EUR/USD Forecast: Bulls aiming to challenge a critical resistance level

EUR/USD Current Price: 1.0690

- Mixed United States data released on Friday put the US Dollar under selling pressure.

- Euro Zone Sentix Investor Confidence improved by less than anticipated in January.

- EUR/USD could test 1.0740, the 61.8% Fibonacci retracement of the 2022 decline.

Following Friday’s rally ahead of the weekly close, the EUR/USD pair surged to 1.0699 on Monday. The Euro benefited from a better market mood. Over the weekend, China finally re-opened sea and land crossings with Hong Kong after three years, the final pillar of the zero-covid policy. As a result, the Chinese Yuan jumped to a fresh five-month high against the US Dollar, pressuring the latter across the FX board.

Furthermore, the American Dollar eased amid renewed speculation the United States Federal Reserve (Fed) will slow the pace of rate hikes, following US data published on Friday. The ISM Services PMI plummeted into contraction territory in December, with the index down to 49.6 from 56.5 in November. At the same time, the Nonfarm Payrolls report indicated solid job creation alongside easing wage pressure.

Data-wise, Euro Zone Sentix Investor Confidence improved to -17.5 in January from -21 in December but missed expectations of -11.1. The November Unemployment Rate, on the other hand, was confirmed at 6.5%, as expected. The US macroeconomic calendar will be light, as the country will publish November Consumer Credit Change., while Federal Reserve’s Raphael Bostic will be on the wires.

EUR/USD short-term technical outlook

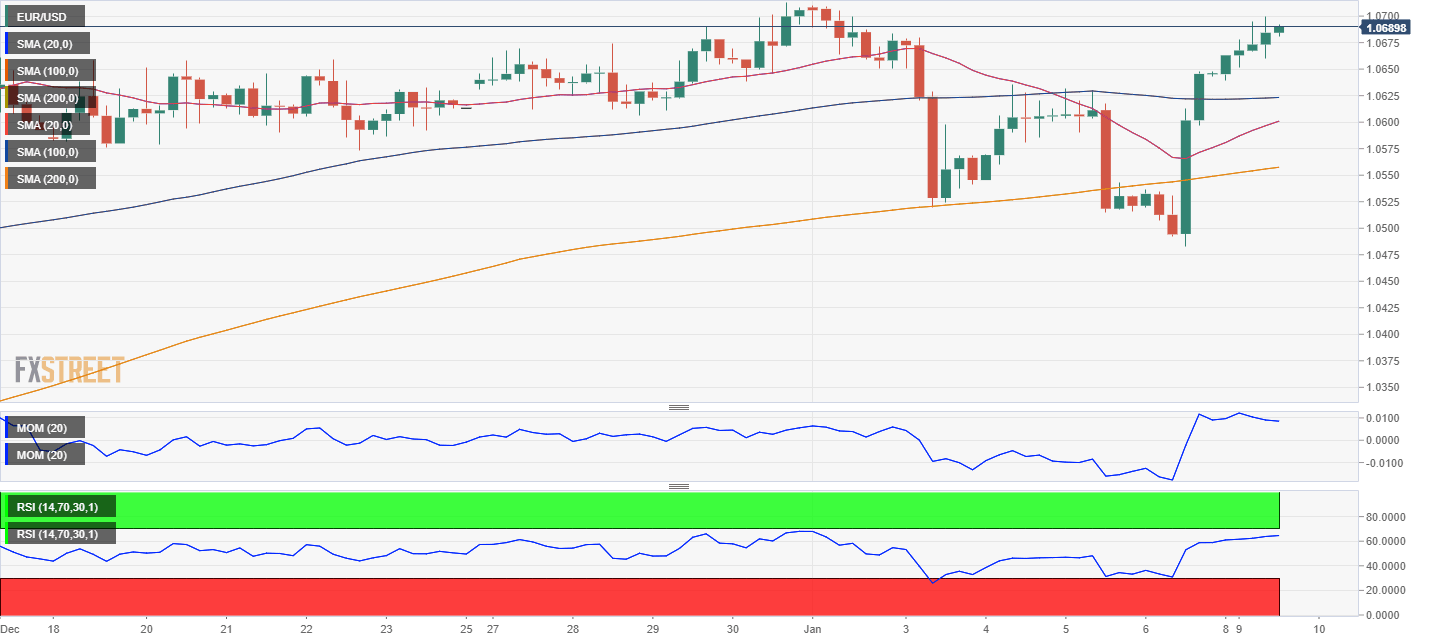

The EUR/USD pair is firmly up for a second consecutive day, trading around the 1.0690 level. Technical readings in the daily chart skew the risk to the upside, although the pair lacks momentum. Technical indicators hold within positive levels but without clear directional strength, while EUR/USD develops above all of its moving averages. The 20 Simple Moving Average (SMA) picks up modestly, providing dynamic support at around 1.0615.

The bullish case is firmer in the near term. The 4-hour chart shows that technical indicators picked up an upward pace within positive levels, with the Relative Strength Index (RSI) approaching overbought readings. At the same time, EUR/USD develops above its moving averages, with the 20 SMA accelerating north between the longer ones. A critical resistance level is located at 1.0740, the 61.8% retracement of the 2022 yearly decline. It seems unlikely the pair could break above it without a clear catalyst.

Support levels: 1.0660 1.0615 1.0570

Resistance levels: 1.0740 1.0785 1.0820

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.