EUR/USD Forecast: Bears paused ahead of next catalyst

EUR/USD Current Price: 1.0833

- German ZEW Survey to report Economic Sentiment deteriorated further in February.

- German’s Bundesbank sees the current situation persisting in the first quarter of the year.

- EUR/USD holding on to the lower end of its latest range and at risk of falling.

The EUR/USD pair has spent most of this Monday consolidating in the 1.0830 price zone, a few pips above 1.0826, the multi-year low pasted last Friday. Market players struggled to find a catalyst, as the EU macroeconomic calendar was empty, while the US celebrated Presidents’ Day. The shared currency’s weakness has been driven by tepid or null growth in Germany throughout the last year. And news from this Monday suggest that the economy has not yet found its bottom, as the Bundesbank said in its monthly report that there are no signs the currency situation is set to change in the first quarter of the year, while coronavirus’ uncertainty adds a new layer of risk.

This Tuesday, Germany will release the February ZEW Survey, and the Economic Sentiment for the country is seen contracting to 21.4 from 26.7 previous. The assessment of the current situation is also seen worsening, to -10.3 from .9.5. For the EU, Economic Sentiment, however, is seen bouncing to 30 from 25.6. If the outcome misses the market’s expectations, fresh yearly lows for EUR/USD are likely. The US macroeconomic calendar will include the NY Empire State Manufacturing Index for February and December TIC Flows.

EUR/USD short-term technical outlook

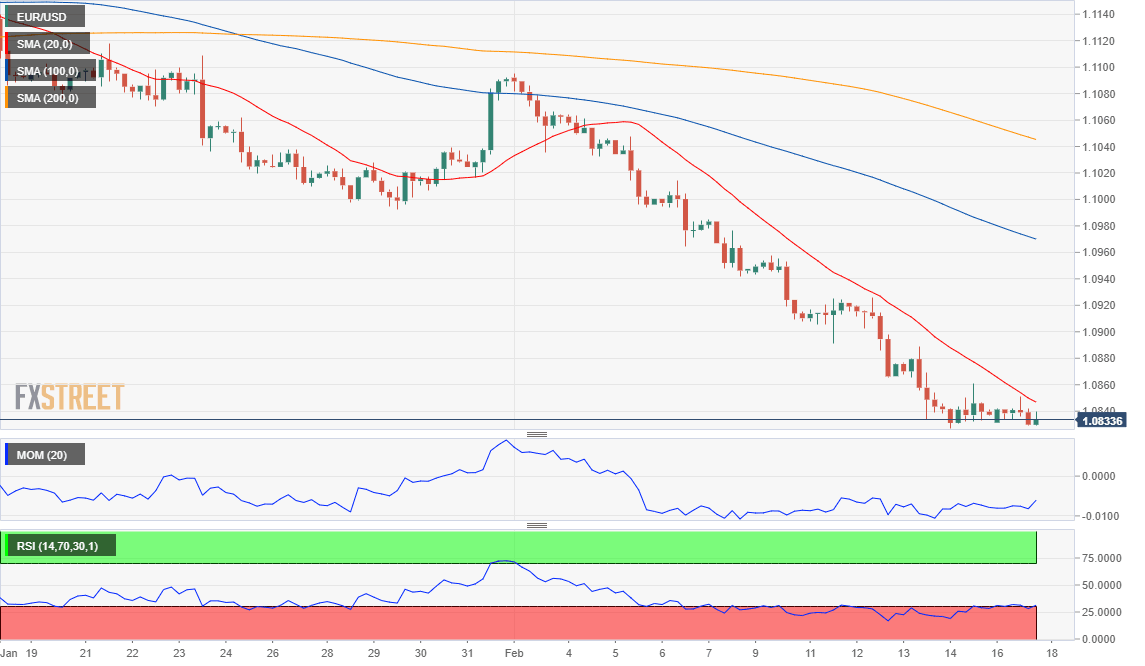

The EUR/USD pair is technically bearish despite holding on to a tight range, with no signs of downward exhaustion, at least in the short-term. The 4-hour chart shows that a bearish 20 SMA retains its downward slope above the current level and below the larger ones, which also head south. Technical indicators have corrected oversold conditions, the Momentum advancing within negative levels, while the RSI stands pat around 33. The immediate support is 1.0810, en route to a more relevant one at 1.0770.

Support levels: 1.0810 1.0770 1.0725

Resistance levels: 1.0850 1.0895 1.0930

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.