EUR/USD Forecast: Bulls looking for a reason to add longs

EUR/USD Current price: 1.0858

- Market participants await inflation updates that could affect central banks’ upcoming decisions.

- United States Durable Goods Orders and CB Consumer Confidence coming up next.

- EUR/USD is technically bullish in the near term, but sill limited by a critical Fibonacci level.

The EUR/USD pair trades lifeless around the 1.0850 level as market players extend the wait-and-see phase ahead of the release of relevant inflation-related figures and a slew of Federal Reserve (Fed) speakers. The US Dollar trades with a soft tone across the FX board, struggling to find direction as stock markets consolidate their recent gains near record highs.

The focus remains on the release of the United States (US) January Core Personal Consumption Expenditures (PCE) Price Index. The Bureau of Economic Analysis (BEA) is expected to report the largest gain in a year in the Fed’s favorite inflation gauge next Thursday, following an optimistic December report which suggested tempered inflationary pressures. However, the January Consumer Price Index (CPI) surprised with higher-than-anticipated readings, fueling speculation the central bank will further delay rate cuts. At this point, market participants are betting the central bank will trim the current record interest rate next June, but bets can change should PCE inflation bring a positive surprise.

Meanwhile, the Eurozone and Germany will also deliver inflation updates. The economies will unveil their preliminary estimates of the February Harmonized Index of Consumer Prices (HICP) in the upcoming days.

Earlier in the day, the EU released the January M3 Money Supply report prepared by the European Central Bank (ECB). The document indicated a persistently sluggish growth in the broad monetary aggregate M3, which increased by a mere 0.1% in the month, slightly decelerating from a revised 0.2% increase in December 2023. Germany unveiled the Gfk Consumer Confidence Survey, which showed a modest improvement from -29.6 to -29 in March.

The upcoming US session will bring January Durable Goods Orders, expected to have plummeted 4.5% in the month, and CB Consumer Confidence, which is foreseen unchanged at 114.8.

EUR/USD short-term technical outlook

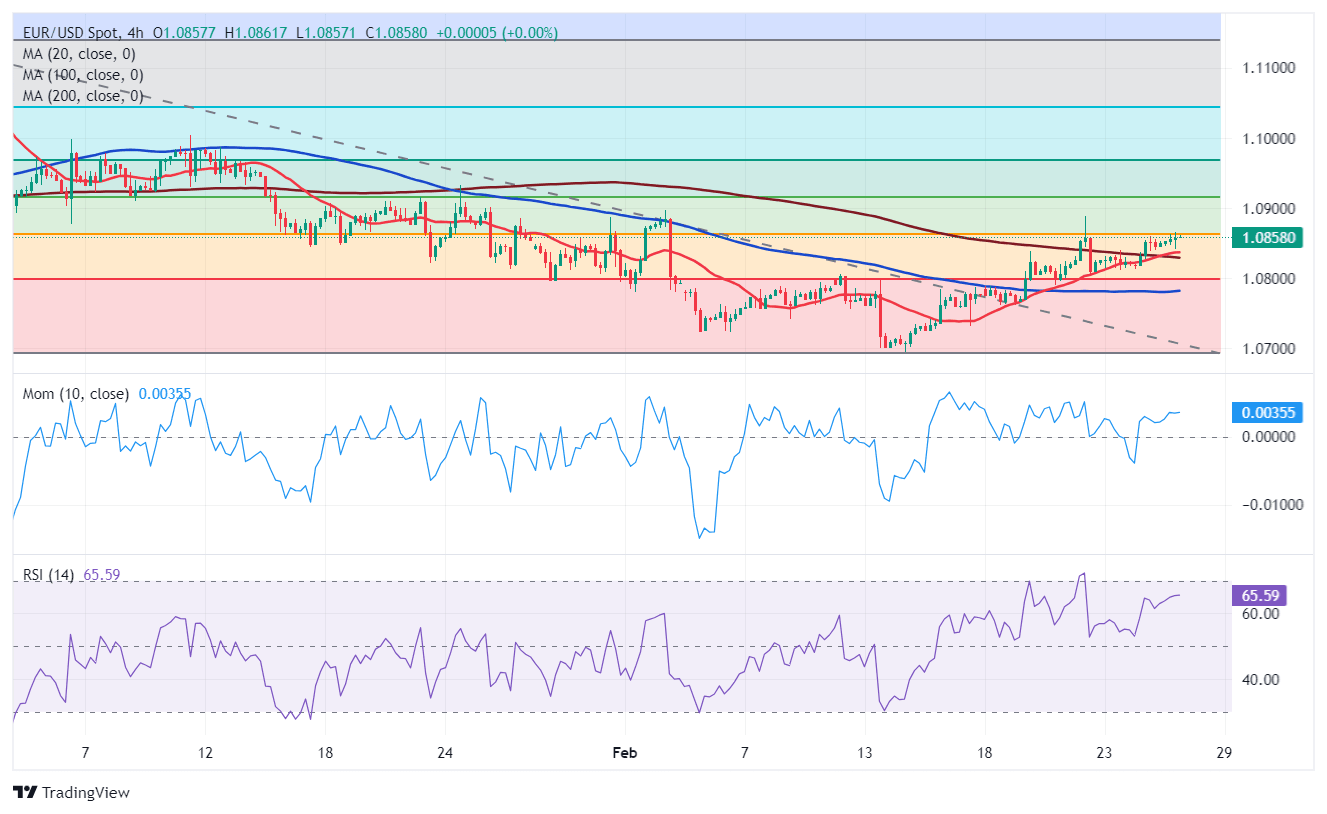

The EUR/USD pair peaked at 1.0866, meeting sellers at around the 38.2% Fibonacci retracement of the 1.1139-1.0694 daily slump at 1.0865, although it remains just below the critical resistance area. Technical readings in the daily chart reflect the absence of directional momentum, although the risk remains skewed to the upside, as technical indicators decelerated their advances but hold well above their midlines. At the same time, the pair develops above all its moving averages, although they remain directionless and confined to a tight 40 pips range, reflecting the lack of directional interest.

The EURUSD pair retains its bullish potential in the near term. The 4-hour chart shows technical indicators moving marginally higher within positive levels. The Relative Strength Index (RSI) indicator ticked higher and is currently developing around 65, suggesting the pair has room to extend gains, particularly if it clearly breaks through the aforementioned Fibonacci resistance level. At the same time, the 20 Simple Moving Average (SMA) has crossed above the 200 SMA, while the 100 SMA stands far below the longer one, usually a sign of bulls’ control. Speculative interest is cautiously optimistic, but additional technical signs are required to confirm another leg north.

Support levels: 1.0825 1.0770 1.0720

Resistance levels: 1.0865 1.0910 1.0950

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.