EUR/USD Forecast: Bulls mounted on hopes

EUR/USD Current Price: 1.1902

- Mixed US data provides support to high-yielding assets.

- Brexit-related concerns temporarily interrupted the dollar’s slide.

- EUR/USD is neutral-to-bullish in the near-term, could reach 1.2011.

The EUR/USD pair peaked at 1.1929 during European trading hours, as the upbeat mood continues. The pair suffered a knee-jerk and fell to 1.1881 from such a high, as discouraging Brexit headlines gave the greenback a temporal lift. European Commission´s leader Ursula von der Leyen said that she cannot tell if in the end there will be a Brexit trade deal.

The EU didn’t publish relevant data, but the US has offered a good number of macroeconomic figures. Durable Goods Orders were up 1.3% in October, beating expectations, while the core reading printed at 0.7% against the 0.5% forecast. Q3 economic growth was confirmed at 33.1%, while Initial Jobless Claims for the week ended November 20 came in worse than expected, up to 778K. Mixed news had a limited effect on currencies, with the dollar down within range against the shared currency.

EUR/USD short-term technical outlook

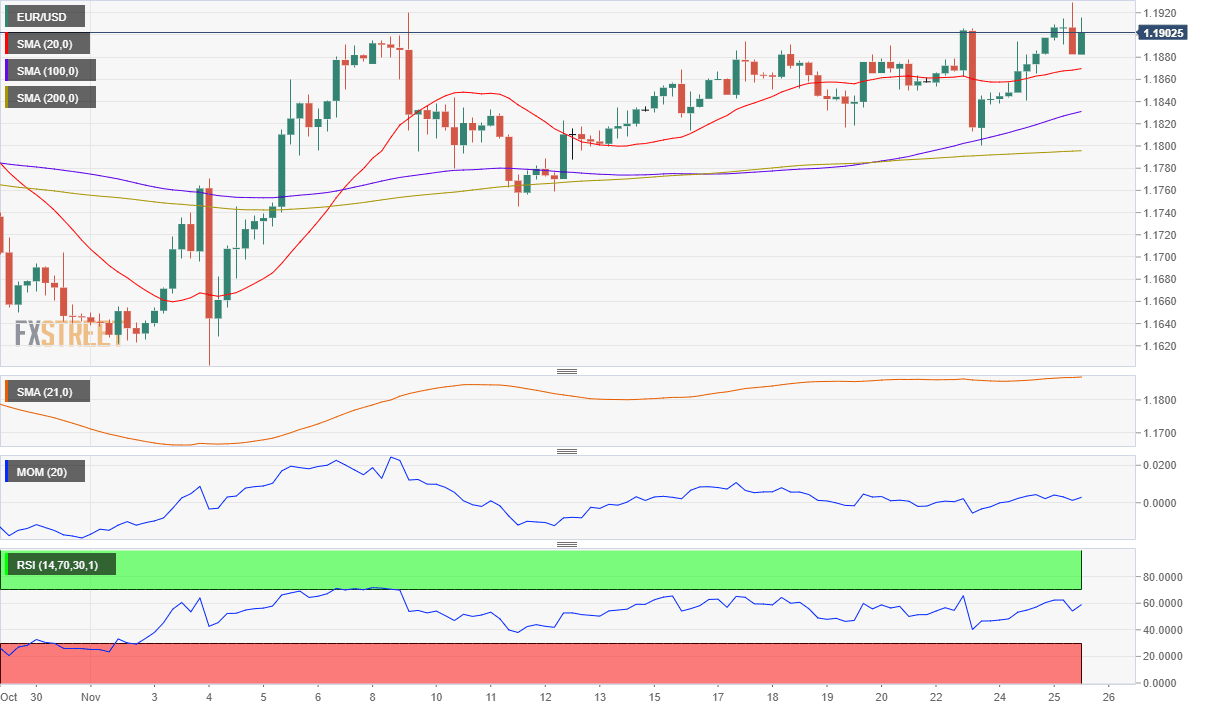

The EUR/USD pair trades around 1.1900, poised to extend its advance. The 4-hour chart shows that it remains above a mildly bullish 20 SMA, which grinds higher above the longer ones. Technical indicators remain within positive levels but lack directional strength. Renewed buying interest above 1.1920 could see the pair extending its advance up to 1.2011, this year´s high.

Support levels: 1.1810 1.1770 1.1715

Resistance levels: 1.1920 1.1960 1.2010

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.