EUR/USD Forecast: Bulls to challenge 1.1915 resistance level

EUR/USD Current Price: 1.1879

- Industrial Production in the EU continued to improve in July.

- The market’s sentiment is positive, but there are no fireworks in financial markets.

- EUR/USD is grinding higher on dollar’s weakness, approaching the 1.1900 threshold.

The EUR/USD pair is up at the beginning of the week, as the greenback remains out of the market’s favor. The pair traded as high as 1.1883 during the European session, holding not far below the level ahead of the US opening. The market’s mood is positive, although there are no fireworks. Equities are marginally higher in Asia and Europe, finding support in news that Oxford and AstraZeneca resumed testing their coronavirus vaccine.

The EU published earlier today July Industrial Production, which was up 4.1% in the month, beating expectations. When compared to a year earlier, it rose 8.7% better than the 8% expected. The US won’t publish relevant data today.

EUR/USD short-term technical outlook

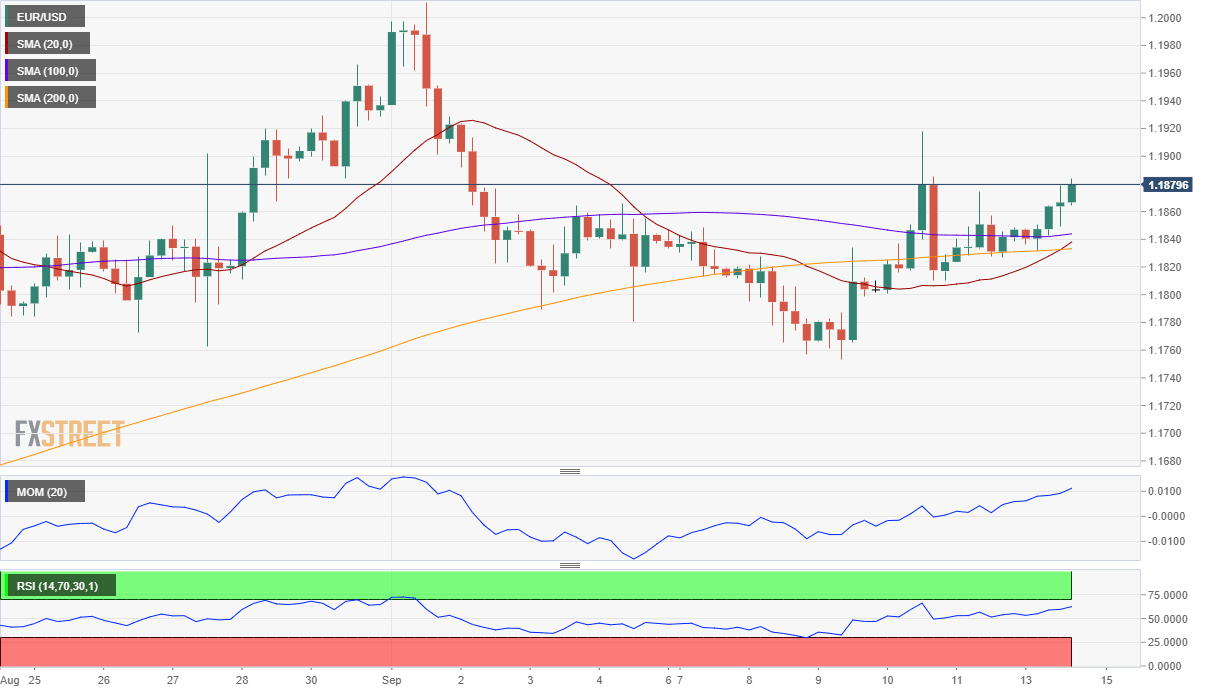

The EUR/USD pair is trading around the 50% retracement of its September decline, and biased higher in the short-term. The 4-hour chart shows that the pair is extending its advance above all of its moving averages, while technical indicators advance within positive levels. The next Fibonacci resistance level comes at 1.1915, where sellers surged last week. Beyond the level, the pair has higher chances of retesting the year high at 1.2011.

Support levels: 1.1840 1.1800 1.1750

Resistance levels: 1.1915 1.1960 1.2010

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.