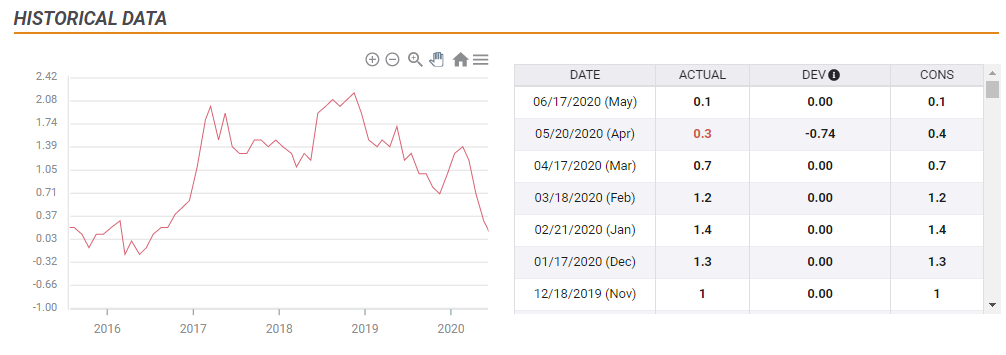

- Preliminary eurozone inflation figures for June will likely beat expectations.

- An increase of core inflation back above 1% would be a welcome surprise for the euro.

- EUR/USD has the wind in its back due to the better coronavirus situation.

Giving the Germans reasons to be worried – that would be welcome news for euro bulls. Economists at Europe's largest economy tend to fear the specter of rising prices – with pictures of wheelbarrows full of worthless cash in the ill-fated Weimar Republic coming to mind. In recent years, the European Central Bank found itself fighting the danger of deflation – not inflation.

The coronavirus crisis sent the headline Consumer Price Index close to zero amid a fall in demand. Isabel Schnabel, a German member of the European Central Bank, even said that CPI may dip below 0%. However, that is almost impossible for June. Early figures from her country and from Spain both came out above expectations.

That makes the current expectation for 0.1% YoY CPI obsolete.

Core matters

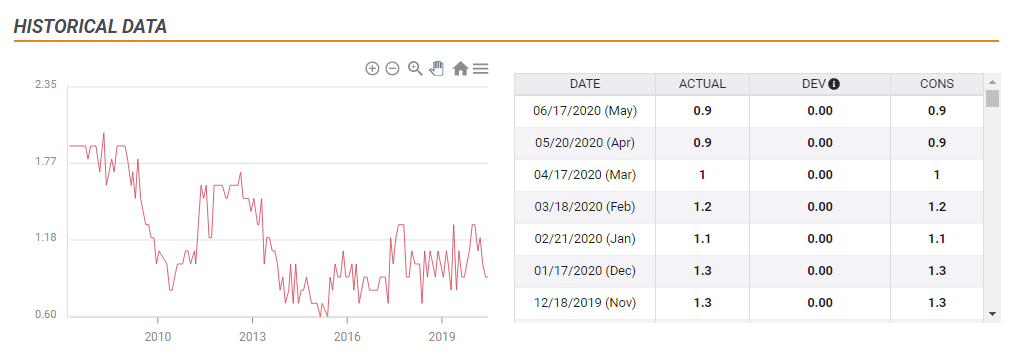

The focus for the upcoming release – and for the ECB in recent years – is therefore on Core CPI. Germany and Spain did not publish underlying inflation figures, which are projected to hold at 0.9%. The increase in headline raises the chances for a run above 1%.

That would still be far from the bank's "2% or close to 2%" target – but would be welcome by the Frankfurt-based institution and by EUR/USD buyers. It would reduce the chances for a rate cut by the ECB – whose deposit rate is already at -0.50%.

What about Quantitative Easing? In any case, Christine Lagarde, President of the European Central Bank, said that the Pandemic Emergency Purchase Program – already worth €1.35 trillion – is essential to prevent deflation. It will likely remain unchanged until the crisis ends.

Any increase above 1% would, therefore, boost the common currency, and now has higher chances of happening. A disappointing rise of 0.8% yearly or less would weigh on the euro.

What would happen if Core CPI meets economists' expectations with 0.9%? In that case, EUR/USD may still edge higher.

EUR/USD positive bias

The common currency is benefiting from having COVID-19 under control – in comparison to the US and the UK. The euro seems to weather any dollar strength better than its peers. Is the euro also turning into a safe-haven currency?

That temporarily happened in 2015 around the Greek crisis and still requires more proof in 2020. Nevertheless, at least for the inflation report, EUR/USD has room to rise.

Conclusion

Eurozone CPI will likely exceed original estimates and rise more than 0.1%, leaving the focus on Core CPI. An increase beyond 1% would boost the euro, which benefits from a positive bias.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.