EUR/USD Forecast: Bears seem reluctant despite rising trade tensions, firmer USD

- EUR/USD edges lower in reaction to Trump’s latest tariff threats on EU imports.

- Reduced Fed rate cut bets underpin the USD and further weigh on spot prices.

- Bears seem reluctant and now await US inflation figures before placing fresh bets.

The EUR/USD pair touches over a two-week low on Monday, though it lacks follow-through selling and manages to hold above mid-1.1600s through the early part of the European session. The shared currency weakens in reaction to US President Donald Trump's threat to impose a 30% tariff on imports from two of the largest US trading partners – Mexico and the European Union (EU) – starting August 1. Trump conveyed the decision to European Commission President Ursula von der Leyen and Mexico’s President Claudia Sheinbaum in separate letters on Saturday. This adds to a string of over 20 tariff notices issued by Trump since last Monday and comes on top of a 50% tariff on copper imports, marking a further escalation of trade wars. Apart from this, a modest US Dollar (USD) uptick weighs on the currency pair.

Traders pared bets on the number of interest rate cuts by the Federal Reserve (Fed) this year following the release of the upbeat US employment data for June, which pointed to a still resilient labor market. Adding to this, Minutes from the June 17-18 FOMC meeting showed that most policymakers remain worried about the risk of rising inflation on the back of Trump's trade tariffs and a narrow support for a near-term reduction in borrowing costs. This, along with the anti-risk flow, lifts the safe-haven Greenback to its highest level since June 25 and further acts as a headwind for the EUR/USD pair. The USD bulls, however, seem reluctant and opt to wait for the latest US inflation figures – the Consumer Price Index (CPI) and the Producer Price Index (PPI) on Tuesday and Wednesday, respectively – before placing aggressive bets.

Meanwhile, the EU said it would extend its suspension of countermeasures to US tariffs until early August and continue to press for a negotiated settlement. Furthermore, a relatively muted reaction to Trump's latest tariff threats, along with mixed signals over the next European Central Bank (ECB) policy move, warrants some caution before placing aggressive bearish bets around the EUR/USD pair. ECB board member Isabel Schnabel said in an interview on Friday that the bar for another rate cut is very high. The economy is resilient and another cut would require significant inflation deviation, Schnabel added further. On the other hand, ECB executive board member Fabio Panetta argued on Friday that the ECB should continue to ease the monetary policy if downside growth risks reinforce the disinflationary process.

Hence, it will be prudent to wait for strong follow-through selling in order to confirm that the EUR/USD pair has topped out in the near term and positioning for an extension of the recent corrective pullback from a multi-year high touched earlier this month. In the absence of any relevant market-moving economic releases, either from the Eurozone or the US, traders will keep a close eye on comments from influential FOMC members to grab short-term opportunities. Nevertheless, the aforementioned fundamental backdrop warrants caution before placing aggressive directional bets.

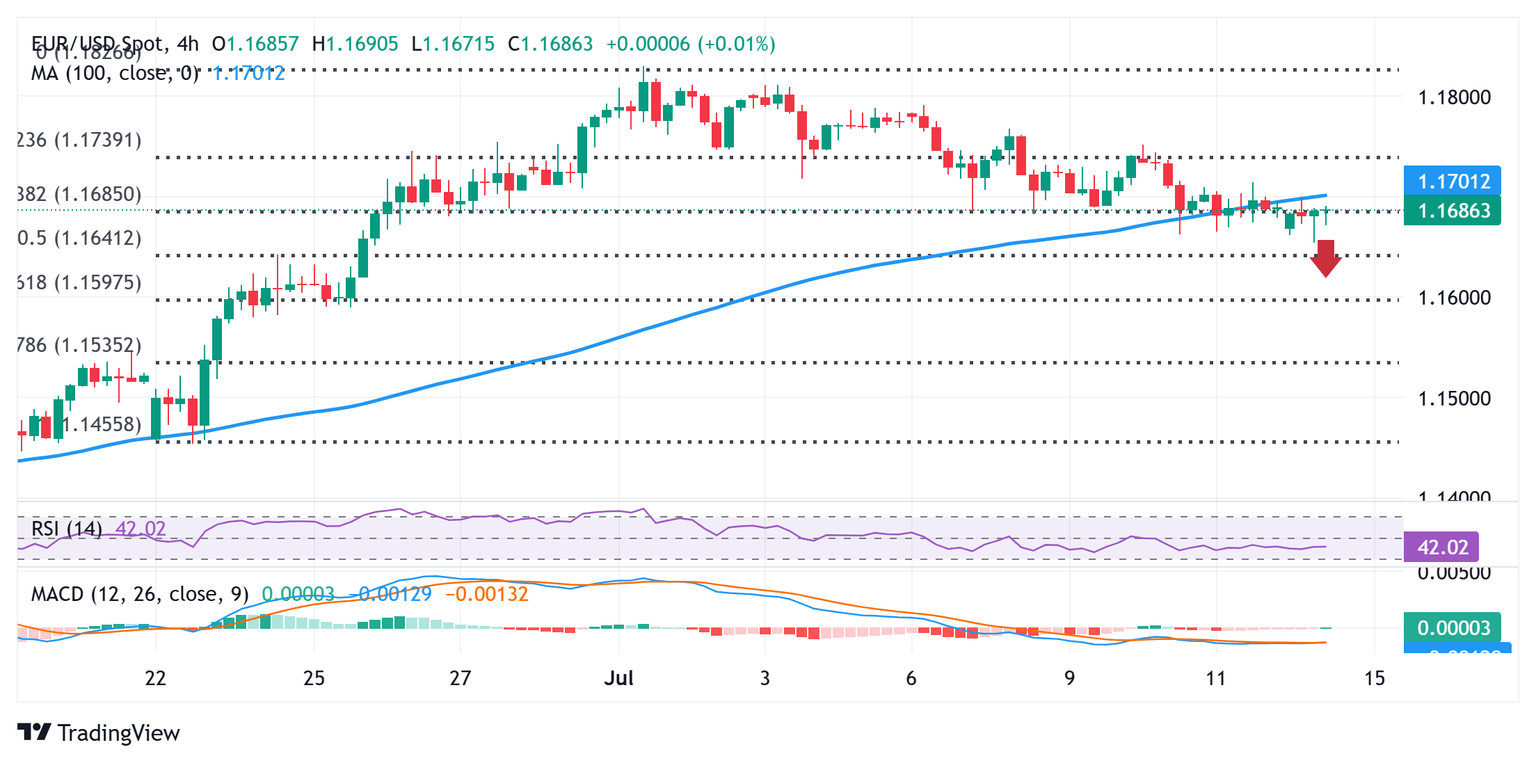

EUR/USD 4-hour chart

Technical Outlook

The EUR/USD pair now seems to have found acceptance below the 100-period Simple Moving Average (SMA) on the 4-hour chart. Moreover, oscillators on the said chart have been gaining negative traction and back the case for deeper losses. However, the daily Relative Strength Index (RSI, 14) remains above 50, while the Moving Average Convergence Divergence (MACD) histogram and the signal line are also holding in bullish territory. This, in turn, suggests that any subsequent slide below the 1.1640 area, or the 50% Fibonacci retracement level of the recent move higher since late June, is likely to find decent support near the 1.1600 mark. The latter coincides with the 61.8% Fibo. retracement level, which if broken decisively will be seen as a fresh trigger for bearish traders and pave the way for deeper losses.

On the flip side, any attempted recovery back above the 1.1700 round figure could face some resistance near the 1.1740-1.1745 region, or the 23.6% Fibo. retracement level support breakpoint. A sustained strength beyond the said barrier would negate any near-term negative bias and allow the EUR/USD pair to reclaim the 1.1800 mark. The momentum could extend further towards the 1.1830 area, or the highest level since September 2021 touched earlier this month, before spot prices eventually aim to retake the 1.1900 round-figure mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.