EUR/USD Forecast: Bearish pressure persists after mixed US data

EUR/USD Current Price: 1.2109

- German inflation was confirmed at 2.4% YoY in May.

- US Retail Sales fell by 1.3% in May, worse than anticipated.

- EUR/USD is technically bearish in the near-term, support at 1.2090.

Demand for the American dollar picked up steam ahead of Wall Street’s opening, with EUR/USD retreating from a daily high of 1.2123 but holding above the 1.2100 threshold on a first attempt. The greenback retained its strength after the release of mixed US data. May Retail Sales were down 1.3% MoM, worse than anticipated, while the Producer Price Index in the same month jumped to 6.6% YoY, another sign of mounting inflationary pressures.

Earlier in the day, Germany published the final version of its May inflation readings. The annual Consumer Price Index was confirmed at 2.4%, as previously estimated. The EU published the April Trade Balance, which posted a seasonally adjusted surplus of €9.4 billion.

EUR/USD short-term technical outlook

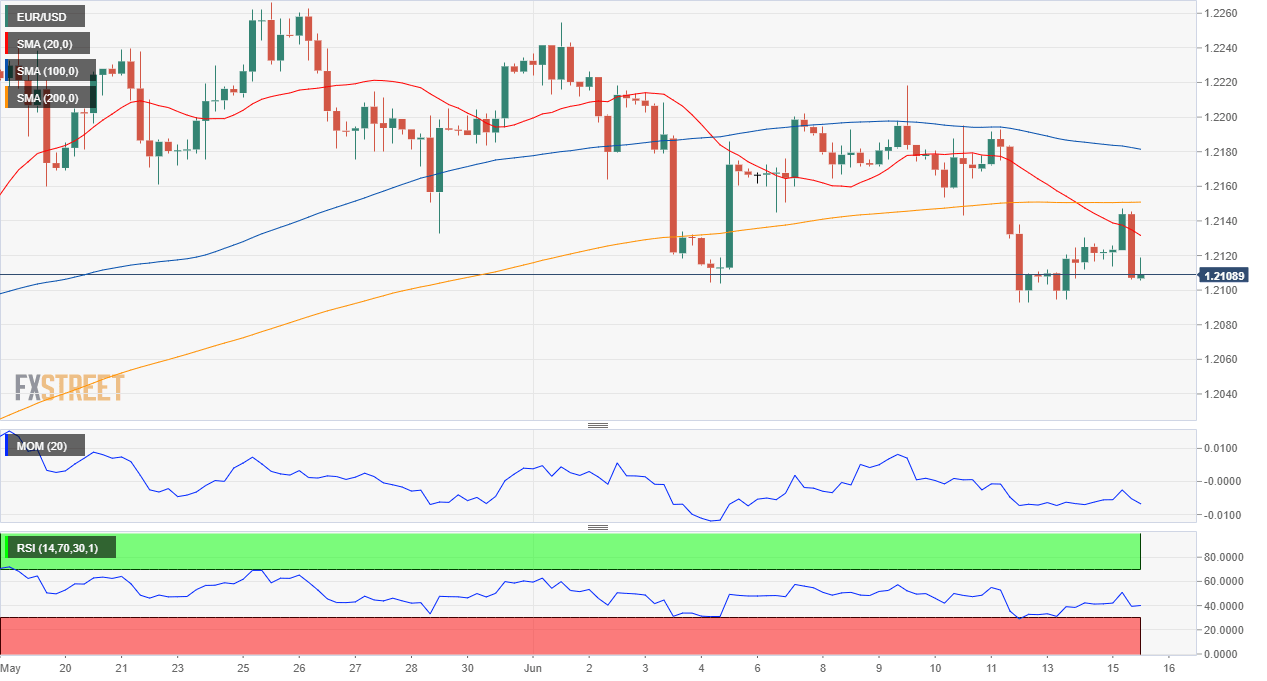

The EUR/USD pair trades at daily lows, a few pips above the 1.2100 mark. The near-term picture is bearish. The 4-hour chart shows that the pair retreated from around a bearish 20 SMA, which heads firmly lower below the longer ones. Technical indicators have turned south within negative levels, indicating increased selling interest. The bearish momentum will be clearer once below 1.2090, the immediate support level.

Support levels: 1.2090 1.2050 1.2010

Resistance levels: 1.2125 1.2160 1.2200

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.