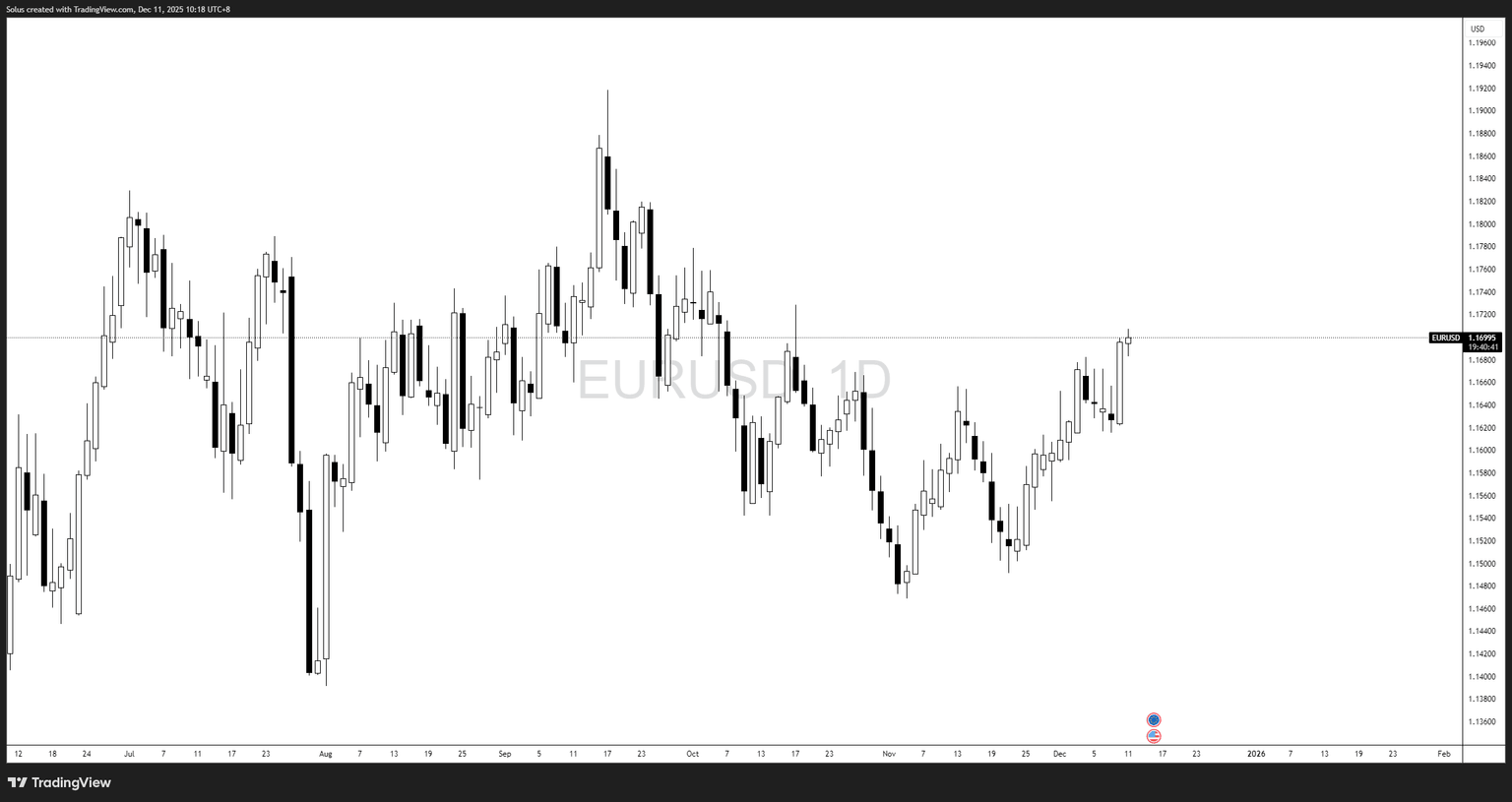

EUR/USD forecast: After the Fed rate cut, can Euro extend the breakout?

- EUR/USD surged to fresh multi-week highs after the Fed delivered its widely expected rate cut, weakening the U.S. dollar.

- Powell’s guidance leaned dovish, signaling room for additional easing in 2026, accelerating USD downside pressure.

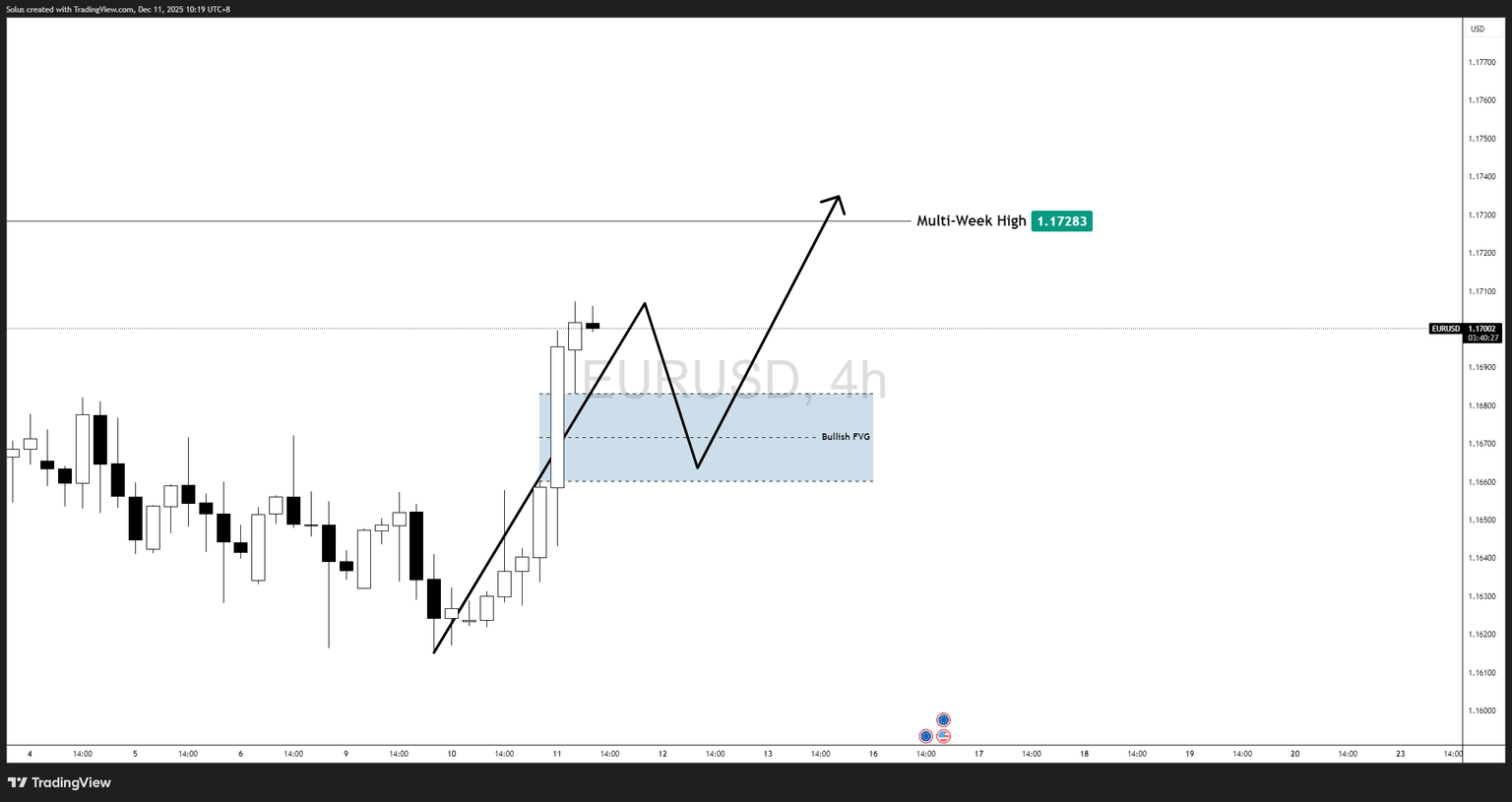

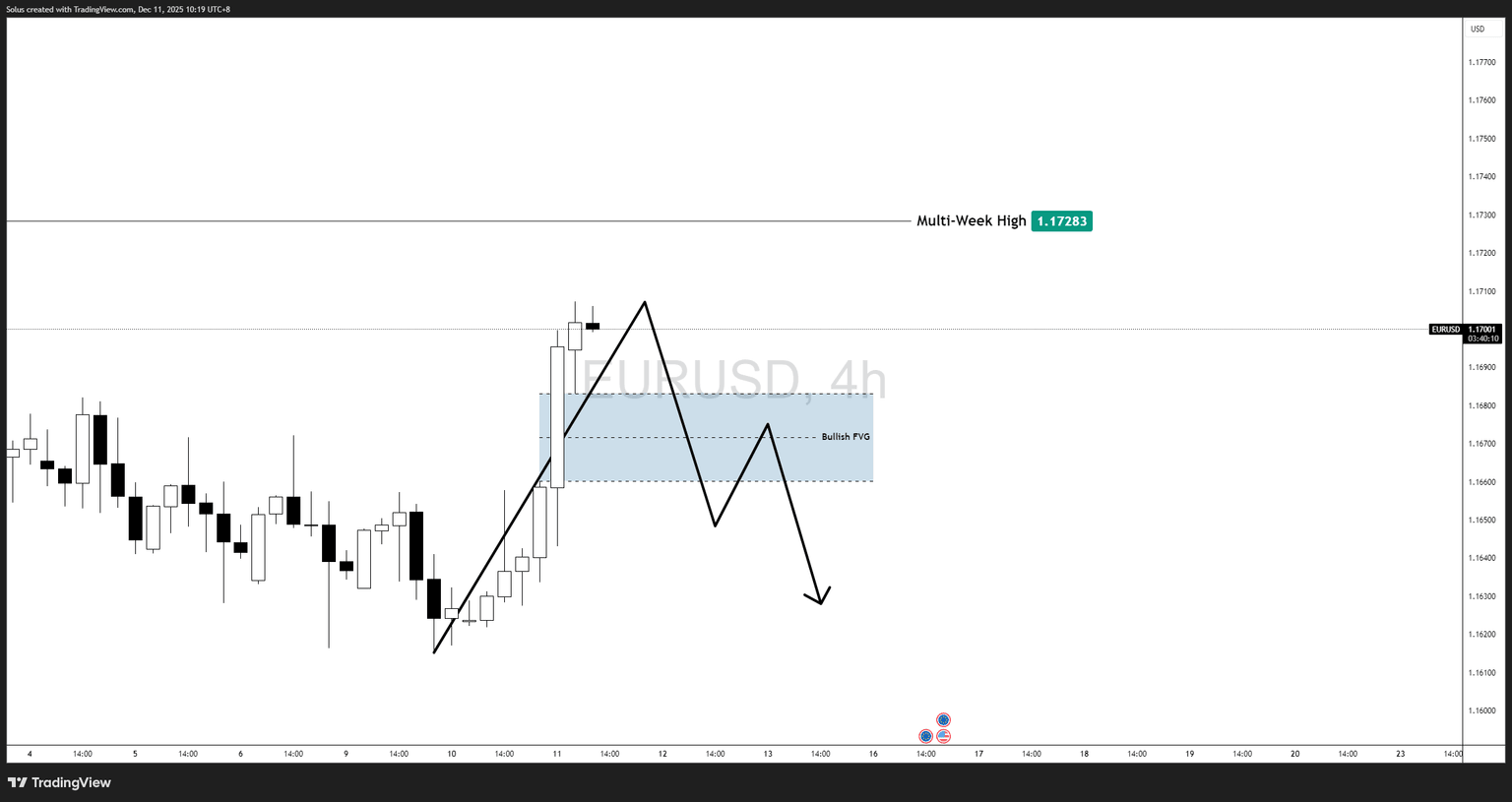

- Technical outlook shows a clean bullish FVG, with continuation possible—but a pullback into the imbalance remains a probable setup before trend continuation.

EUR/USD extends higher after the Fed cut: Dollar weakens as markets reprice 2026 path

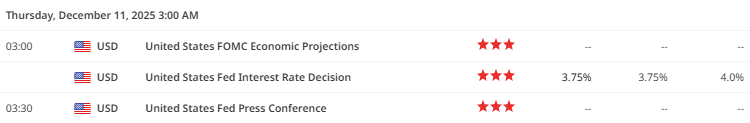

EUR/USD traded sharply higher following the Federal Reserve’s December rate cut, a move that financial markets had largely priced in—but the reaction shows that the tone of Powell’s press conference carried even more weight.

Instead of signaling a one-and-done scenario, the Fed emphasized:

- Slowing labor market momentum

- Inflation progress continuing steadily

- Openness to additional easing if conditions soften further

This pushed markets into a deeper dovish repricing, sending Treasury yields lower and undermining USD strength. EUR/USD immediately capitalized, breaking above previous swing highs and tapping levels not seen in weeks.

Why the Euro is strengthening after the Fed cut

Even though the ECB is not aggressively hawkish, the euro benefits from:

- A softer USD environment driven by slower expected U.S. growth

- Improving Eurozone sentiment indicators in PMI and confidence surveys

- Reduced recession probability in Europe heading into Q1 2026

The result: EUR/USD has shifted into a clearer bullish trend structure, supported by both fundamentals and technicals.

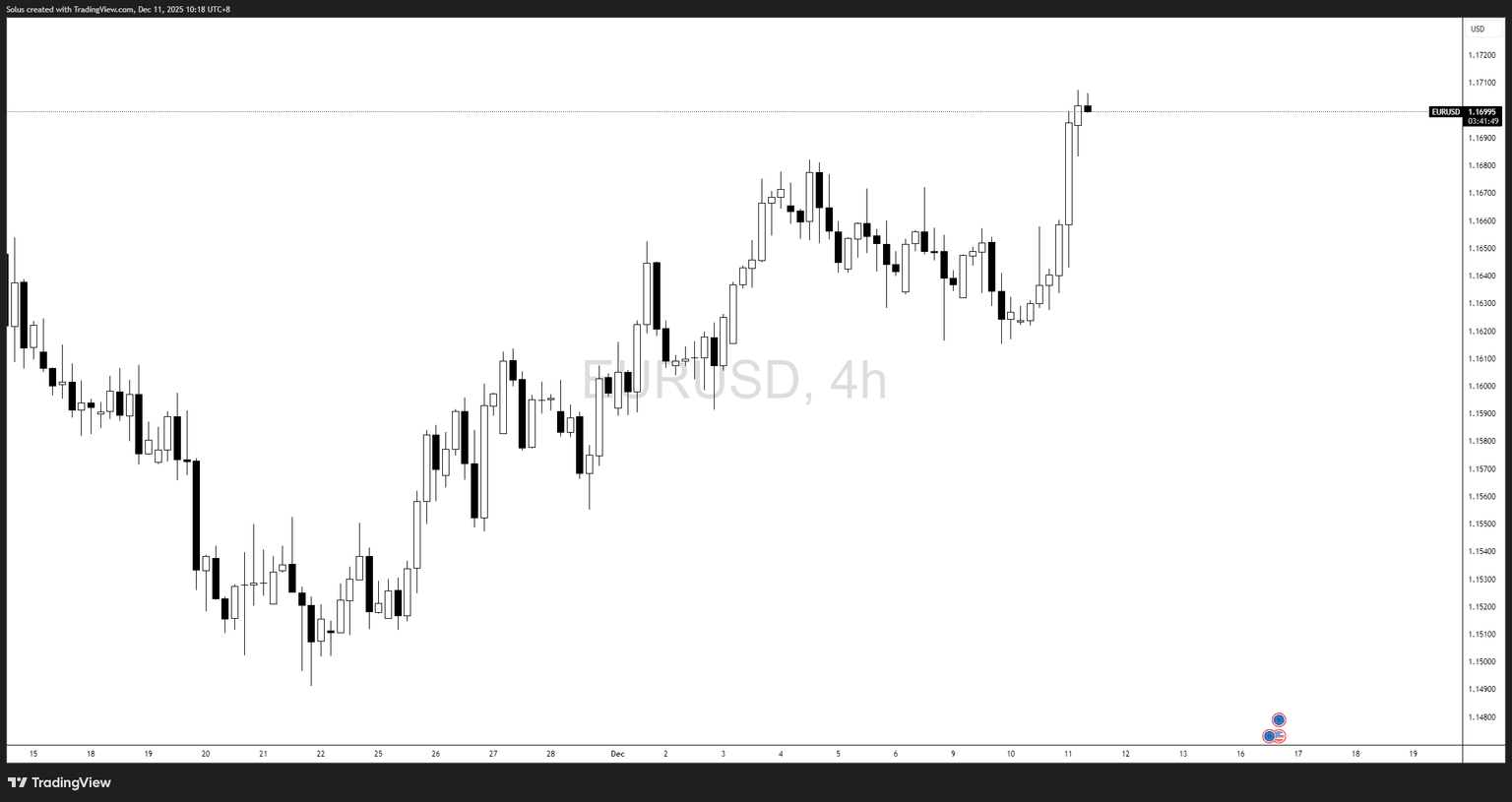

News drivers affecting EUR/USD (post-cut)

1. Fed rate cut (completed)

- Target rate: 3.75% → 3.50% equivalent path

- USD sold off broadly

- Market now pricing another cut in 2026 if inflation continues to ease

Impact: Bearish USD → bullish EUR/USD

2. FOMC economic projections

- Growth forecasts trimmed

- Core inflation projections moved slightly lower

- Fed’s median dot plot shows policy drifting toward a more accommodative stance

Impact: Reinforces downside pressure on the USD

3. Fed press conference

Powell acknowledged slowing demand and hinted that the balance of risks is shifting. He avoided sounding restrictive—this alone added fuel to EUR/USD buyers.

Impact: Encourages further EUR/USD upside unless future data reverses sentiment

Technical outlook

Your 4H charts show a newly formed bullish Fair Value Gap (FVG) following the impulsive rally post-FOMC. Price is currently sitting above the multi-week high around 1.1728, but short-term exhaustion is visible.

The rally has extended aggressively, suggesting that a corrective move into the 4H FVG is possible before continuation. The broader daily structure remains bullish, with clean displacement and a shift toward higher highs.

Bullish scenario: FVG tap → Continuation toward 1.1800–1.1850

A bullish continuation remains the higher-probability path if:

- Price retraces into the 4H bullish FVG (1.1650–1.1675 zone)

- Buyers defend the imbalance

- We see a higher-low structure form on the H1/H4

Upside targets:

- 1.1728 (multi-week high retest)

- 1.1800 psychological level

- 1.1850 extension target

A dovish Fed + structural breakout supports this idea.

Bearish scenario: Failure at 1.1728 → Deeper pullback

A corrective decline may unfold if:

- EUR/USD rejects strongly from the multi-week high

- The 4H FVG fails to hold on the first retest

- Risk sentiment strengthens in favor of USD (e.g., strong NFP, hawkish Fed speakers later this month)

Downside levels:

- 1.1650 FVG low

- 1.1600 liquidity pocket

- 1.1550 deeper structural retracement

This would not break the overall bullish narrative but would reset the trend.

Final thoughts

The December Fed rate cut has already reshaped USD expectations. With the door open for further easing and the U.S. economy cooling, EUR/USD now has fundamental backing for medium-term upside—provided the Eurozone doesn't weaken sharply in upcoming data.

Technically, the market wants a pullback. Fundamentally, the dollar wants to soften.

Put together, EUR/USD favors buy-the-dip conditions into the 4H FVG unless macro data flips the narrative.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.