EUR/USD Forecast: Bullish potential still limited short-term

EUR/USD Current Price: 1.1736

- Optimism took its toll on the greenback, but dollar’s bulls refuse to give up.

- Mixed data were overshadowed by hopes related to the US economic comeback.

- EUR/USD holds above a critical Fibonacci support level, but the market prefers selling at higher levels.

The EUR/USD pair peaked this Tuesday at 1.1807, as the dollar weakened for most of the day, recovering some ground ahead Wall Street’s close. Market players were on an upbeat mood, with global equities posting gains after US President Trump hinted a tax cut on capital gains, late on Monday. Traders bet back on the greenback during the American afternoon, resulting in EUR/USD ending the day in the red in the 1.1740 price zone.

Data was mixed both shores of the Atlantic, as the German ZEW Survey showed that Economic Sentiment in the country improved in August from 59.3 to 71.5, although the assessment of the current situation deteriorated to -81.3 from -80.9. The EU Economic Sentiment in the same month improved to 64 from 59.6, beating expectations. The US, on the other hand, published the July NFIB Business Optimism Index, which declined to 98.8 in July, missing expectations. The Producer Price Index for the same month improved to 0.5% YoY in the same month, beating the market’s forecast. Wednesday will bring the EU Industrial Production data for June, and US CPI figures for July.

EUR/USD short-term technical outlook

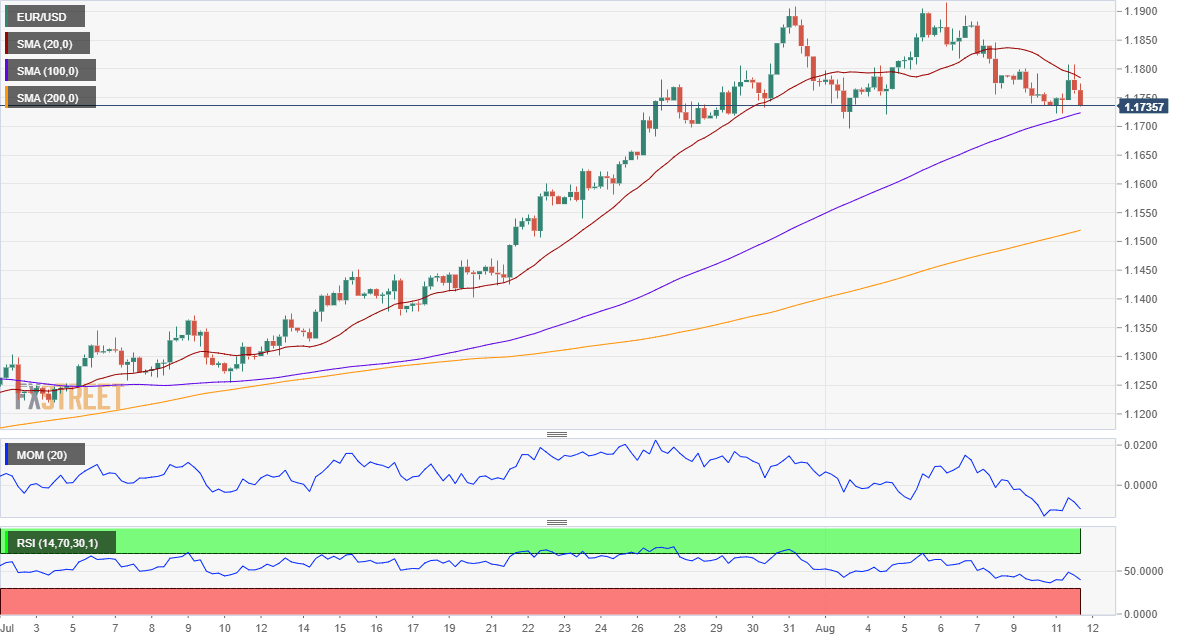

The EUR/USD pair has briefly fallen below the 23.6% retracement of its July/August rally at 1.1740,t settling a few pips below it. From a technical point of view and in the short-term, the bullish potential seems limited, given that in the 4-hour chart, the pair was unable to advance beyond a bearish 20 SMA. The 100 SMA, however, continues heading north at around 1.1720, providing dynamic support. Technical indicators, in the meantime, corrected oversold conditions but resumed their declines within negative levels.

Support levels: 1.1720 1.1690 1.1650

Resistance levels: 1.1770 1.1810 1.1845

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.