EUR/USD Forecast: Bears become more confident after Powell’s words

EUR/USD Current Price: 1.0720

- US Federal Reserve chief Powell repeated his hawkish message, sending stocks dip into the red.

- European policymakers focused on a 50 bps rate hike in March.

- EUR/USD´s failed attempt to regain the 1.0750 area fuels chances of a bearish extension.

The EUR/USD pair fell to 1.0668, its lowest since early January, bouncing from the level ahead of the US close. The Euro was among the weakest US Dollar rivals, despite European policymakers repeating its hawkish rhetoric. European Central Bank (ECB) policymaker Joachim Nagel said that ECB rate cuts are not on the agenda in the foreseeable future and noted that the central bank’s rates are not yet restrictive. He added that “more significant” hikes are needed. Additionally, Isabel Schnabel, a Member of the Executive Board of the ECB, said she intends to raise rates by 50 bps in March.

The focus remained on Federal Reserve Chair Jerome Powell, as market players were still reluctant to give up on a possible rate cut from the American central bank before year-end. Chances, however, have diminished after the latest central bank meeting and the outstanding January employment report. Powell started repeating his hawkish message, stating they would probably need to do further interest-rate increases adding that the process is going to be “bumpy.”

The market welcomed the concept delivered by Powell that stronger than anticipated data would see the Fed raising rates accordingly. The US Dollar fell as Wall Street soared, resulting in EUR/USD recovering to 1.0766. Nevertheless, he added that solid labor market reports or higher inflation reports would result in the Fed raising rates by more than what is currently priced in. The USD recovered as stocks collapsed to fresh daily lows.

Data-wise, Germany published December Industrial Production, which fell 3.1% in the month, and 3.9% from a year earlier, much worse than anticipated. The United States released the December Goods and Services Trade Balance, which posted a better-than-anticipated deficit of $67.4 billion. On Wednesday, the macroeconomic calendar will remain light, as the Euro Zone will not publish relevant data, while the United States will only share minor reports. Still, a couple of Federal Reserve speakers will be on the wires.

EUR/USD short-term technical outlook

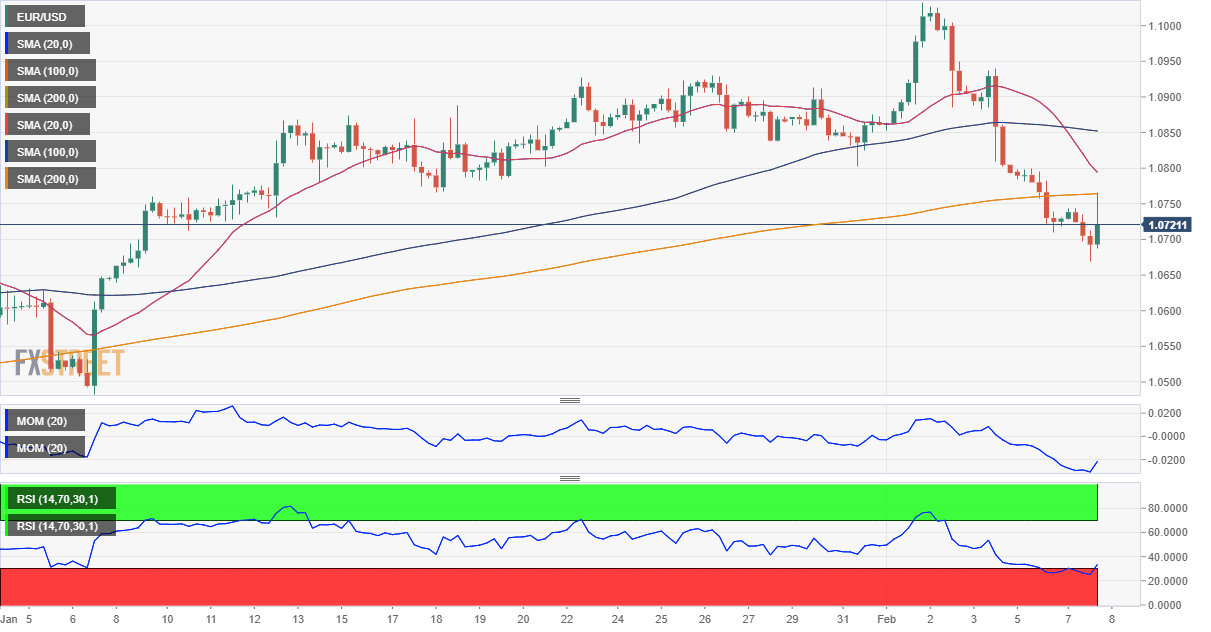

The EUR/USD pair trades above the 1.0700 level heading into the Asian opening, as bulls seem to be losing the battle to regain control. The level stands for the 61.8% Fibonacci retracement of the 2022 yearly decline and has become a psychological barrier. The risk remains skewed to the downside, according to technical readings in the daily chart, as the pair continues to develop below a flat 20 Simple Moving Average (SMA), while the 100 and 200 SMAs currently converge in the 1.0320 price zone. Finally, technical indicators have turned flat within negative levels, short of suggesting a bulls’ comeback.

The 4-hour chart shows sellers rejected the advance around a flat 200 SMA, which stands a few pips above the aforementioned resistance level, as the 20 SMA heads south almost vertically above it. The Momentum indicator struggles for direction within negative levels, but the Relative Strength Index (RSI) has already resumed its decline, anticipating lower lows in the near term.

Support levels: 1.0660 1.0615 1.0570

Resistance levels: 1.0745 1.0790 1.0840

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.