats, with Senators Bernie Sanders and Elisabeth Warren regulating Wall Street. Such fears are also supporting the dollar.

The market mood was less damp on Monday when US Pending Home Sales beat expectations with a leap of over 40%. Investors were also encouraged by Chinese Purchasing Managers' Indexes, exceeding expectations and pointing to growth.

The Conference Board's Consumer Confidence gauge for June is projected to show another gradual increase as the economy opened.

See Consumer Confidence Preview: Modest improvement

Sino-American tensions remain high as China officially passed the controversial Hong Kong bill, giving it more powers over the financial hub. The US is set to limit HK's ability to buy weapons, and China vowed to retaliate. The news adds to the risk-off mood.

Back to the old continent, Spain's GDP was confirmed at a fall of 5.2% in the first quarter, serving as a reminder of Europe's troubles. Inflation figures will probably show a bounce in June after falling beforehand. Christine Lagarde, President of the European Central Bank, reiterated her pledge to fight deflation and do whatever is needed.

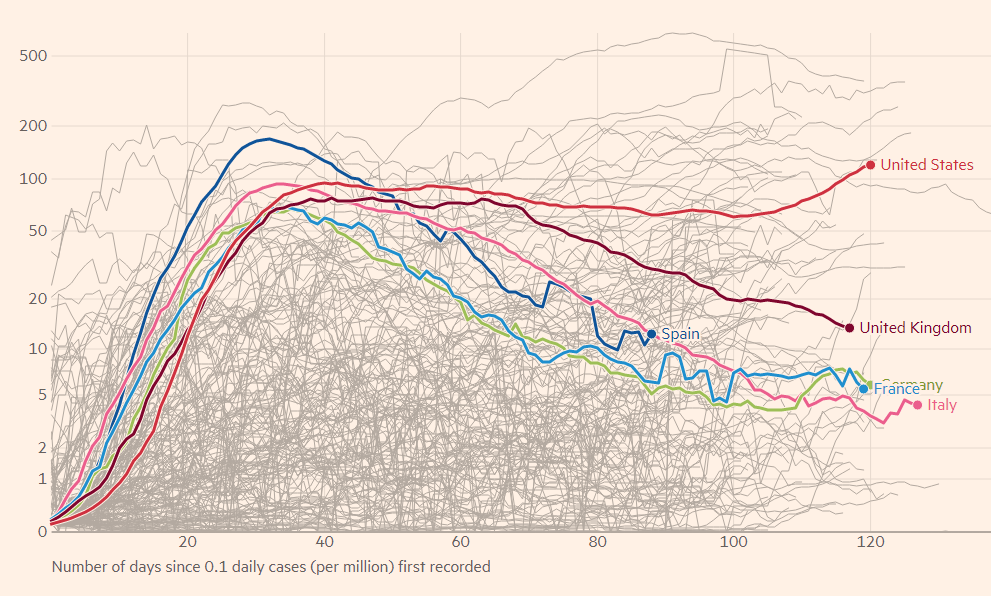

Coronavirus cases remain low in Europe, including when accounting for population. However, small local outbreaks can turn into larger ones if they are not dealt with on time. Here is the current situation:

Source: Financial Times

Overall, COVID-19 – cases, deaths, and reopening – remains the overwhelming topic on the last day of Q2, as it did throughout the quarter.

EUR/USD Technical Analysis

Euro/dollar is trading alongside an uptrend support line since late May – and it is holding up impressively well. Can it withstand end-of-quarter flows? Momentum on the four-hour chart is to the downside and the currency pair slipped below the 50 and 100 Simple Moving Averages, bearish signs. On the other hand, the uptrend looks robust.

Some support awaits at 1.1190, which provided support twice in recent days. The mid-June trough of 1.1170 is next. Further down, the 200 SMA hits the chart at 1.1150, and 1.1075 is where the uptrend line originated from.

Looking up, resistance is at 1.1250, which capped a recovery attempt early in the day, and then 1.1290, the weekly high. The next lines to watch are 1.1350 and 1.1385.

More Why the dollar is king in the US coronavirus comeback? Discover what to watch out for!

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.