EUR/USD Forecast: Bullish potential intact, 1.2100 holds the key ahead of German/EU data

- A modest USD rebound prompted some profit-taking around EUR/USD on Thursday.

- Dovish Fed capped the upside for the USD and helped limit the downside for the pair.

- The USD bulls seemed rather unimpressed by better-than-expected US Q1 GDP print.

The EUR/USD pair struggled to capitalize on its Asian session uptick to two-month tops, around mid-1.2100s and witnessed a modest pullback on Thursday, though lacked any follow-through selling. As investors digested the Fed's dovish message, a strong pickup in the US Treasury bond yields allowed the US dollar to recover a bit from the lowest level since February 26. This, in turn, was seen as a key factor that exerted some pressure on the major. That said, a combination of factors helped limit the downside. The shared currency found some support from an unexpected rise in German consumer inflation figures. In fact, the flash version of the report showed that the headline CPI rose 0.7% in April and 2.0% YoY.

On the other hand, the Fed's reassurance to maintain the current accommodative monetary policy stance acted as a headwind for the USD. At the conclusion of the latest FOMC policy meeting on Wednesday, Fed Chair Jerome Powell vowed to look through any transitory spikes in inflation. Further, Powell reiterated that substantial progress is needed before talking about scaling back the massive bond purchases. This was evident from a rather muted market reaction to the better-than-expected US Q1 GDP report. The first estimate revealed that growth in the world's largest economy accelerated by 6.4% annualized pace during the January-March period as against 6.1% expected and 4.3% rise recorded in the previous quarter.

Nevertheless, the pair managed to end the day above the 1.2100 mark and held steady above the mentioned handle through the Asian session on Friday. Market participants now look forward to the prelim German/EU GDP report for a fresh impetus. The Eurozone economic docket also features the release of flash CPI print for April. The US will publish March Personal Income/Spending data, Core PCE Price Index and revised Michigan Consumer Sentiment Index for April. This, along with the US bond yields, might influence the USD price dynamics and allow traders to grab some short-term opportunities on the last day of the week.

Technical outlook

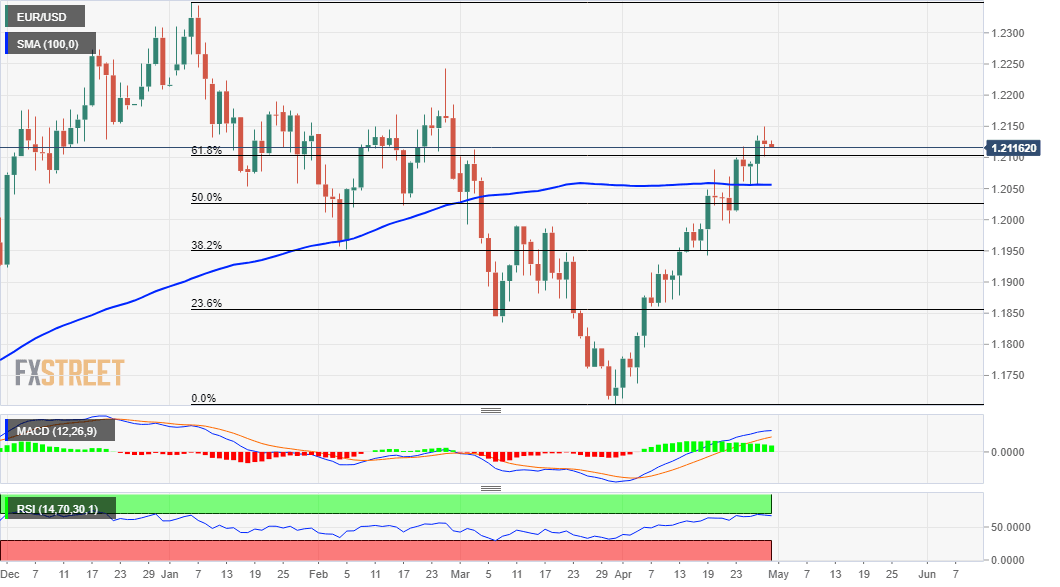

From a technical perspective, acceptance above the 1.2100 mark, representing the 61.8% Fibonacci level of the 1.2345-1.1704 recent leg down, favours bullish traders. A subsequent strength beyond the overnight swing highs, around mid-1.2100s, will reaffirm the positive outlook and assist bulls to aim to reclaim the 1.2200 mark. The upward trajectory could further get extended towards February monthly swing highs, around the 1.2245 region.

On the flip side, sustained weakness below the 1.2100 mark might prompt some long-unwinding and drag the pair towards weekly lows, around the 1.2055 region. This is closely followed by the 50% Fibo. level, around the 1.2030 region, which if broken decisively will suggest that the recent positive move witnessed over the past one month or so has run out of steam. The pair might then turn vulnerable to break below the key 1.2000 psychological mark and accelerate the fall towards 38.2% Fibo. level, around mid-1.1900s.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.