EUR/USD Forecast: Advancing on dollar’s weakness

EUR/USD Current Price: 1.2050

- US Treasury yields ease as Fed policymakers cooled hopes for a rate hike.

- Upbeat European and American data fuels the demand for high-yielding EUR.

- EUR/USD is mildly bullish in the near-term, could advance further once above 1.2075.

The EUR/USD pair is firmly higher this Thursday, trading in the 1.2050 region. The greenback is down across the board as cooling expectations of a rate move in the US affected the demand for the American currency. Also, the Bank of England announced its decision on monetary policy, leaving rates unchanged but making a twist to its bond-buying program, which put further pressure on the greenback.

Macroeconomic data coming from Europe was quite encouraging, as Germany Factory Orders soared 27.8% MoM in March, while EU Retail Sales surged 2.7% in the same month, both beating the market’s expectations. US figures were also upbeat. Challenger Job Cuts decreased to 22.913K in April, while Initial Jobless Claims for the week ended April 30 resulted in 498K, better than the 540K expected. Q1 Nonfarm Productivity increased 5.4%, while Unit Labor Cost in the same period declined by 0.3%.

EUR/USD short-term technical outlook

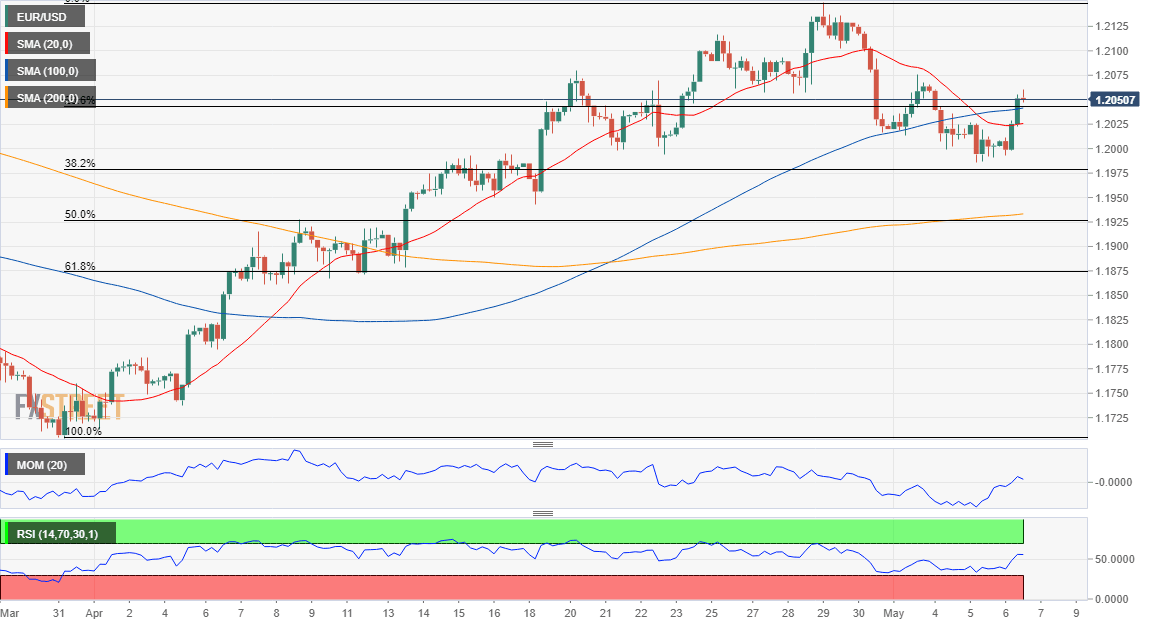

The EUR/USD pair is trading a few pips above the 23.6% retracement of its latest bullish run after repeatedly meeting buyers on approaches to the 38.2% retracement of the same rally. The near-term picture offers a mildly bullish stance, as, in the 4-hour chart, technical indicators are entering positive territory. In the same time-frame, the pair is developing above all of its moving averages, with the 20 SMA losing its bearish strength. The pair could accelerate its advance once above 1.2075, the weekly high.

Support levels: 1.2020 1.1980 1.1940

Resistance levels: 1.2075 1.2110 1.2150

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.